Kazakhstan Likely To Insist on Revisions to Kashagan Oil Contracts

Kazakhstan is demanding compensation for lost profits from the North Caspian Operating Company (NCOC), the consortium that manages the Kashagan oil field, and arbitration claims have risen to $150 billion. Sources close to Kashagan told The Times of Central Asia that this should send the message to western energy companies...

Kazakhstan Repurposing Floodwater

In a strategic response to the unprecedented spring flooding this year, Kazakhstan is channeling its efforts towards harnessing the disastrous floods to its advantage. The Ministry of Water Resources and Irrigation in Kazakhstan has embarked on a program to utilize the massive floodwaters for future irrigation and environmental sustainability. In...

Britain’s Cameron to Central Asia: Work with Us

Britain’s foreign secretary is in Central Asia this week, seeking deeper ties with a part of the world seen as increasingly vital to international security, energy flows and efforts to combat climate change. The trip, which David Cameron described as overdue, followed criticism that Britain had neglected what the envoy’s...

Disinformation Targets Kazakhstan’s Ties with China, Russia, and the U.S.

Over an eight-day period in April 2024, a barrage of news stories featuring rumors about Kazakhstan’s foreign policy permeated Chinese media. These dubious reports alleged that the U.S. had hyped an unverified leak from a Russian Duma official claiming Kazakhstan was engaged in covert negotiations to join NATO and suggested...

Kyrgyzstan’s Law on NGOs: What Alarms Human Rights Activists?

In April 2024 Kyrgyz President Sadyr Japarov signed a law on non-governmental organizations (NGOs). Now all NGOs must submit full financial reports and register with the Ministry of Justice. Despite the authorities' statements about the need for a document regulating the financing of such organizations, the law has numerous opponents....

Central Asian Countries Set 2024 Quotas for Amu Darya, Syr Darya River Water Usage

Last week in Kazakhstan, delegates came together for the 87th meeting of the Interstate Commission for Water Coordination (ICWC) of Central Asia, where they discussed the potential and limitations of regional water reservoirs ahead of the 2023-2024 agricultural growing season. According to the ICWC, some of the more pressing questions...

Kazakhstan: Floods Still a Threat, but Some Residents Returning Home as Waters Ebb

For weeks, it’s been a frantic grind of evacuations, pumping water and shoring up dams as Kazakhstan battles widespread floods. While the threat remains, water levels are declining in some areas and the country is working to help disaster victims in the long term. Some 22,700 people who fled their...

TikTok Users Struggle to Access App after Kyrgyzstan Announces Restrictions

Kyrgyzstan is restricting access to TikTok. The Ministry of Digital Development sent a letter to internet providers, asking them to block the TikTok social media platform, local media has reported. The ministry cited the network´s failure to comply with a law designed to “prevent harm to the health of children,...

Central Asians Not Bananas About Bananas

36 mins ago

Kazakhstan Repurposing Floodwater

1 day ago

Mudslides in Kyrgyzstan Flood Over 200 Homes

2 days ago

China Remains Uzbekistan’s Top Trade Partner

2 days ago

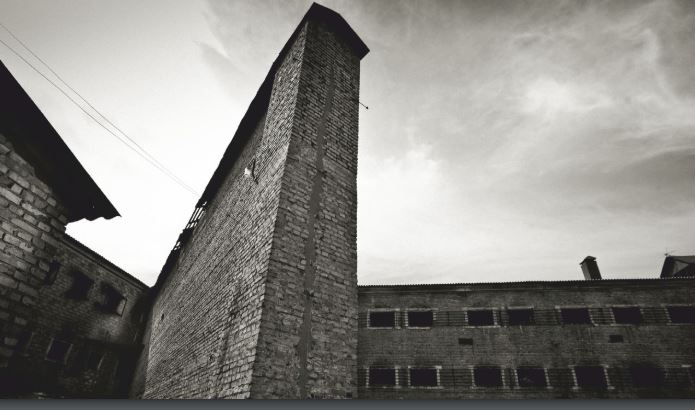

Growth of Non-Custodial Sentences in the Kyrgyz Republic Since 2020

The Kyrgyz Republic has reported a decrease of its prison population, which speaks to the ongoing humanization of its criminal justice system. In 2023, the prison population amounted to just 7,728 persons, a 20% decrease compared to 2020 (9,658 prisoners). Despite a 22% increase in the number of convictions, from...

Uzbekistan Seeks to Expand Trade Horizons with Europe

- Opinion by Robert Cutler Uzbekistan's economic landscape has been evolving, with announcements of major reforms and international cooperation aimed at economic modernization and increasing its profile in global markets. Its partnership with the European Union (EU) has focused on critical raw materials. At the same time, Tashkent plans...

