Open Society to Close its Foundation in Kyrgyzstan, Citing Law on Foreign-Funded NGOs

The Open Society Foundations said it will close its national foundation in Kyrgyzstan after the country’s parliament passed a new law that tightens control over non-governmental groups that receive foreign funding. Open Society, which was founded by billionaire investor and philanthropist George Soros, said Monday that the law“imposes restrictive, broad,...

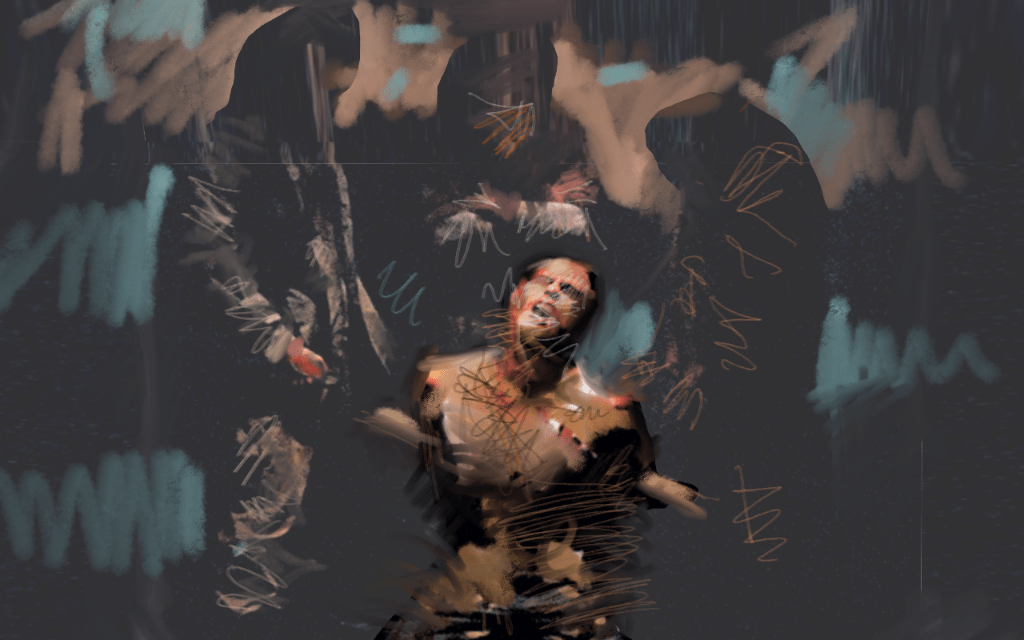

Tajikistan Denounces “Torture” of Tajik Suspects in Moscow Attack, Urges Fair Trial

Tajikistan’s foreign minister has described the beating and abuse of several Tajik suspects in the mass killing of more than 140 people at a Russian concert hall as “torture” that is at odds with the need for a thorough investigation and a fair trial. Foreign Minister, Sirojiddin Muhriddin also said...

