Kyrgyzstan Tightens Regulations on Religious Activities

Kyrgyzstan’s President Sadyr Japarov has signed into law a series of amendments regulating the religious sphere. The amendments, approved by the Kyrgyz parliament on December 26, 2024, aim to ensure the rights of citizens while establishing clear responsibilities for religious associations in accordance with the Law “On Freedom of Religion and Religious Associations.”

Key Provisions of the Amendments

The new legislation introduces several notable restrictions and guidelines:

- Prohibition of Face-Covering Clothing:

Clothing that obscures a person’s identity, such as the niqab, is now banned in government offices and public places. Exceptions include clothing required for work or for medical purposes. - Prohibition of Coercion in Religious Conversion:

The amendments ban any form of coercion aimed at converting individuals to a particular religion. This includes targeting followers of other faiths, religiously neutral individuals, or atheists. - Restrictions on Religious Ceremonies:

Religious ceremonies, meetings, and other religious events are now prohibited in nursing homes, homes for the disabled, correctional institutions, pre-trial detention centers, and military units. Invitations to religious figures or preachers from foreign religious organizations for such events are also prohibited. - Limitations on Religious Organizations:

- Religious organizations are prohibited from interfering in the activities of state authorities or local governments.

- Dissemination of religious literature, audio, and video materials in public places, educational institutions, or through door-to-door efforts is banned.

- Restrictions on Political and Electoral Activities:

- Political parties cannot be established on a religious basis, nor can they be financed by foreign entities.

- Civil servants are barred from engaging in religious activities, and religious materials cannot be used in electoral campaigns.

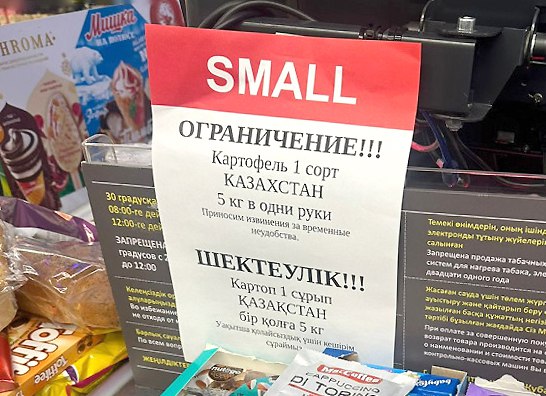

- Prohibition on Religious Terms in Business Names:

The Kyrgyz Cabinet of Ministers approved list of religious words and terms that cannot be used in the names of businesses or legal entities. Prohibited terms include references from various religions, such as “Jesus Christ,” “The Bible,” “Jihad,” “Krishna,” “Kosher,” “Hajj,” and “Caliphate,” among others.

Expanding Oversight of Religious Activities

The new laws reflect the Kyrgyz government’s growing efforts to exert control over the religious sphere in the predominantly Muslim nation. Kyrgyzstan leads Central Asia in terms of the number of mosques per believer, with 3,593 mosques across the country as of 2024. Of these, 46 are registered in Bishkek and 89 in Osh. The country also has 220 religious educational institutions, most of which are located in the southern Osh region.

The restrictions on religious literature, events, and political activity come amid broader efforts to regulate religious influence on public and political life.

Implications for Religious Organizations

The prohibition on using religious terminology in business names has drawn particular attention, as the banned terms include key concepts from Islam, Christianity, and other major religions. This move could limit the visibility of religious organizations and restrict their operations in the public sphere.

Additionally, the ban on foreign preachers in sensitive locations, such as prisons and military units, underscores the government’s intent to limit external religious influence and maintain tighter control over religious practices within the country.

Kyrgyzstan’s amended laws mark a significant tightening of state regulation over religious activities. While the government frames these changes as necessary for ensuring order and protecting citizens’ rights, critics may view them as an attempt to curtail religious freedoms in a country known for its religious diversity. The long-term impact of these measures on the country’s religious landscape remains to be seen.