The Taliban and its Neighbors: An Outsider’s Perspective

This is part two of a piece of which part one was published here. The topic of a regional approach to solving Afghanistan's problems is increasingly being discussed in various expert and diplomatic circles. The International Crisis Group (ICG), a reputable think tank whose opinion is extremely interesting as part...

Uzbekistan: From Silk Roads to New Horizons

Cradled by the embrace of the Syr Darya and Amu Darya Rivers, Uzbekistan boasts a rich tapestry woven from the threads of history. Being home to trade hubs like Samarkand and Bukhara, this land has been at the center of cultural exchange for over a millennia. From the Turkic-Mongol tribes...

The New Silk Road

In light of the current geopolitical situation in the world, many countries are puzzled by the search for new alternative transport routes. One of these is the Trans-Caspian International Transport Route (TITR), which runs through China, Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, and further to Turkey and European countries. New...

Taliban and its Neighbors: A Regional Format for Overcoming Challenges in Afghanistan and Beyond

The process of making Afghanistan an independent economic entity that can work constructively within globally accepted economic standards and formats will require addressing pressing security issues as well as strengthening regional partnerships and cooperation. In the long term, this will not only benefit the people of Afghanistan but also its...

How India is Becoming a Robust Soft Power in Central Asia

The middle-income trap, a pressing issue that has led to the stagnation of many successful developing economies, demands immediate attention. This trap, which occurs when a middle-income country can no longer compete internationally in standardized, labor-intensive goods due to relatively high wages, is a result of various factors, including countries...

The Priority of Maintaining a United and Stable Afghanistan

The issue of inter-ethnic relations in Afghanistan affects not only the country itself but also its surrounding region. Recent history has placed a heightened importance on the “nation” question in Afghanistan in terms of the country’s political and social stability. Since regaining power in 2021, the de facto Taliban authorities...

The Middle Corridor: How Kazakhstan is Carving its Niche in Europe-Asia Transport

In the aftermath of the pandemic and amid rising geopolitical tensions and sanctions – leading to the breakdown of traditional shipping and logistics chains – the need to develop new, alternative routes for trade has gained particular importance. One such route is the Middle Corridor, or Trans-Caspian International Transport Route,...

One Step Forward, Two Steps Back: the EU’s Indecisive Strategy Towards Eurasia

Times of Central Asia Editorial Marking the next chapter in the geopolitical re-balancing competition between Russia and the West, the European Parliament (EP) on 13 March passed a resolution on deepening ties between the EU and Armenia. The document puts forth the possibility of granting Armenia candidate status for EU...

Central Asia Can Help Bring Afghanistan into the International Fold

Afghanistan's situation remains deeply troubling, reflecting a complex history of conflict and political instability that has severely impacted its social and economic fabric. The Soviet Union's invasion 45 years ago, followed by the Taliban's rise to power in 1996 and the U.S. involvement after the September 2001 terrorist attacks linked...

Creation of Kazakhstan–Azerbaijan “Supreme Interstate Council” Marks New Era of Cooperation

Diplomatic relations between Kazakhstan and Azerbaijan have developed dynamically since they were first established in August 1992, and have increased over the past 20 years, and grown especially since 2017. Over the last decade, the number of high-level visits in both directions have been rising to the point where they...

Uzbekistan’s First Quarter 2024 Gold Exports Rise to $2.66 Billion

Uzbekistan exported gold worth $2.66 billion in the first quarter (January-March) of 2024. In 1Q 2024, Uzbekistan's total foreign trade turnover amounted to $15.8 billion, which is almost $1 billion (6.2%) more than in the same period in 2023. Exports increased by 10% to $6.38 billion, and imports increased to...

Central Asians Not Bananas About Bananas

According to the agricultural trade publication East Fruit, Central Asians have little taste for bananas. Kazakhstan has the highest consumption rate but with an average of 4.5 kg of fresh bananas eaten per person, per year, comes nowhere near Uganda where each year, individuals enjoy a whopping 270 kg of...

Starlink Close to Providing Internet Access in Remote Parts of Kyrgyzstan

Representatives of Kyrgyzstan's ministry of digital development have met again with the American company Starlink, with a view to bringing satellite internet access to the country. However, there are still regulatory hurdles in Kyrgyzstan that hinder the development of Starlink technology. Elon Musk's aerospace company SpaceX first entered the Kyrgyz...