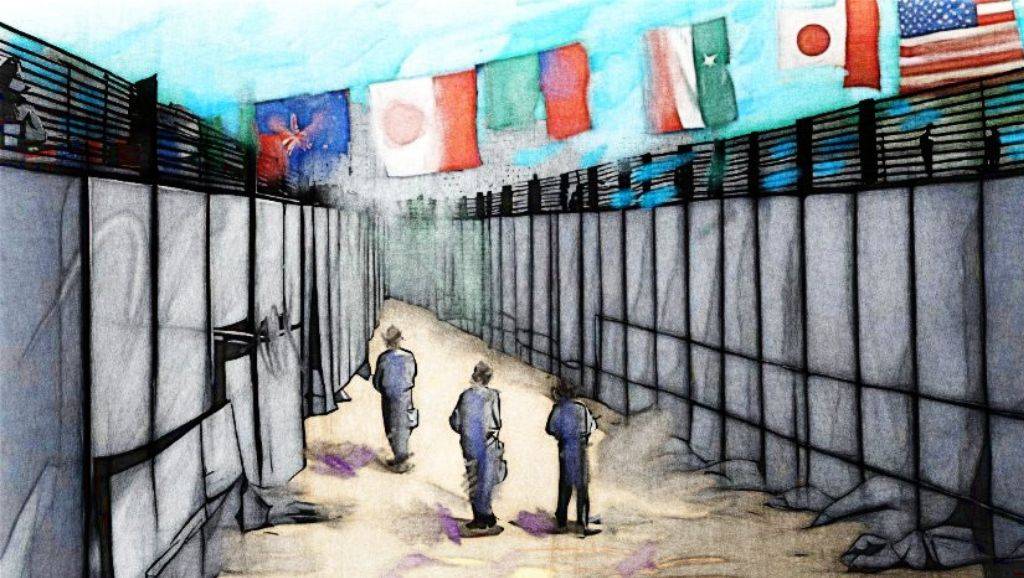

Kazakh Khorgos Still a Vital Trade Link Between China and Europe

The Khorgos dry port in eastern Kazakhstan, on the border with China, has seen more than 2,000 container trains pass through it already this year, The Times of Central Asia has learned. Today 80% of all container trains taking Chinese goods to Europe pass through Khorgos. Railroad tracks in Khorgos...

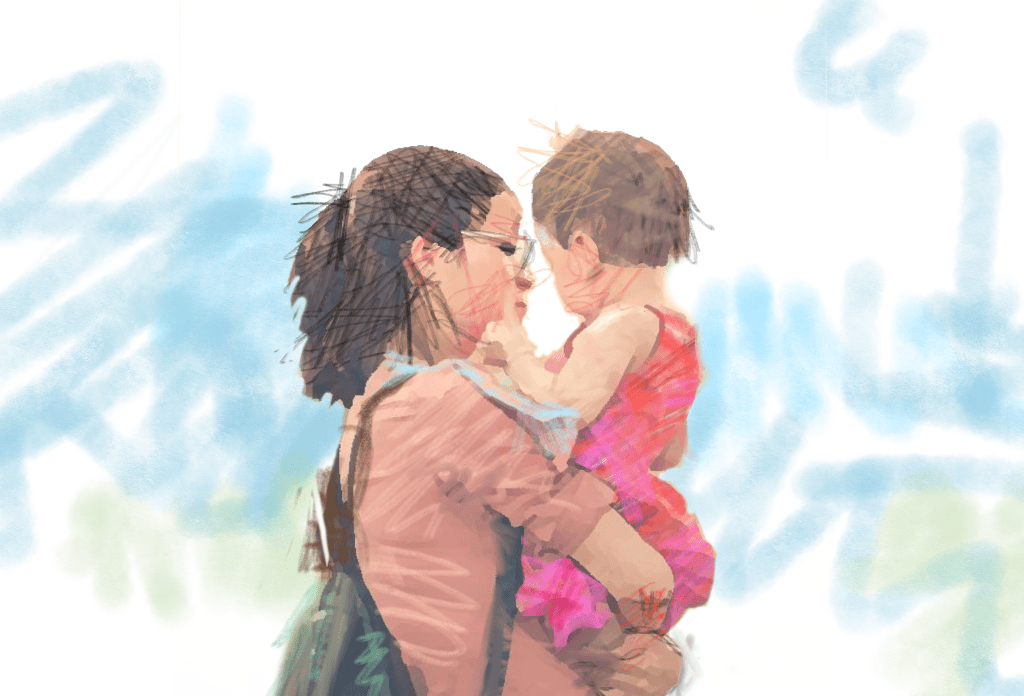

The Bishimbayev Trial: The Women of Kazakhstan Speak

The trial of the trial of former Minister of the Economy, Kuandyk Bishimbayev, has ignited discussions across Kazakhstan, particularly among women. Online actions and rallies across Europe have been organized in memory of the victim, Saltanat Nukenova, and the Senate has passed a law strengthening protections for women and children...

