Kazakhstan, with China’s Help, Plans to Export Green Energy to Europe

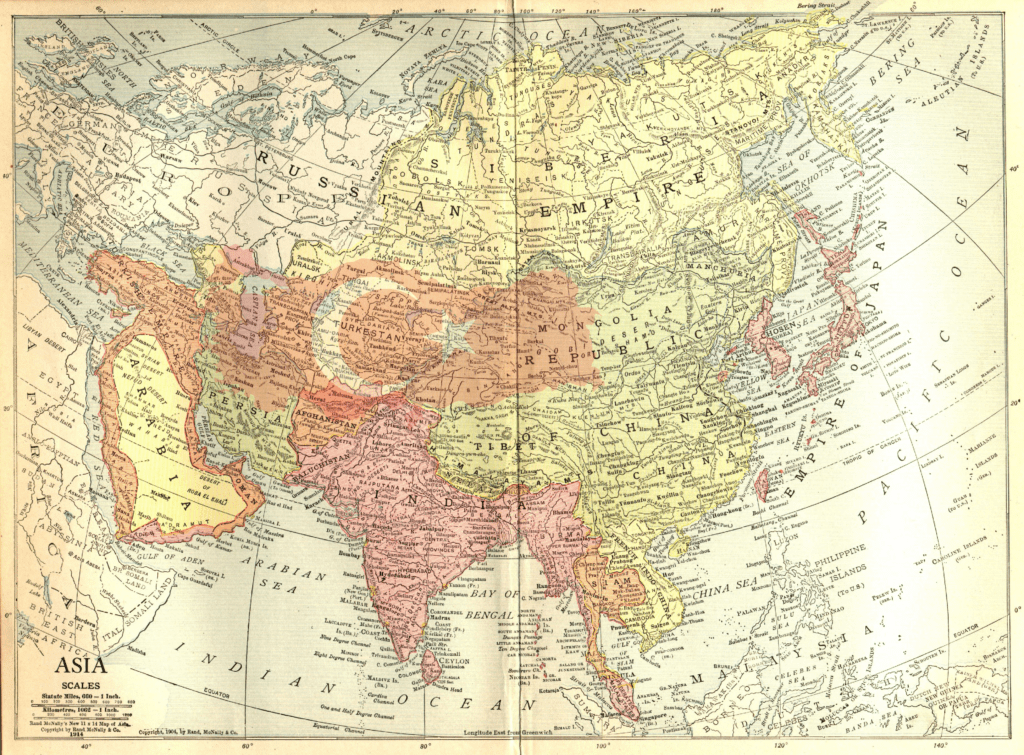

Although Kazakhstan is a major producer of all fossil fuels – coal, crude oil, and natural gas – it also has the capacity to secure its energy future by prioritizing renewable energy. Fully aware of that, the European Union – one of the former Soviet republic’s most significant trade partners – aims to strengthen its energy ties with Astana, hoping to begin importing not only “green electricity” from the Central Asian nation, but also green hydrogen. On November 25, at Nazarbayev University in Astana, the “Energy in Transition – Powering Tomorrow” traveling exhibition was held, and one of the major topics discussed by energy experts was green hydrogen – hydrogen produced using renewable energy sources such as solar and wind power. It is unlikely a pure coincidence that the German Federal Foreign Office initiated the event. Over the past few years, Germany has shown interest in the development of the Kazakh green hydrogen sector. The most prominent green hydrogen project in Kazakhstan is currently being developed by Hyrasia One, a subsidiary of the German-Swedish energy company, Svevind. In 2021, the company announced its plans for €50 billion ($55 billion) green hydrogen project in the Mangystau Region in western Kazakhstan. It is expected that Hyrasia One will begin the production of green hydrogen in 2030, and the power plant will reach full capacity by 2032. Meanwhile, the authorities in Astana will need to find a way to export this form of renewable energy to Europe, a major energy market for Kazakhstan. Although Astana and Brussels signed a strategic partnership on the production of green hydrogen in November 2022, several challenges remain in the implementation of the deal. Issues such as the high cost, water scarcity in the largest Central Asian state (with water being the key component of green hydrogen production), and a lack of transport infrastructure, are significant barriers to exporting hydrogen from Kazakhstan to Europe. Using Russian gas pipeline systems for transportation of the Kazakh green hydrogen to Europe is not an option given current geopolitical circumstances. To resolve this transportation issue, the Kazakh authorities and their European partners could build hydrogen pipelines across the Caspian Sea, the Caucasus and Turkey to reach southern European countries. The problem is that building such a pipeline infrastructure is very expensive, and it remains uncertain who would be willing to fund such a project. That, however, does not mean that Kazakhstan cannot become Europe’s major green hydrogen supplier. What Astana would have to do, according to experts, is to convert the green hydrogen into green ammonia and then export it to Europe via the Middle Corridor – running through Kazakhstan, the Caspian Sea, Azerbaijan, and Georgia. On the Black Sea coast, ammonia would be loaded onto ships and transported past the Bosphorus to EU members such as Greece, Romania, and Bulgaria. From there, it would be sent further north, where green hydrogen would eventually be extracted from the ammonia. This is a rather complex process, and it is unclear how feasible and...

1 year ago