Kazakhstan Likely To Insist on Revisions to Kashagan Oil Contracts

Kazakhstan is demanding compensation for lost profits from the North Caspian Operating Company (NCOC), the consortium that manages the Kashagan oil field, and arbitration claims have risen to $150 billion. Sources close to Kashagan told The Times of Central Asia that this should send the message to western energy companies...

AI Takes Hold in Kazakhstan’s Finance Industry

The National Bank of Kazakhstan has conducted a survey on the prospects for developing artificial intelligence (AI) in the country. The results of this survey showed that 31% of respondents who work in the finance industry are already using AI in their work. Analysts from the National Bank concluded that...

Rosatom Set to Build Small Nuclear Power Plants in Uzbekistan

Russian state nuclear power corporation Rosatom is ready to offer lower-capacity nuclear power plant (NPP) projects to Uzbekistan. That's according to comments made by Denis Manturov, Russia's Minister of Trade and Industry, at the fourth annual international industrial exhibition, Innoprom, Central Asia. “Currently, the Rosatom state corporation and the Uzatom...

Kazakhstan Plans To Stop Bloggers From Promoting Gambling

Kazakhstan is preparing big changes for the gambling business in the form of a new bill that's under consideration in the country's lower house of parliament, the Majilis. Should the bill become law, bloggers will be banned from advertising betting platforms and online casinos. These changes are aimed at stricter...

China Remains Uzbekistan’s Top Trade Partner

In the first three months of 2024, the value of bilateral trade between China and Uzbekistan reached $2.1 billion. During this period, Uzbekistan's exports to China totaled $349.4 million, whilst imports from the People's Republic of China (PRC) reached $1.7 billion. This trade flow reflects a significant surplus in the...

Starlink Close to Providing Internet Access in Remote Parts of Kyrgyzstan

Representatives of Kyrgyzstan's ministry of digital development have met again with the American company Starlink, with a view to bringing satellite internet access to the country. However, there are still regulatory hurdles in Kyrgyzstan that hinder the development of Starlink technology. Elon Musk's aerospace company SpaceX first entered the Kyrgyz...

Kyrgyz Servicemen Will Be Allowed to Buy Their Military Housing

A new law in Kyrgyzstan allows military personnel who have served in the Kyrgyz army for more than 20 years to purchase their government-issued housing for temporary use. Additionally, families of servicemen killed in the line of duty -- and former members of the military themselves -- can submit claims...

Kazakhstan Plans To Stop Bloggers From Promoting Gambling

Kazakhstan is preparing big changes for the gambling business in the form of a new bill that's under consideration in the country's lower house of parliament, the Majilis. Should the bill become law, bloggers will be banned from advertising betting platforms and online casinos. These changes are aimed at stricter...

Mudslides in Kyrgyzstan Flood Over 200 Homes

Kyrgyzstan's emergencies ministry has formed an operational headquarters to deal with recent flooding in the south of the country. Rescuers report that hundreds of local residents have been evacuated to safety. Flooding due to heavy rains began last week in Kyrgyzstan's southern Osh region, prompting the region to declare a...

Kyrgyzstan’s Law on NGOs: What Alarms Human Rights Activists?

In April 2024 Kyrgyz President Sadyr Japarov signed a law on non-governmental organizations (NGOs). Now all NGOs must submit full financial reports and register with the Ministry of Justice. Despite the authorities' statements about the need for a document regulating the financing of such organizations, the law has numerous opponents....

Uzbekistan to Open Centres for Workers Seeking Employment Abroad

The Uzbek government is to open 27 educational institutions across the country for the purpose of training potential migrants in professions in demand by foreign employers. Students will also have access to lessons in various languages including English, German, Japanese, Korean and Arabic. Courses will be offered on a paid-contract...

Money of Kazakhstan’s National Fund to Be Invested in New Format

The National Bank of Kazakhstan has revealed its strategy for investing the National Fund's money in alternative instruments, emphasizing the gradual increase in money committed to that tranche of investments to $2.5 billion by 2025. This portfolio, launched in 2023, represents 3% of the total allocation of the savings portfolio...

Turkmenistan’s Government Employees Should Know President’s Biography in Order to Pass Certification

According to a report by the Chronicles of Turkmenistan, the main questions asked to employees of state bodies in Turkmenistan during the attestation period are related to the president and his relatives. This year, employees of the Transport and Communications Agency, the Health and Medical Industry, the Ministry of Labor...

Kazakhstan Likely To Insist on Revisions to Kashagan Oil Contracts

Kazakhstan is demanding compensation for lost profits from the North Caspian Operating Company (NCOC), the consortium that manages the Kashagan oil field, and arbitration claims have risen to $150 billion. Sources close to Kashagan told The Times of Central Asia that this should send the message to western energy companies...