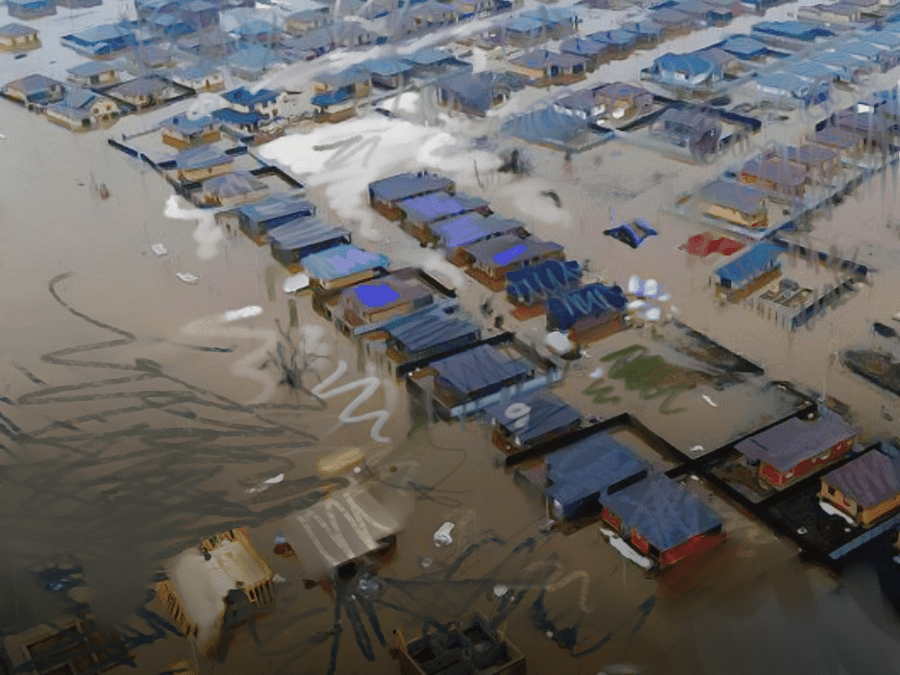

Kazakhstan Cancels International Forum to Focus on Flood Recovery

Kazakhstan’s president said on Saturday that he has canceled a major international forum scheduled for June in Astana so that the country can tackle nationwide floods. “Due to the severe flooding in Kazakhstan and the need to allocate financial resources for the relief efforts and aid for affected citizens, I...

As Bishimbayev Case Continues, Kazakhstan Toughens Domestic Violence Laws

While a court in Astana tries former economy minister Kuandyk Bishimbayev for murdering his wife Saltanat Nukenova, the Kazakhstani Senate has passed a law strengthening protections for women and children against domestic violence. The new law, if properly implemented, can hand out much harsher punishments to those who abuse those...

Turkmenistan Using Almost All Available Water Resources With No Additions in Sight

Meteojournal has reported that Turkmenistan's State Statistics Committee has published a voluntary national review of its progress in implementing the global agenda for sustainable development until 2023 on its website. According to MeteoJournal, in 2021, almost all water resources in the country – 92% – went to agricultural needs. Another 5%...

Uzbekistan to Host Eco Race in Support of Aral Sea Region

On April 18 in Moynaq, Karakalpakstan, organizers Prorun will host an Aral Sea Eco Race with a total distance of two kilometers. Participants will run one km to the location of a tree planting, plant a tree, and then return. At the finish line, each participant will receive a medal...

Dearth of Teachers and Nurses in Kazakhstan

13 hours ago

Uzbekistan: From Silk Roads to New Horizons

16 hours ago

Uzbekistan Proposes Ban on E-Cigarettes

2 days ago

Henkel to Develop Production in Kazakhstan

2 days ago

Uzbekistan: From Silk Roads to New Horizons

Cradled by the embrace of the Syr Darya and Amu Darya Rivers, Uzbekistan boasts a rich tapestry woven from the threads of history. Being home to trade hubs like Samarkand and Bukhara, this land has been at the center of cultural exchange for over a millennia. From the Turkic-Mongol tribes...

The New Silk Road

In light of the current geopolitical situation in the world, many countries are puzzled by the search for new alternative transport routes. One of these is the Trans-Caspian International Transport Route (TITR), which runs through China, Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, and further to Turkey and European countries. New...

Taliban and its Neighbors: A Regional Format for Overcoming Challenges in Afghanistan and Beyond

The process of making Afghanistan an independent economic entity that can work constructively within globally accepted economic standards and formats will require addressing pressing security issues as well as strengthening regional partnerships and cooperation. In the long term, this will not only benefit the people of Afghanistan but also its...

How India is Becoming a Robust Soft Power in Central Asia

The middle-income trap, a pressing issue that has led to the stagnation of many successful developing economies, demands immediate attention. This trap, which occurs when a middle-income country can no longer compete internationally in standardized, labor-intensive goods due to relatively high wages, is a result of various factors, including countries...

The Priority of Maintaining a United and Stable Afghanistan

The issue of inter-ethnic relations in Afghanistan affects not only the country itself but also its surrounding region. Recent history has placed a heightened importance on the “nation” question in Afghanistan in terms of the country’s political and social stability. Since regaining power in 2021, the de facto Taliban authorities...

