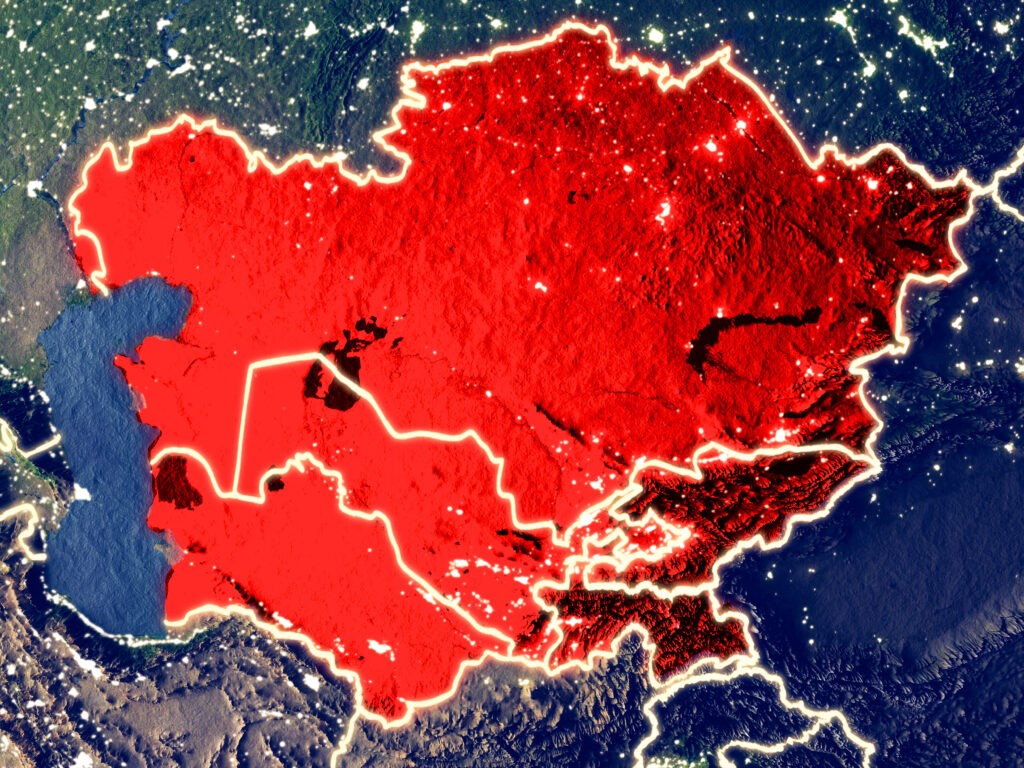

Central Asia, with its rich history as a crossroads of civilizations and a gateway between East and West, finds itself at a crucial juncture in its economic development. The region is showing signs of moving towards becoming a more cohesive economic group, an evolution that could have far-reaching implications for renewable energy development, food security, global commerce and geopolitics. Central Asian states are better positioned than ever to capitalize on their strengths and resources to help the rest of the world deal with climate change, security challenges associated with geopolitical shifts and the ongoing digital transformation of the global economy. Realizing this vast potential will require continued focus, commitment and cooperation from the region’s leaders, as well as long-overdue support from Western leaders for some of the most progressive reforms Central Asia has seen in recent years. Green energy potential Rich in natural resources, Central Asia is fast becoming pivotal for the global green energy transition. Leveraging vast reserves of rare earth elements (REEs) and other crucial minerals combined with its significant potential for renewable energy production, the region is increasingly recognized as a key contributor to realizing a more sustainable future. Kazakhstan, one of the region's major players, boasts over 56 identified deposits of REEs, with reserves and resources surpassing 450,000 tons. These elements, including lithium and cobalt production, are crucial for battery technologies powering renewable energy applications. This positions Kazakhstan as a significant supplier for the burgeoning green technology industry. Kyrgyzstan and Tajikistan also show promise. Inventory reviews of REE-bearing mineral occurrences and delineation of areas-of-interest suggest these countries could be home to considerable undiscovered resources, further boosting their contribution to green energy transitions. In addition to its abundant natural resources, Central Asia is an ideal candidate for green hydrogen production. Uzbekistan, with PowerChina and the Saudi company ACWA Power is constructing the country's first green hydrogen plant. Meanwhile, Kyrgyzstan and Tajikistan, with their surplus hydropower electricity, are well-positioned for hydrogen production. Once again, however, Kazakhstan boasts the most ambitious goal: The country aims to produce two million tons of green hydrogen annually by 2032, marking its intent to become a major player in the global green hydrogen market. In 2022, it inked a $50 billion deal with the German energy grou Svevind to build one of the world's largest green hydrogen plants supplying Europe. Kazakhstan, which holds 13% of the world’s uranium reserves, also leads the pack in uranium mining, meeting a significant portion of annual demand from Europe and the U.S.. As nuclear power plays a crucial role in the green energy transition, Kazakhstan's role is set to grow. The country is exploring new avenues to access the international market. On the other hand, Kyrgyzstan, Uzbekistan and Tajikistan are also known for their uranium deposits but they are currently prioritizing the remediation of past mining sites over active uranium production. This responsible approach underscores the region's commitment to sustainable development. Central Asia's commitment to a greener future extends beyond resource development.. Several states, including Kazakhstan, Turkmenistan,...