Rosatom Set to Build Small Nuclear Power Plants in Uzbekistan

Russian state nuclear power corporation Rosatom is ready to offer lower-capacity nuclear power plant (NPP) projects to Uzbekistan. That's according to comments made by Denis Manturov, Russia's Minister of Trade and Industry, at the fourth annual international industrial exhibition, Innoprom, Central Asia. “Currently, the Rosatom state corporation and the Uzatom...

Britain’s Cameron to Central Asia: Work with Us

Britain’s foreign secretary is in Central Asia this week, seeking deeper ties with a part of the world seen as increasingly vital to international security, energy flows and efforts to combat climate change. The trip, which David Cameron described as overdue, followed criticism that Britain had neglected what the envoy’s...

Turkmen Dissidents Mark Anniversary of Deadly Storm With Government Protest

On April 27 activists from the Warsaw Post-Soviet Dissident Alliance will hold a protest in Warsaw, Poland, against the Turkmen government. The event is being organized in memory of the dozens of victims of the 2020 windstorm in the city of Turkmenabat. The protest will mark the fourth anniversary of...

Disinformation Targets Kazakhstan’s Ties with China, Russia, and the U.S.

Over an eight-day period in April 2024, a barrage of news stories featuring rumors about Kazakhstan’s foreign policy permeated Chinese media. These dubious reports alleged that the U.S. had hyped an unverified leak from a Russian Duma official claiming Kazakhstan was engaged in covert negotiations to join NATO and suggested...

Kazakhstan Has Become Main Trade Partner of China’s Xinjiang Province

According to Chinese Customs Service data from the first quarter of 2024, Kazakhstan became the main trade partner of China's Xinjiang Uygur Autonomous Region. Since the beginning of the year, Xinjiang has conducted trade with 193 countries and regions of the world. The volume of imports and exports with Kazakhstan...

Central Asian Countries Set 2024 Quotas for Amu Darya, Syr Darya River Water Usage

Last week in Kazakhstan, delegates came together for the 87th meeting of the Interstate Commission for Water Coordination (ICWC) of Central Asia, where they discussed the potential and limitations of regional water reservoirs ahead of the 2023-2024 agricultural growing season. According to the ICWC, some of the more pressing questions...

Kyrgyzstan Makes Inroads into Silicon Valley

On a visit to San Francisco (USA) on April 21, Chairman of the Cabinet of Ministers of the Kyrgyz Republic Akylbek Japarov was guest of honour at the opening of the High Technology Park (HTP) House of the Kyrgyz Republic in Silicon Valley. Speaking at the event which brought together...