The Middle Corridor: How Kazakhstan is Carving its Niche in Europe-Asia Transport

In the aftermath of the pandemic and amid rising geopolitical tensions and sanctions – leading to the breakdown of traditional shipping and logistics chains – the need to develop new, alternative routes for trade has gained particular importance. One such route is the Middle Corridor, or Trans-Caspian International Transport Route,...

One Step Forward, Two Steps Back: the EU’s Indecisive Strategy Towards Eurasia

Times of Central Asia Editorial Marking the next chapter in the geopolitical re-balancing competition between Russia and the West, the European Parliament (EP) on 13 March passed a resolution on deepening ties between the EU and Armenia. The document puts forth the possibility of granting Armenia candidate status for EU...

Central Asia Can Help Bring Afghanistan into the International Fold

Afghanistan's situation remains deeply troubling, reflecting a complex history of conflict and political instability that has severely impacted its social and economic fabric. The Soviet Union's invasion 45 years ago, followed by the Taliban's rise to power in 1996 and the U.S. involvement after the September 2001 terrorist attacks linked...

Creation of Kazakhstan–Azerbaijan “Supreme Interstate Council” Marks New Era of Cooperation

Diplomatic relations between Kazakhstan and Azerbaijan have developed dynamically since they were first established in August 1992, and have increased over the past 20 years, and grown especially since 2017. Over the last decade, the number of high-level visits in both directions have been rising to the point where they...

Letting Women Lead: Bridging the Finance Gap for Women-Led Businesses

Opinion by Hela Cheikhrouhou, IFC Regional Vice President, Middle East, Central Asia, Türkiye, Afghanistan, and Pakistan I get to meet many courageous women in my work for IFC in Southwest and Central Asia. [1] I’ve witnessed the seemingly insurmountable challenges they encounter every day. I’ve seen the unyielding resolve of...

Religion in the Cities of Kazakhstan – Opinion by Gulmira Ileuova

The research discussed in this article was conducted in July-August 2023 by the Strategy Center for Sociological and Political Studies Public Foundation in collaboration with the office of the Rosa Luxemburg Foundation in Central Asia. A total of 1,604 people were surveyed in six cities. Since the goal of the...

Nurturing Global Partnerships – Opinion by the Minister of Science and Higher Education of the Republic of Kazakhstan, Sayasat Nurbek

Kazakhstan, a sprawling and culturally diverse nation nestled in Central Asia, has strategically embraced a multi-vector policy across its foreign relations, economic strategies, and governance. At the heart of this strategy lies Kazakhstan's multi-vector policy in education, a forward-thinking initiative that underscores the nation's commitment to diversification, international collaboration, and...

Kyrgyz PM Zhaparov In U.S. For Talks With Energy Investors

Kyrgyzstan's prime minister Akylbek Zhaparov is in the United States this week, and will meet with potential investors as Kyrgyzstan looks to grow its energy sector. Zhaparov will meet with the heads of the World Bank, International Monetary Fund, the U.S. Agency for International Development (USAID), the U.S.-Kyrgyz Chamber of...

Taliban Returns 120,000 Liters of Uzbek Oil Products Over Low-Quality

The National Department of Standards of Afghanistan has reported that it returned two tanker trucks worth of oil products with a volume of 120,000 liters from the port of Hairatan back to Uzbekistan. According to Radio Television of Afghanistan (RTA) English, the reason for this was the low quality of...

Uzbekistan Aims to Become One of World’s Largest Producers of Olefins

Uzbekistan's largest private oil and gas company, Sanoat Energetika Guruhi (Saneg) will build a gas chemical plant to produce olefins from methanol. The work will be done in partnership with the Chinese state-owned energy giant, Sinopec. The complex will utilize natural gas from the Mubarek fields. Olefins are raw petrochemical...

Kazakhstan and Armenia Negotiate on Trade and Transport Cooperation

Following negotiations on 15 April in Yerevan, with Armenian Prime Minister Nikol Pashinyan, Kazakh President Kassym-Jomart Tokayev stated that with regard to furthering cooperation, the countries enjoy “unshakable friendship and mutual support.” With reference to developing a more comprehensive partnership, he cited their common goals as expanding and activating bilateral...

