Kazakhstan Faces Turbulence as External Pressures Mount

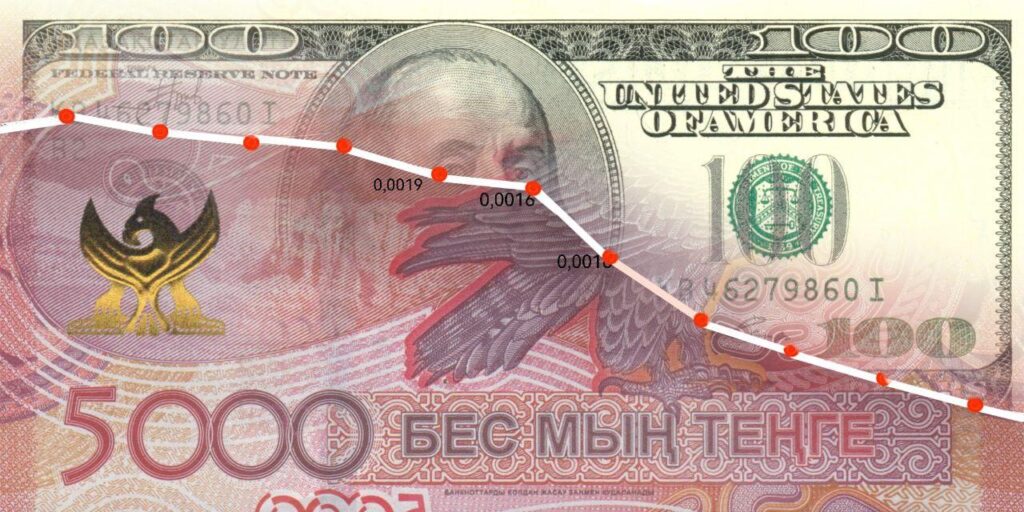

Kazakhstan, Central Asia’s largest economy, is facing a convergence of pressures that President Kassym-Jomart Tokayev and National Bank Chairman Timur Suleimenov must now manage simultaneously, from currency depreciation and geopolitical turmoil to volatile oil markets and contentious fiscal reforms, that are testing its economic resilience. Geopolitical Pressures Escalate By mid-2025, it had become increasingly apparent that Kazakhstan has limited capacity to influence global geopolitical dynamics. Like many “middle powers,” the country must adapt to the actions of larger states, whose unpredictable decisions continue to exert downward pressure on the tenge and fuel inflation. On July 28, U.S. President Donald Trump shortened a previously issued 50-day ultimatum to Russian President Vladimir Putin, giving him just 10-12 days to agree to a peace deal with Ukraine. This development added to the mounting uncertainty already impacting Kazakhstan’s economy. As previously reported by The Times of Central Asia, analysts warn that Trump’s secondary sanctions, 100% tariffs targeting Russia’s trading partners, could potentially be extended to Kazakhstan and other Central Asian economies. Though Kazakhstan is not among Russia’s largest trading partners, its economic links to Moscow are still substantial. The country relies heavily on imports from Russia, including electricity, gasoline, food, and medicine. Adding to the pressure, on July 7, Trump announced a 25% tariff on Kazakhstani goods, effective August 1, 2025. While $1.8 billion of Kazakhstan’s $2 billion in exports to the U.S. (mostly oil, metals, and rare earth elements) are exempt, the move has nonetheless rattled Kazakhstan’s already fragile industrial sector and spooked investors. Oil price instability, largely driven by Western efforts to curtail Russian exports, also poses a major risk. Oil revenues make up the bulk of Kazakhstan’s export income and are a key source of budget financing. Further complicating matters, new Russian restrictions require foreign tankers to obtain Federal Security Service (FSB) approval before accessing key Black Sea ports. This affects the Caspian Pipeline Consortium (CPC), which handles more than 80% of Kazakhstan’s oil exports and is partly owned by U.S. firms Chevron and ExxonMobil. Reuters estimates the new rules could disrupt over 2% of global oil supply. Tenge Hits Historic Low As of July 28, the tenge dropped to a record low of 544.87 per U.S. dollar. The depreciation is driving up the cost of imports, an acute problem in an import-dependent economy, pushing more families to spend over half their income on food. Companies with debt obligations in U.S. dollars are also seeing their liabilities grow, worsening the investment climate and prompting firms to scale back on planned expansions. Central Bank Warns Against Intervention National Bank Chairman Timur Suleimenov cautioned against government intervention in currency markets, a position supported by President Kassym-Jomart Tokayev, who has repeatedly cautioned against short-term administrative measures that can destabilize the economy. Suleimenov noted that past attempts to control the exchange rate led to abrupt and damaging devaluations. Suleimenov attributed the tenge’s vulnerability to rising fiscal injections and an 18% increase in the money supply, stressing that without parallel growth in GDP and industrial output,...