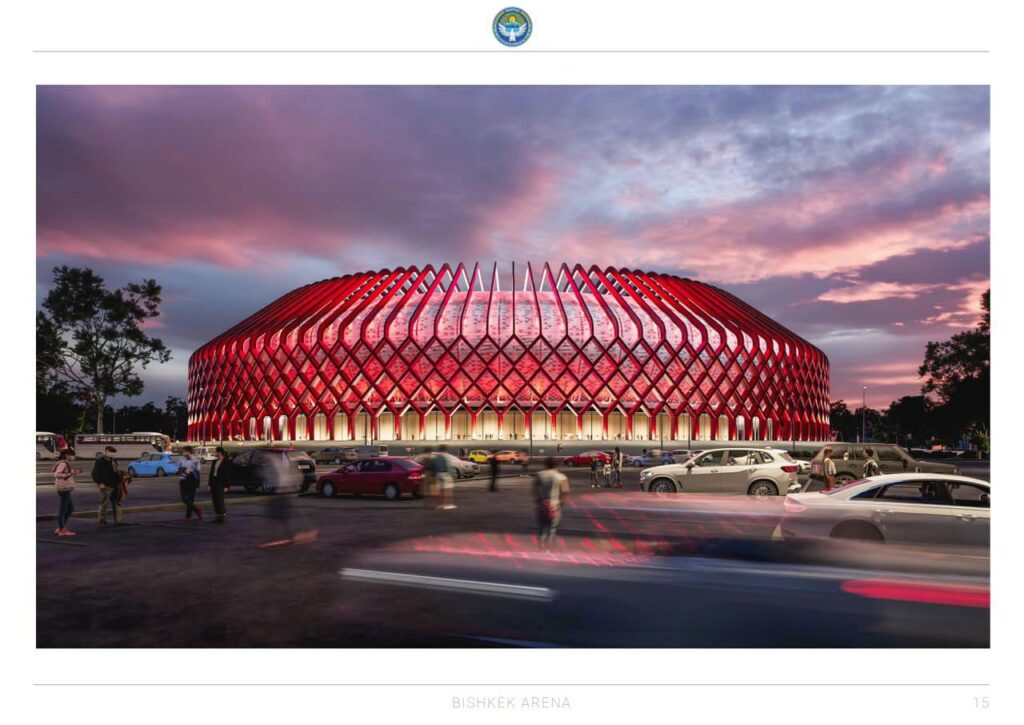

Kyrgyz Football Gets Boost as Construction Starts on New Stadium

Kyrgyzstan is building a 45,000-seat stadium designed to host Asian Football Confederation finals as well as FIFA group matches. This week, President Sadyr Japarov announced that construction on the new stadium near Bishkek had begun and would take two years. Local and Turkish architects and engineers are involved, and there...

Tennis World No. 4 Rybakina Wins Third Tournament of Year in Stuttgart

Kazakhstan’s Elena Rybakina is leading in 2024 tennis titles - three so far - after a comfortable victory over Marta Kostyuk in the Stuttgart final on Sunday. Rybakina, who has also won titles in Brisbane and Abu Dhabi this year, has now won a tour-leading 26 matches this season. That’s...

Kazakhstan: Floods Still a Threat, but Some Residents Returning Home as Waters Ebb

For weeks, it’s been a frantic grind of evacuations, pumping water and shoring up dams as Kazakhstan battles widespread floods. While the threat remains, water levels are declining in some areas and the country is working to help disaster victims in the long term. Some 22,700 people who fled their...

TikTok Users Struggle to Access App after Kyrgyzstan Announces Restrictions

Kyrgyzstan is restricting access to TikTok. The Ministry of Digital Development sent a letter to internet providers, asking them to block the TikTok social media platform, local media has reported. The ministry cited the network´s failure to comply with a law designed to “prevent harm to the health of children,...

Kazakh News Publisher Says New Media Law Does Little for National Press

Kazakhstan's new law "On Mass Media," recently passed by its lower house of parliament (the Majilis), has agitated the country's reporters. In an interview with The Times of Central Asia, Dzhanibek Suleyev, the publisher of several news sites, remonstrates that the law should have been more supportive of the national press. An...

Development of Kazakhstan’s Cinematography: An Inside Look – An Interview with Kazakh Actor, Abay Kazbayev, on Kazakhstan’s Film Industry and its Prospects for Development

Kazakhstan's film industry is attracting more and more attention globally, and many talented actors are contributing to its development. One such theater and film actor is Abay Kazbayev, who agreed to share his experience and vision of the industry. How did you start in the industry? I have...

Central Asia’s Scorecard on Women’s Rights and Welfare

Women's rights differ significantly around the world, with progress varying greatly from one country to another. Some states have advanced gender equality significantly through strong legal systems and policies while others are hindered by cultural norms and a lack of political commitment. In Central Asia, each of the young nations...