Kazakhstan’s Foreign Debt Increases by $4 Billion in Five Years With Russia Growing as Creditor

According to the National Bank of Kazakhstan, at the beginning of 2024 the external financial obligations of the republic reached almost $163 billion, whilst in 2019 this figure stood at $158.8 billion. The Netherlands are Kazakhstan's largest creditor with $42.6 billion owed, followed by the U.K. with $13.8 billion, and...

Over 90% of Economically Active Kazakhstanis Have Loans

Lyazzat Usenbekova, director of consumer protection at the Association of Financiers of Kazakhstan, conducted calculations to find out what percentage of Kazakh citizens have debt obligations, concluding that "more than 90% of those who actively participate in the economic life of the country bear the burden of credit obligations on...

Kazakhstan to Spend 500 Billion Tenge to Buy Domestic Bank Bonds

According to a document on asset management from the Unified National Pension Fund (EPPF), the Times of Central of Asia has learned that the National Bank of Kazakhstan is ready to invest 500 billion tenge ($1.1 billion) of pension funds in bonds issued by Kazakhstan's second-tier banks (BVU). According to...

Kyrgyzstan’s New Tariff Policy Aim to Solve Problems in Energy Sector

Kyrgyzstan's minister of economy Daniyar Amangeldiev has told a press conference in Bishkek about his vision for the country's energy sector. A new tariff pricing policy has been presented to the Kyrgyz parliament, and will be adopted in May this year. According to Amangeldiev, the new electricity tariff policy will...

State Mortgages in Kyrgyzstan Can Now Be Obtained Without Credit History

On April 15, a law introducing a mechanism called "Shared Housing Construction" within the framework of the program, "My House 2021-2026" came into force in Kyrgyzstan. The program, as defined by the State Mortgage Company (SMC) of Kyrgyzstan, is available to all citizens. According to authorities, Kyrgyz citizens should be...

Open Society to Close its Foundation in Kyrgyzstan, Citing Law on Foreign-Funded NGOs

The Open Society Foundations said it will close its national foundation in Kyrgyzstan after the country’s parliament passed a new law that tightens control over non-governmental groups that receive foreign funding. Open Society, which was founded by billionaire investor and philanthropist George Soros, said Monday that the law“imposes restrictive, broad,...

Uzbekistan Proposes Ban on E-Cigarettes

Uzbekistan is drafting a law banning the import, sale and production of electronic cigarettes and tobacco heating systems. The bill has been published on the regulation.gov.uz portal and its discussion will last until April 18, The Times of Central Asia has learned. The draft law mentions that over the past...

Turkmenistan Stops Selling Tickets to Russia for Migrant Laborers

In a number of regions of Turkmenistan, the sale of air tickets to citizens who have received an official offer to work in Russia has been suspended, according to news portal Turkmen.news. The halting of ticket sales is related to the terrorist attack on the Crocus City Hall near Moscow...

Experts in Kyrgyzstan Sound Alarm Over Acute Shortage of Medicines

Doctors in the Central Asian republic are saying that medical institutions lack emergency, intensive care, pediatric, and cardio-pulmonary drugs, as well as contraceptives and the supplies needed for safe medical abortions. Kyrgyzstan's hospitals lack basic medicines and basic daily medications, according to Bermet Baryktabasova, head of the Kyrgyz Medical Trade...

Kazakhstan and Uzbekistan Enhance Strategic Partnership

On April 5th, President of Uzbekistan Shavkat Mirziyoyev and President of Kazakhstan Kassym-Jomart Tokayev met in Khiva to discuss further strengthening of the Kazakh-Uzbek strategic partnership and allied relations. The presidents exchanged views on a wide range of economic interactions, including increasing mutual trade, cooperation in the fields of energy,...

Bishkek Tightens Grip on NGOs

BISHKEK, Kyrgyzstan - Kyrgyzstan´s President said on Tuesday that he has approved a law that tightens control over non-governmental organizations which receive foreign funding, despite concerns that the measure could erode basic freedoms and services. President Sadyr Japarov defied international pressure to refrain from signing the law, which was passed...

Kazakhstan and Kyrgyzstan to Unite Against External Military Threat

Proposals are in place for Kazakhstan and Kyrgyzstan to enter an agreement on deepening and expanding allied relations. Drafted by the President of Kazakhstan Kassym-Jomart Tokaye, the decree, ‘On the signing of an agreement on deepening and expanding allied relations between the Republic of Kazakhstan and the Kyrgyz Republic’, was...

