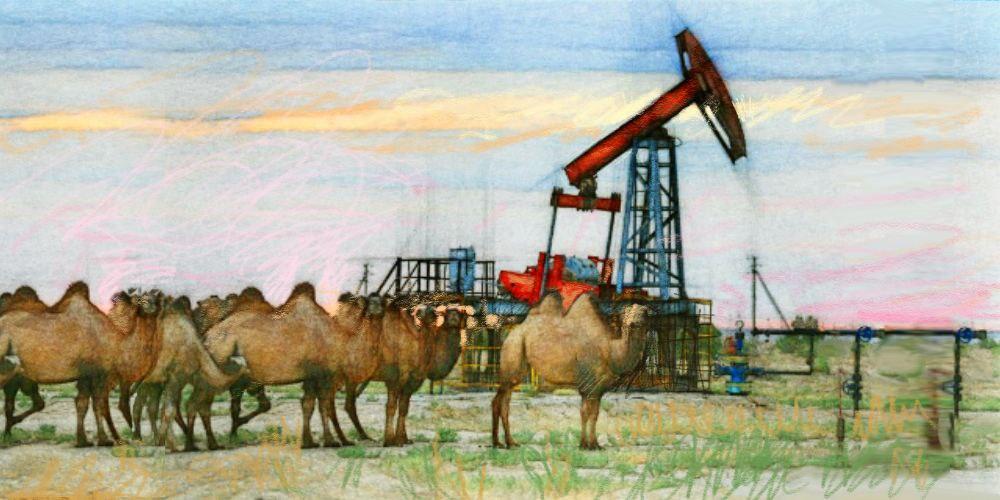

Slippery Slope: How Falling Oil Prices Threaten Kazakhstan’s Energy Giant

With global oil markets in flux and prices dipping below $70 per barrel, Kazakhstan’s state oil company faces mounting financial strain. If KazMunayGas (KMG) fails to adapt, it risks edging toward a fiscal cliff. Yet, political constraints, exacerbated by the ongoing specter of potential social unrest, have hindered the company’s ability to implement reforms. OPEC+ Fuels Market Uncertainty The global oil market is entering a new period of turbulence reminiscent of the pandemic era. Despite prolonged efforts by OPEC+ to manage output and stabilize prices, the alliance’s fragile consensus unraveled this April, when Saudi Arabia and Russia led an unexpected increase in production, undermining earlier commitments and tipping the market into oversupply. Meanwhile, U.S. shale producers have continued to expand their output and export aggressively, squeezing traditional suppliers out of lucrative Asian markets. A decelerating Chinese economy, the world’s largest oil importer, adds further downward pressure. As a result, Brent crude fell below $70 per barrel in early May and briefly traded under $65. For Kazakhstan, where oil exports are a key source of budgetary and foreign exchange income, this trend spells trouble, and KMG is particularly exposed. The “Black Hole” in KMG’s Finances Public data shows that KMG’s production costs vary from $40 to $70 per barrel, depending on the field. However, factoring in transportation, taxes, and social obligations, the real breakeven point nears $90 per barrel. Aging infrastructure in the Mangistau region, reliant on constant technical upkeep and subsidies, only adds to the burden. KMG’s debt load compounds the challenge. At the end of 2024, its total debt exceeded 4 trillion tenge ($7.87 billion). With export revenues dwindling, debt servicing is becoming untenable. Even short-term dips to $60-65 per barrel could have systemic consequences, stalling new investments, triggering layoffs, and slashing social spending. A key drain is OzenMunayGas (OMG), KMG’s subsidiary in Zhanaozen, where production costs reportedly hit $90 per barrel. “OzenMunayGas exemplifies how populism, inflated promises, and stagnant reforms can turn a major asset into a financial sinkhole,” Arman Bataev, a former internal auditor at KMG has stated. On his Telegram channel, Finmentor.kz, Bataev warned that a $90 production cost versus Brent at $59 is “not a temporary hardship but a dead end.” OMG required 30 billion KZT in financial aid last year, and Bataev predicts it may require 60-70 billion KZT in 2025. KMG Downplays Risks KazMunayGas officials maintain that the company is “prepared for all scenarios” and holds “sufficient reserves.” At a May press briefing, Deputy Chairman Aset Magauov emphasized that 70% of KMG’s output is sold domestically, insulating it somewhat from global price volatility. “Analysts expect prices to average $65 per barrel this year, but forecasts are inherently uncertain,” Magauov said. “We have contingency plans and cost-optimization measures ready. We are equipped to handle price fluctuations.” Magauov also noted that domestic oil prices are lower than export prices, and products like gasoline and diesel, refined at KMG’s three facilities, are now sold at market rates following the end of state price controls. He added...