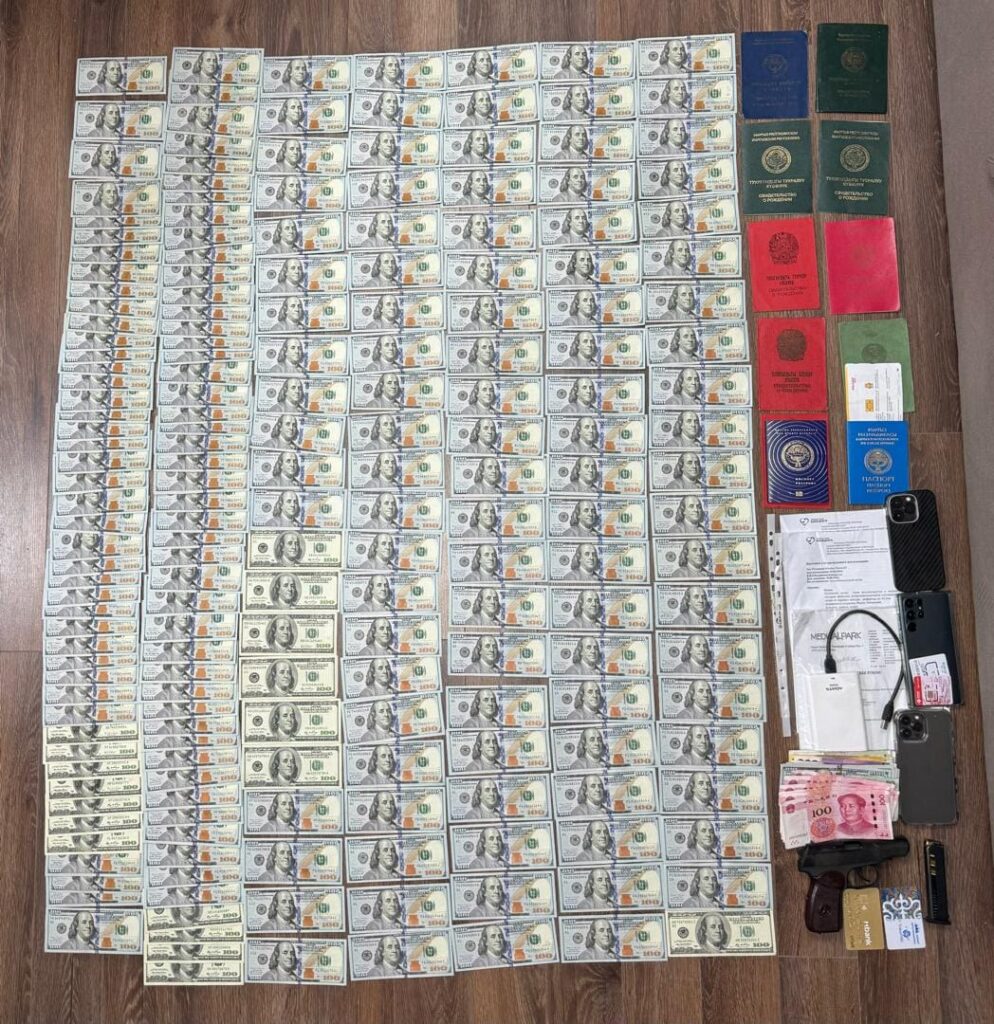

Authorities Find Secret Tunnel Connecting Kyrgyzstan and Uzbekistan

Another underground passage has been found in the Jalal-Abad region of Kyrgyzstan, which was being used to illegally transport both people and contraband goods into neighboring Uzbekistan. The suspects involved have been arrested. That's according to a report from news outlet, Kaktus, which references information from the press service of...

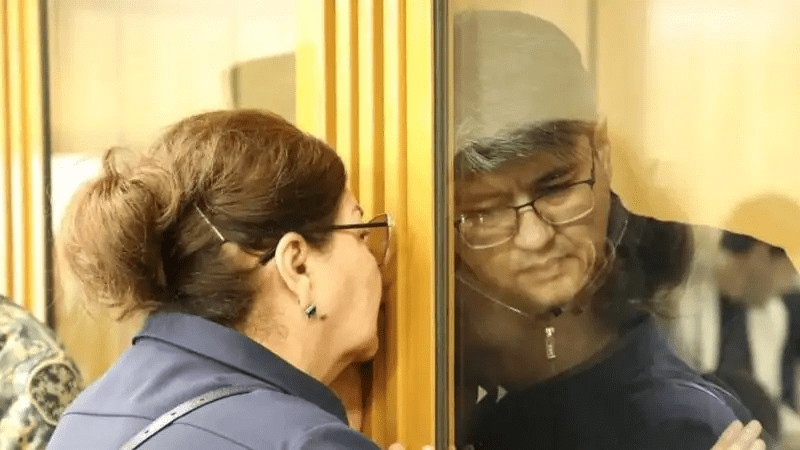

Kuandyk Bishimbayev Pleads Guilty to Negligent Homicide

The judicial inquiry into the case of Kuandyk Bishimbayev concluded on April 24 in Astana. Aitbek Amangeldy, the brother of Saltanat Nukenova, announced that further court dates are scheduled for April 29, 30, and May 2-4. Bishimbayev, who formerly served as Kazakhstan's National Economy Minister, faces allegations of murdering...

Growth of Non-Custodial Sentences in the Kyrgyz Republic Since 2020

The Kyrgyz Republic has reported a decrease of its prison population, which speaks to the ongoing humanization of its criminal justice system. In 2023, the prison population amounted to just 7,728 persons, a 20% decrease compared to 2020 (9,658 prisoners). Despite a 22% increase in the number of convictions, from...

Kyrgyzstan’s Law on NGOs: What Alarms Human Rights Activists?

In April 2024 Kyrgyz President Sadyr Japarov signed a law on non-governmental organizations (NGOs). Now all NGOs must submit full financial reports and register with the Ministry of Justice. Despite the authorities' statements about the need for a document regulating the financing of such organizations, the law has numerous opponents....