Kyrgyz PM Zhaparov In U.S. For Talks With Energy Investors

Kyrgyzstan's prime minister Akylbek Zhaparov is in the United States this week, and will meet with potential investors as Kyrgyzstan looks to grow its energy sector. Zhaparov will meet with the heads of the World Bank, International Monetary Fund, the U.S. Agency for International Development (USAID), the U.S.-Kyrgyz Chamber of...

Kazakhstan and Armenia Negotiate on Trade and Transport Cooperation

Following negotiations on 15 April in Yerevan, with Armenian Prime Minister Nikol Pashinyan, Kazakh President Kassym-Jomart Tokayev stated that with regard to furthering cooperation, the countries enjoy “unshakable friendship and mutual support.” With reference to developing a more comprehensive partnership, he cited their common goals as expanding and activating bilateral...

Central Asian and Gulf Cooperation Council Countries Engage in Strategic Dialogue

The 2nd Ministerial Meeting of Strategic Dialogue ‘Central Asia – Gulf Cooperation Council (GCC)’, hosted by Tashkent on April 15, was attended by top diplomats from Central Asia and six member states of the Gulf Cooperation Council: Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, the Sultanate of Oman, and...

Uzbekistan to Hold CIS Anti-Terror Exercise for First Time in 2024

Uzbekistan will host a joint anti-terrorism exercise of countries belonging to the Commonwealth of Independent States, or CIS, for the first time this year. The decision comes at a time of heightened concern after gunmen killed more than 140 people at the Crocus City Hall in Moscow on March 22....

Turkmenistan and USA Set to Strengthen Partnership

On 14 April, delegations led by Rashid Meredov, Minister of Foreign Affairs of Turkmenistan and John Pommersheim, US Deputy Assistant Secretary of State for South and Central Asian Affairs, attended an annual political consultation in Ashgabat. The meeting focused on the current state and prospects for the development of Turkmen-American...

Kazakhstan and Finland to Collaborate on Rail Transportation

KTZ Express JSC (a subsidiary of Kazakhstan’s national railways company Kazakhstan Temir Zholy) and Finnish Nurminen Logistics Services Oy, have signed a Memorandum of Cooperation for container transportation from China to Finland along the Trans-Caspian International Transport Route (TITR) through the Kazakhstan. At a meeting of the Kazakh-Finnish intergovernmental commission...

Kazakhstan and China’s Macao Visa-Free Regime

On April 9, Ambassador of Kazakhstan to China, Shakhrat Nuryshev and the Secretary for Administration and Justice of the Macao Special Administrative Region of the People’s Republic of China, Mr. Cheong Weng Chon, signed an Agreement between their respective governments on mutual exemption from visa requirements for up to 14...

Kazakhstan’s President Addresses Regional Threats

In preparation for the Shanghai Cooperation Organization (SCO) summit in Astana later this year, Kazakh President Kassym-Jomart Tokayev met with security council secretaries of SCO member states: China, Russia, India, Kyrgyzstan, Tajikistan, Pakistan, Iran, Uzbekistan, and Kazakhstan. In his speech on April 3rd, the president began by reiterating the fact...

EU Project SCAFFOLD Set to Empower Central Asian Educators

Over 250 educators from five Central Asian countries are currently participating in training events organized by the European Union in Astana, Kazakhstan. Running from 15 – 19 April, the event organized by the European Training Foundation (ETF) in partnership with the Delegation of the European Union to Kazakhstan, and the...

Rallies Held in Italy in Support of Saltanat Nukenova

On April 13, rallies were held in Italian cities including Rome, Milan, Turin, Bologna and Florence in support of the deceased wife of former Minister of the National Economy of Kazakhstan, Saltanat Nukenova, demanding stricter legislation against domestic violence. The organizers of stressed the importance of exercising the civil right...

Kyrgyzstan battles suspicion about vaccines as measles cases rise

Dear parents! Vaccinate your child. That’s the message from the health ministry in Kyrgyzstan, where the number of reported measles cases this year has soared to nearly 8,000 despite government efforts to overcome the anti-vaccine sentiment fueling the outbreak. “It has been proven that there is no connection between vaccinations...

Kyrgyzstan Continues to Combat Drug Shortages

Health Minister of the Kyrgyz Republic, Alymkadyr Beishenaliyev has told local media that hospitals are 70-80% stocked with medicines, with hospitals in the Issyk-Kul region suffering the worst from short supplies. "There is a list of vital medicines, which we provide 100%. But doctors prescribe drugs which I, a medic,...

