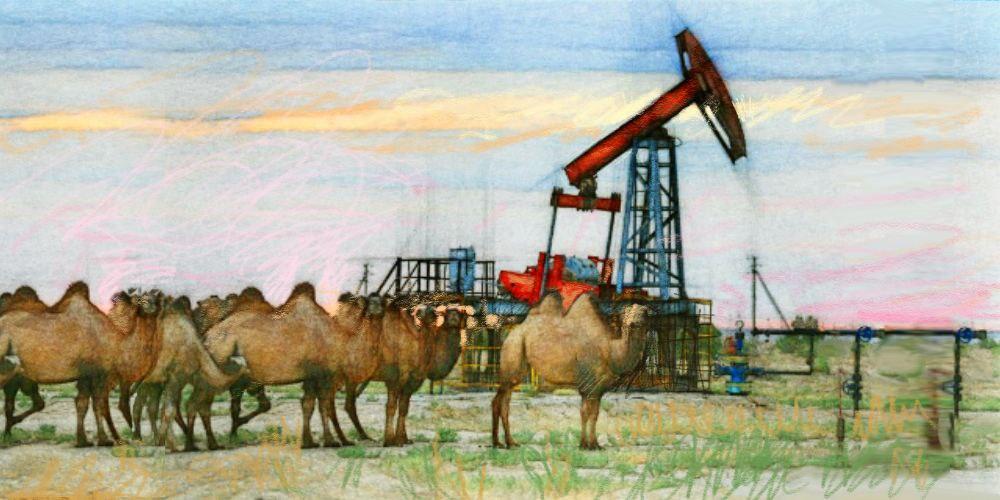

KazMunayGas Sees No Risk from Falling Oil Prices, Prepares for Market Fluctuations

Kazakhstan’s national oil company KazMunayGas (KMG) has developed contingency strategies to manage volatility in global hydrocarbon markets and says it is fully prepared for any changes in oil prices. As of the morning of May 5, Brent crude had dropped to $59.30 per barrel and WTI to $56.19, the lowest levels since April 9, following the OPEC+ decision to increase production. In response to questions at a media briefing, KMG Deputy Chairman Aset Magauov said the company foresees no significant risks despite this sharp decline. “Analysts expect oil prices to average around $65 per barrel this year, though no one can predict with certainty,” Magauov stated. “We don’t see any risks for KazMunayGas. We have prepared for various scenarios and identified measures to optimize our expenses. In principle, we are ready for any fluctuations.” KMG, which accounts for 26% of Kazakhstan’s total oil production and 80% of the domestic refining market, supplies roughly 70% of its crude oil to the domestic market. This oil is processed at Kazakhstan’s major refineries to ensure stable fuel and lubricant supplies. According to Magauov, the cost of domestic supply remains well below export prices, insulating KMG from international volatility. “Even while export prices fluctuate, domestic prices remain stable and significantly lower than the lowest export benchmarks,” Magauov said. “Therefore, the majority of our sales, around 70%, are unaffected by global market movements. Moreover, exports of gasoline and diesel are limited, with nearly all production sold domestically.” Magauov also noted ongoing discussions with Russian energy firm Tatneft on the potential joint development of the Atyrau refinery. As previously reported by The Times of Central Asia, Kazakhstan’s antitrust agency proposed privatizing state-owned stakes in the Pavlodar and Atyrau oil refineries, moves that could reshape the sector’s competitive landscape. Meanwhile, Energy Minister Yerlan Akkenzhenov announced in April that Kazakhstan aims to double its domestic oil refining capacity by 2040, from 17.9 million tons in 2024 to 38 million tons annually.