Kyrgyzstan’s Special Services Take On The Drug Mafia

The head of Kyrgyzstan's National Security Service, Kamchybek Tashiyev, has commented that unless it is curbed, the country's already highly complex drug situation is likely to be beyond control within ten years. Speaking at a meeting with heads of Kyrgyzstan's police departments, Tashiyev said that the number of both drug...

Traffickers of Human Organs Detained in Kyrgyzstan

The State Committee for National Security (SCNS) of Kyrgyzstan has detained members of an international criminal group at Manas Airport. The criminals had organized a black-market channel for the illegal sale of human organs abroad. All detainees are citizens of the Kyrgyzstan. According to the investigation, the criminal group looked...

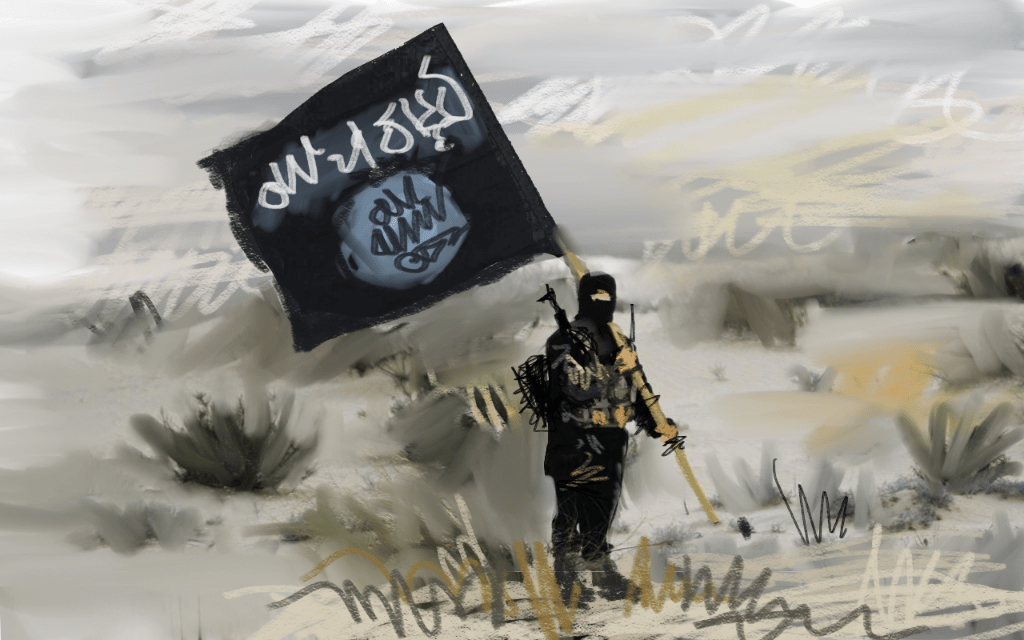

Islamic State – Khorasan Province: An Element of Geopolitical Rivalry?

In the aftermath of the terrorist attack in Moscow, the media has once again been saturated with discussions about the terrorist group Islamic State – Khorasan Province (ISKP), also known as ISIS-Khorasan and “Wilayat Khorasan.” At this point, most of the coverage has focused on the Afghan wing of Islamic...

Kazakhstan President Signs Landmark Legislation on Domestic Violence

On April 15, President Kassym-Jomart Tokayev signed into law amendments and additions passed by Kazakhstan’s parliament on April 11 on legislative acts and the code on administrative offenses on ensuring the rights of women and the safety of children. The initiative represents a first in the CIS in terms of...