OCA Magazine Celebrates Fifteenth Anniversary

The sole English-language magazine dedicated to Central Asia and the CIS region, since 2009 OCA Magazine has been promoting diplomatic relationships and international partnerships between Eurasia and the global community. With a list of contributors which includes heads of state, ambassadors, ministers, celebrities, academicians, business-people, and others, in 2024 the...

Kazakhstan Struggles to Contain Floods; Worst Natural Disaster in 80 Years, President Says

Since last month, more than 75,000 people in Kazakhstan have been rescued from floods that the president has described as the country’s worst natural disaster in 80 years. Kyrgyzstan is sending aid to Kazakhstan, and Türkiye has said it is ready to help. Across the border from Kazakhstan, parts of...

Qazaq Culture Portal Launched in Kazakhstan

In an enlightened new initiative to attract international attention to the country’s rich cultural and historical heritage, the Ministry of Culture and Information of Kazakhstan has supported the creation of an information and educational portal on Qazaq Culture. Available in the six official languages of the United Nations, as well...

Sell-Out of U.K. Tours to World Nomad Games in Kazakhstan

Due to an unprecedented demand, U.K. package tours, organized by Regent Holidays and Wild Frontiers, to attend the Fifth World Nomad Games in Astana from 8-14 September 2024, have already sold out. The news, reported by Kazakh Tourism, is perhaps not surprising given that the magazine 'Wanderlust', listed Kazakhstan as...

Kazakhstan President Signs Landmark Legislation on Domestic Violence

On April 15, President Kassym-Jomart Tokayev signed into law amendments and additions passed by Kazakhstan’s parliament on April 11 on legislative acts and the code on administrative offenses on ensuring the rights of women and the safety of children. The initiative represents a first in the CIS in terms of...

The Bishimbayev Trial: The Women of Kazakhstan Speak

The trial of the trial of former Minister of the Economy, Kuandyk Bishimbayev, has ignited discussions across Kazakhstan, particularly among women. Online actions and rallies across Europe have been organized in memory of the victim, Saltanat Nukenova, and the Senate has passed a law strengthening protections for women and children...

As Bishimbayev Case Continues, Kazakhstan Toughens Domestic Violence Laws

While a court in Astana tries former economy minister Kuandyk Bishimbayev for murdering his wife Saltanat Nukenova, the Kazakhstani Senate has passed a law strengthening protections for women and children against domestic violence. The new law, if properly implemented, can hand out much harsher punishments to those who abuse those...

Kyrgyzstan Minister Says Case Against Media Workers Not About Politics

BISHKEK, Kyrgyzstan – Kyrgyzstan is pushing back against international criticism of a high-profile prosecution of media workers, saying the case is not politically motivated and that those facing charges of inciting mass unrest are poorly educated people masquerading as journalists. Minister of Internal Affairs, Ulan Niyazbekov, said the case against...

Kyrgyzstan Court Moves Four Journalists from Prison to House Arrest

BISHKEK, Kyrgyzstan - Four journalists in Kyrgyzstan who were jailed in January on suspicion of inciting mass unrest have been moved to house arrest, while four others accused in the same case remain in pretrial detention. A district court in Bishkek ordered the release on Tuesday of the former employees...

Online Viral Action #ZaSaltanat: Women of Kazakhstan Oppose Stereotypes About Domestic Violence

The trial of Former Minister of National Economy of Kazakhstan, Kuandyk Bishimbayev, accused of murdering his wife, Saltanat Nukenova, continues. During the hearing, Bishimbayev's lawyers have repeatedly attempted to emphasize that Saltanat, who died from a beating, led a promiscuous lifestyle, including the constant consumption of alcohol. Such arguments caused...

Authorities in Central Asia Warn Against Terrorist Recruitment

Uzbekistan's Interior Ministry has issued a warning over increased instances of calls to commit terrorist acts spread via social media and messenger apps. Citizens are being implored to booby-trap public places - including shopping and entertainment centers, schools and other places of mass gathering - for large sums of money. Besides...

