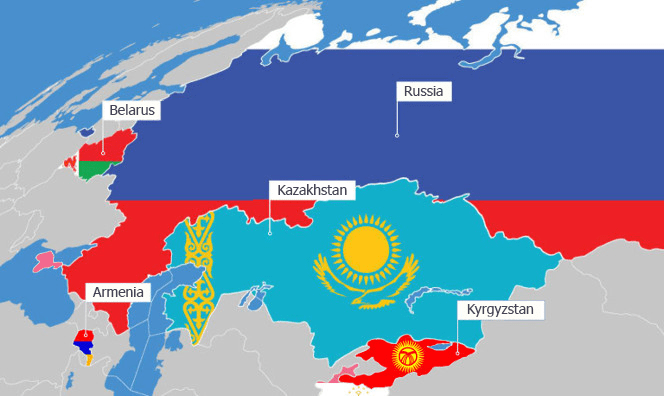

Household Debt Persists Despite Lending Slowdown in Kazakhstan

At the start of 2026, Kazakhstan’s financial indicators appear promising: the population is borrowing less, and banks are increasing financing to businesses. Yet behind this macroeconomic optimism lies a more complex picture. The debt burden on citizens has not disappeared; it has simply changed form. While less visible in financial reports, household debt is becoming increasingly evident in everyday family budgets. Two Realities, One Economy Madina Abylkasymova, chair of the Agency for Regulation and Development of the Financial Market, reported to President Kassym-Jomart Tokayev that consumer lending has slowed, while business lending has begun to grow steadily for the first time in three years. Data from the National Bank confirm this trend. In 2024, lending to individuals increased by 23.5%. By the end of 2025, growth had slowed to 17.7%. Business lending, meanwhile, accelerated from 17.9% to 19%. From a macroeconomic perspective, the regulator has met its interim objective: banks are channeling more resources into the productive economy. However, an analysis of second-tier banks’ portfolios suggests that a fundamental imbalance persists. Excluding development institutions and the quasi-public sector, end-of-year data show household debt to commercial banks at $55.1 billion, compared with business debt of 15.4 trillion tenge, or approximately $34.2 billion. The resulting $22.2 billion gap points to a structural issue: individuals remain the primary source of income for major private banks, including Halyk Bank, Kaspi Bank, and Bank CenterCredit (BCC), while the real sector continues to be underfinanced by market-based institutions. Shift to Installment Plans In 2025, under pressure from regulators, banks tightened lending standards for consumer loans. Traditional cash loan issuance slowed significantly. Despite this, total household debt continued to grow. According to the National Bank, the consumer loan portfolio expanded by KZT 2 trillion in the first half of 2025, reaching $55.1 billion by year’s end. This growth was driven not by large loans but by installment plans and Buy Now, Pay Later (BNPL) services. The number of loan contracts is rising much faster than the number of borrowers, a classic sign of demand fragmentation. Instead of a single large loan, citizens are taking out multiple small loans for food, clothing, and everyday necessities. This reflects declining purchasing power. Inflation reached 12.3% by the end of the year, with food prices rising 13.5%. At the same time, official data shows real incomes fell by 2%. Installment plans, once used primarily to purchase durable goods, are increasingly being used to “make ends meet.” Statistically, this appears as a reduction in average loan size and risk exposure. In reality, it points to growing debt dependency among households. Why the Bankruptcy Law Has Fallen Short The 2023 law on restoring personal solvency and bankruptcy was designed to address over-indebtedness structurally. But by early 2026, it was clear the system was functioning unevenly. Data from 2025 reveals the scale of rejections. Of more than 270,000 submitted applications, only about 34,000, just 12%, were approved. Approximately 87% of applicants received official denials. The main reason lies in strict eligibility criteria. For out-of-court...