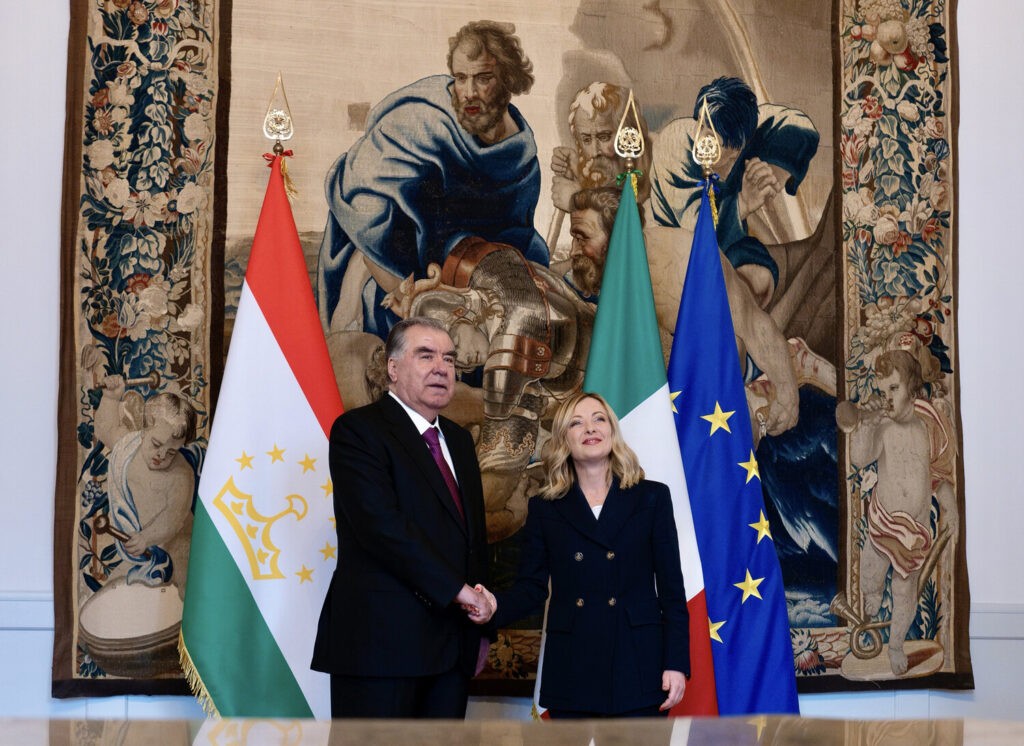

Tajikistan and Italy Engage in Dialogue to Enhance Collaboration

On April 23, Tajikistan President Emomali Rahmon and the President of the Council of Ministers of Italy Giorgia Meloni met in Rome to discuss expanding bilateral relations regarding political, economic, trade, cultural, humanitarian, and security issues. According to Tajikistan’s president’s press service, both sides expressed interest in expanding cooperation in the fields of hydropower, light, food, metallurgical, mining, and chemical industries, as well as agriculture, pharmaceuticals, and tourism. Seeking to attract Italian capital for the development of his country’s industrial sector, President Rahmon emphasized that Tajikistan has all the necessary components for creating joint ventures in processing agricultural and industrial products and increasing their export to European countries. The leaders also discussed opening direct flights between Tajikistan and Italy, cooperation in education and healthcare, and the allocation of quotas for Tajik students wishing to study at Italian universities. As reported by the Italian prime minister’s office, the meeting resulted in the signing of several bilateral agreements aimed to strengthen Italy’s relationship with Central Asia through enhanced dialogue and collaboration in all sectors of common interest including security, drug control and tourism, as well as cultural, scientific and technological cooperation, and sustainable development.