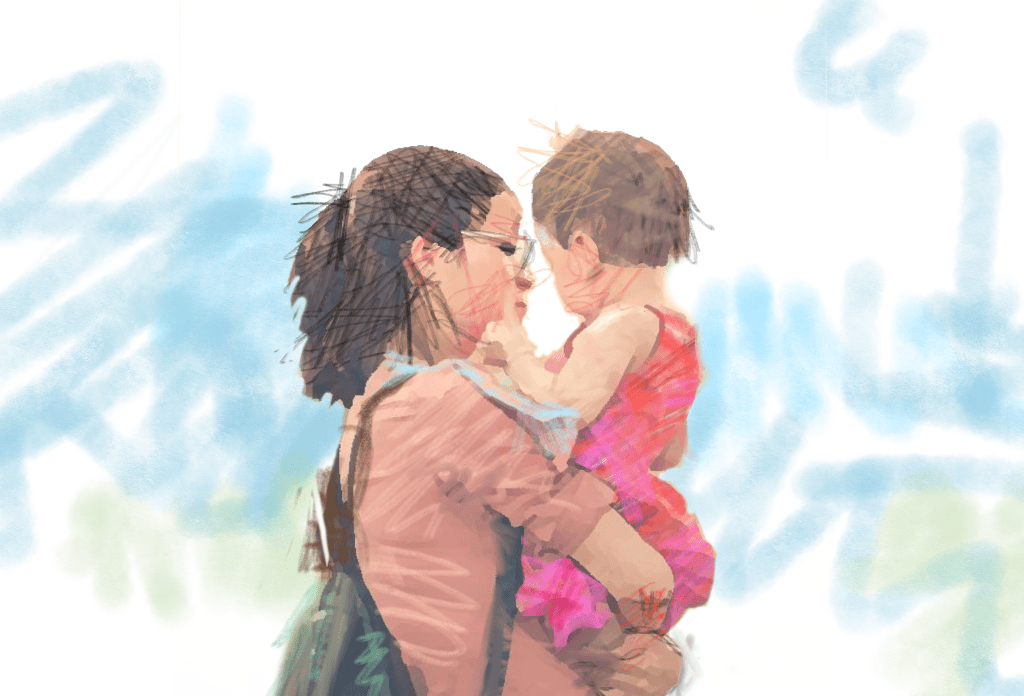

The Bishimbayev Trial: The Women of Kazakhstan Speak

The trial of the trial of former Minister of the Economy, Kuandyk Bishimbayev, has ignited discussions across Kazakhstan, particularly among women. Online actions and rallies across Europe have been organized in memory of the victim, Saltanat Nukenova, and the Senate has passed a law strengthening protections for women and children...

Kazakhstan Repurposing Floodwater

In a strategic response to the unprecedented spring flooding this year, Kazakhstan is channeling its efforts towards harnessing the disastrous floods to its advantage. The Ministry of Water Resources and Irrigation in Kazakhstan has embarked on a program to utilize the massive floodwaters for future irrigation and environmental sustainability. In...

Mudslides in Kyrgyzstan Flood Over 200 Homes

Kyrgyzstan's emergencies ministry has formed an operational headquarters to deal with recent flooding in the south of the country. Rescuers report that hundreds of local residents have been evacuated to safety. Flooding due to heavy rains began last week in Kyrgyzstan's southern Osh region, prompting the region to declare a...

U.S. Government Discusses Data From Air Quality Monitor at Tashkent Embassy

On April 22, a press conference was held at the U.S. Embassy in Uzbekistan with American air quality specialist and researcher Jay Turner speaking to media representatives about the air quality monitoring device installed at the embassy in Tashkent in 2018. According to Turner, the device monitors the concentration of...

Central Asian Countries Set 2024 Quotas for Amu Darya, Syr Darya River Water Usage

Last week in Kazakhstan, delegates came together for the 87th meeting of the Interstate Commission for Water Coordination (ICWC) of Central Asia, where they discussed the potential and limitations of regional water reservoirs ahead of the 2023-2024 agricultural growing season. According to the ICWC, some of the more pressing questions...

Kazakhstan: Floods Still a Threat, but Some Residents Returning Home as Waters Ebb

For weeks, it’s been a frantic grind of evacuations, pumping water and shoring up dams as Kazakhstan battles widespread floods. While the threat remains, water levels are declining in some areas and the country is working to help disaster victims in the long term. Some 22,700 people who fled their...

No Lessons Being Learned From Kazakh Floods, Says Political Analyst

Kazakhstan has been prone to flooding before, but the 2024 Kazakh floods have added a catastrophic page to the chronicles. Political analyst Marat Shibutov tells The Times of Central Asia that only extremely tough measures can motivate ministers and akims (local government executive) to actually work on flood prevention. ...

Kyrgyzstan, Kazakhstan and Uzbekistan Consider Joint-Stock Company to Build Kambarata HPP-1

Kazakhstan’s Ministry of Energy has announced that the draft Agreement between the governments of Kyrgyzstan, Kazakhstan, and Uzbekistan on the joint implementation of the construction and operation of Kambarata hydroelectric power plant (HPP)-1 has been posted on Kazakhstan’s official Internet portal Open Legal Acts. Available for public discussion, the agreement...

“Eco-Enthusiasts” – Tashkent Hosts Environmental Competition for Students

On April 13, an environmental awareness competition, "Eco-Enthusiasts" was held in Tashkent's Zahiriddin Muhammad Babur Central Ecopark. The event was organized in accordance with the decree of the President, "On measures for effective work of the Ministry of Ecology, Environmental Protection and Climate Change," and was timed to coincide with...