Analysis: How Kazakhstan’s New Road and Rail Projects Are Boosting the Economy

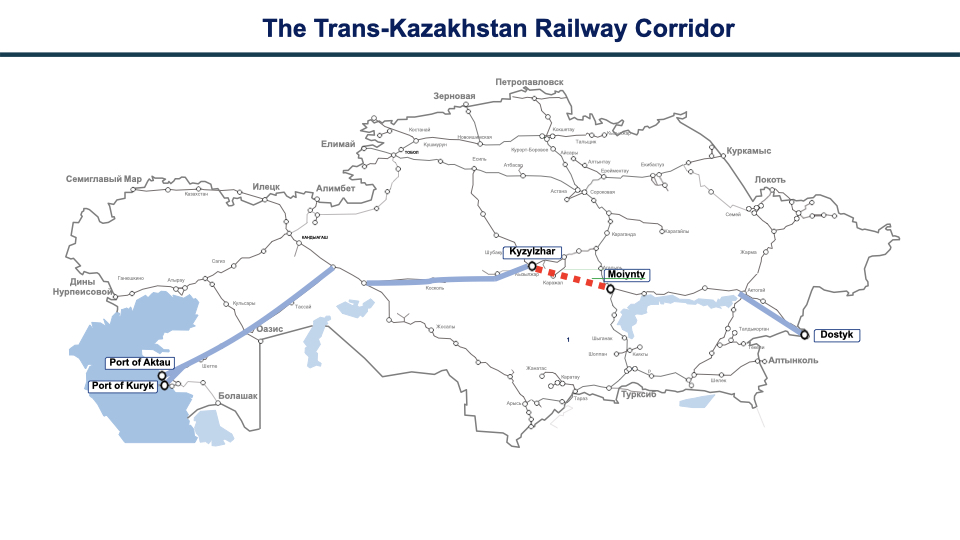

Kazakhstan is the largest landlocked country in the world, located at the strategic crossroads of Eurasian trade routes. This year, the country launched two major infrastructure projects: the Trans-Kazakhstan Railway Corridor and the construction of a new Center-West Highway, which will connect the capital, Astana, with Kazakhstan’s western regions. How the Center-West Highway will reshape Kazakhstan’s economy and logistics The Center-West Highway will link Astana to the country’s western territories, providing direct access to the Middle Corridor, also known as the Trans-Caspian International Transport Route (TITR). Passing through the towns of Arkalyk, Turgay, and Irgiz, the route will cut the distance to western Kazakhstan by more than 560 kilometers (about 350 miles). It is expected to improve interregional connectivity, stimulate socio-economic growth, increase the capacity of the transport network, and strengthen Kazakhstan’s role as a transit hub. Deputy Minister of Transport Maksat Kaliakparov told The Times of Central Asia that construction is still in its early stages. Repairs on the Astana-Korgalzhyn-Karazhar section are currently funded by the Development Bank of Kazakhstan, with completion planned for 2026. “The remaining sections are still in the design phase, and financing is being secured,” Kaliakparov said. “This year we plan to complete feasibility studies for unpaved sections, approve project documentation for the Arkalyk-Egindikol and Irgiz-Torgay stretches, and explore public-private partnerships to attract investment.” Beyond improving domestic transport links, the Center-West Highway is set to become a crucial part of the TITR, providing a shorter and more reliable route to Kazakhstan’s Caspian ports of Aktau and Kuryk. This will speed up transit, increase freight volumes, and reduce logistics costs for both domestic and international shippers. According to Kaliakparov, the project also includes modern roadside infrastructure: logistics hubs in Arkalyk and Irgiz, service stations, cafés, hotels, and an intelligent traffic monitoring and control system. “It is also important to introduce a number of innovative and environmentally friendly solutions, such as stormwater treatment facilities, energy-saving LED lighting, and the use of recycled materials. Environmental requirements will also be taken into account, including the preservation of animal migration routes using environmentally friendly solutions such as underground passages and eco-bridges,” emphasized Kaliakparov. However, despite its significant advantages, the project faces a number of challenges. The key ones among them are financing, complex terrain and geological conditions, seasonal limitations, and low population density along parts of the route, which affect its commercial viability. Kaliakparov added: “The road requires significant investment, especially for the construction of new sections, some of which pass through hard-to-reach areas. It is also necessary to take into account the short construction season in the northern and central regions of the country”. According to him, the highway is being designed with the local climate in mind. Kazakhstan’s continental weather patterns, sharp temperature fluctuations, steppe and semi-desert landscapes, hydrological studies, erosion prevention measures, and strict environmental compliance are taken into account. Once completed, the Center-West Highway is expected to increase freight traffic to 5–6 million tons per year, cut delivery times between central and western Kazakhstan by 30–40%,...