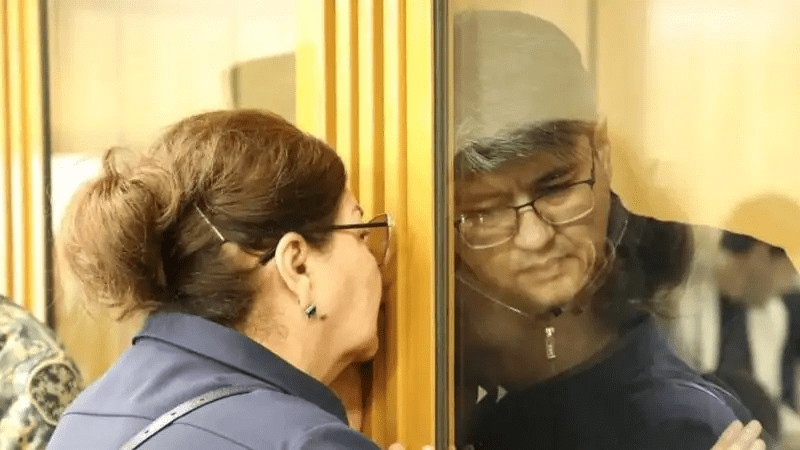

Video of Beating of Saltanat Nukenova on the Day of Her Death Presented in Court

At the fourth court session on April 3 of the murder case of Saltanat Nukenova, a video was presented which depicts the moment of her beating on the day of her death. The video shows former Minister of the National Economy, Kuandyk Bishimbayev, delivering several blows to Nukenova's head area...

Kyrgyzstan, Kazakhstan and Uzbekistan Consider Joint-Stock Company to Build Kambarata HPP-1

Kazakhstan’s Ministry of Energy has announced that the draft Agreement between the governments of Kyrgyzstan, Kazakhstan, and Uzbekistan on the joint implementation of the construction and operation of Kambarata hydroelectric power plant (HPP)-1 has been posted on Kazakhstan’s official Internet portal Open Legal Acts. Available for public discussion, the agreement...

“Eco-Enthusiasts” – Tashkent Hosts Environmental Competition for Students

On April 13, an environmental awareness competition, "Eco-Enthusiasts" was held in Tashkent's Zahiriddin Muhammad Babur Central Ecopark. The event was organized in accordance with the decree of the President, "On measures for effective work of the Ministry of Ecology, Environmental Protection and Climate Change," and was timed to coincide with...

Chinese Invest in Solar Power for Kyrgyzstan

On April 12, the Chairman of the Cabinet of Ministers of the Kyrgyz Republic, Akylbek Japarov unveiled plans for the construction of a solar power plant near Balykchy in the country’s northern Issyk-Kul region. Financed with an investment of $400 million by a Chinese company, the plant will have a...

USAID Oasis Project on Course to Restore Aral Sea Ecosystem

The U.S. Embassy in Kazakhstan has announced that from 12 – 16 April, the United States Agency for International Development (USAID) will visit the Oasis project on the former shores of the Aral Sea in the Kyzylorda region of Kazakhstan. Launched in 2021, the Oasis is integral to Environmental Restoration...

Turkmenistan Using Almost All Available Water Resources With No Additions in Sight

Meteojournal has reported that Turkmenistan's State Statistics Committee has published a voluntary national review of its progress in implementing the global agenda for sustainable development until 2023 on its website. According to MeteoJournal, in 2021, almost all water resources in the country – 92% – went to agricultural needs. Another 5%...

Uzbekistan to Host Eco Race in Support of Aral Sea Region

On April 18 in Moynaq, Karakalpakstan, organizers Prorun will host an Aral Sea Eco Race with a total distance of two kilometers. Participants will run one km to the location of a tree planting, plant a tree, and then return. At the finish line, each participant will receive a medal...

Kazakhstan Faces Unprecedented Threats from Floods, Droughts, Locust Infestations

Experts are predicting a severe drought in Kazakhstan. Additionally, locusts are expected to invade the country, and the flood situation will be even worse next year. That's according to Kazakhstani ecologist, Dmitry Kalmykov, who further explained to the Times of Central Asia in an interview that climate change in the...

No Central Asian Country Can Cope With Floods, Droughts On Its Own, Expert Tells TCA

Lack of funds, the predominantly commodity-based nature of their economies, and the inability to reach agreement at a national level make the Central Asian republics vulnerable to natural disasters, Dr. Petr Svoik, Ph.D, a Kazakhstani economist and former head of the Anti=monopoly Policy Committee has told the Times of Central...