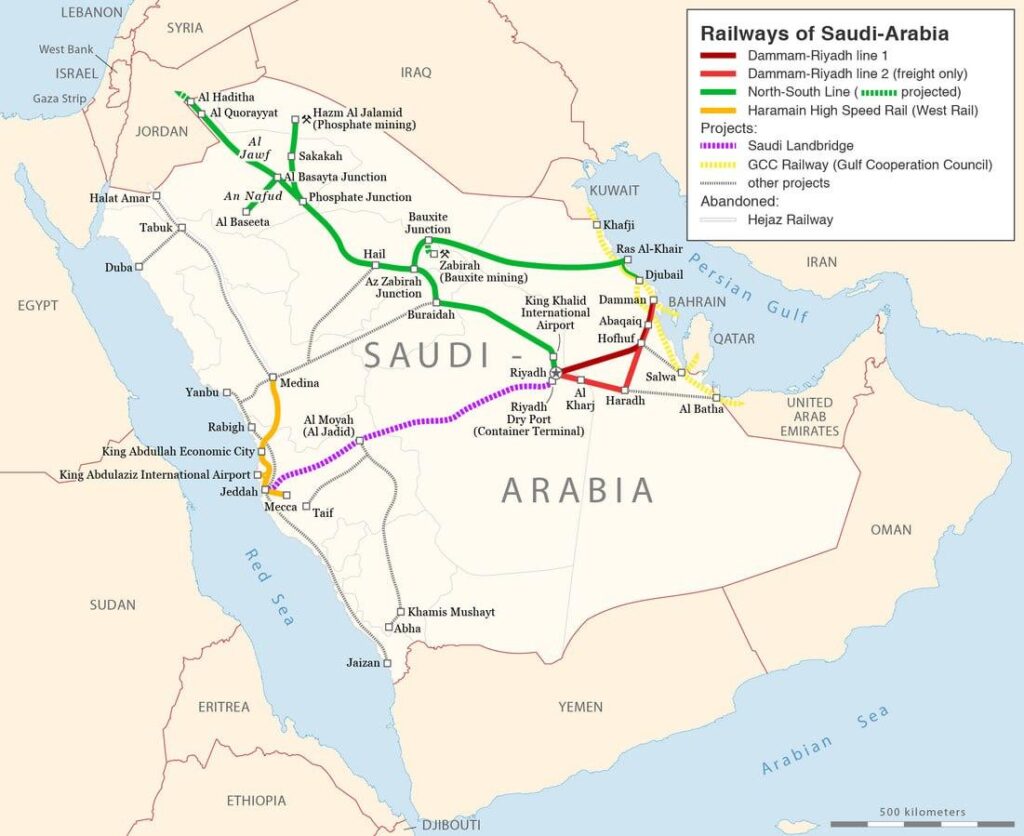

The agreement signed on December 8, 2025, between Saudi Arabia and Qatar to construct a high-speed railway linking Riyadh and Doha marks a pivotal development in transport connectivity across the Persian Gulf. Beyond its bilateral implications, the project could have broader consequences for transregional logistics, particularly for Central Asia and Kazakhstan. The 785-km railway will pass through key cities in Saudi Arabia’s Eastern Province, including Dammam and Al-Hufuf, and will connect King Salman and Hamad International Airports. Trains are expected to reach speeds exceeding 300 km/h, reducing travel time between the two capitals to approximately two hours. The six-year project is projected by officials to boost the combined GDP of both countries by around $30 billion and create up to 30,000 jobs. The Gulf Railway and New Regional Connectivity The Riyadh-Doha line is a central element of the Gulf Railway initiative, which is seeking to establish a unified railway network among Gulf Cooperation Council (GCC) member states, Saudi Arabia, Qatar, the UAE, Bahrain, Kuwait, and Oman, with a target date of around 2030. Originally envisioned primarily as a freight system, the Gulf Railway is increasingly incorporating high-speed passenger services alongside freight, reflecting the region’s push for greater internal integration and reduced dependence on air travel. The Riyadh-Doha segment forms a vital axis between the Gulf’s political and financial hubs and is expected to link with Saudi, Emirati, and Omani infrastructure, laying the groundwork for a more integrated regional transport system. Beyond the Peninsula While the Gulf Railway’s scope is geographically confined to the Arabian Peninsula, meaningful integration with Eurasia would require additional connectivity, particularly via land and multimodal routes through Iran, Turkey, and the Caspian region. Among these, the overland corridor through Iran is especially significant, though constrained by sanctions, financing risks, and political uncertainty. Kazakhstan-Turkmenistan-Iran Corridor Unlike many conceptual infrastructure proposals, the Kazakhstan-Turkmenistan-Iran railway, operational since 2014, is already a functioning freight corridor. It provides Central Asian nations with direct access to Persian Gulf ports and Middle Eastern markets. For Kazakhstan, the route offers strategic diversification away from traditional corridors. While no formal plans exist to link GCC rail infrastructure directly with Central Asia, the emergence of high-capacity Gulf rail corridors reshapes the long-term connectivity landscape. A future interface could allow Astana overland access to Gulf markets, while enabling reciprocal flows from the Gulf into Central Asia, China, and Europe. President Kassym-Jomart Tokayev has previously described Iran as a “gateway” to Southeast Asia and Africa. Kazakhstan has also outlined plans to establish its own logistics terminal in the Iranian port of Shahid Rajai in Bandar Abbas, further enhancing its position in Gulf-Eurasia trade flows. Iran’s Evolving Role Historically, Iran’s role as a transit state has been hampered by international sanctions and regional tensions. However, the 2023 normalization of relations between Saudi Arabia and Iran, brokered by China, has altered the regional calculus. Although still fragile, this diplomatic thaw improves prospects for long-term infrastructure projects involving Iran as a critical transit link between the Persian Gulf and Eurasia. Alternatives and Their...