Development Spending in Kyrgyzstan Surpasses Social Spending for the First Time

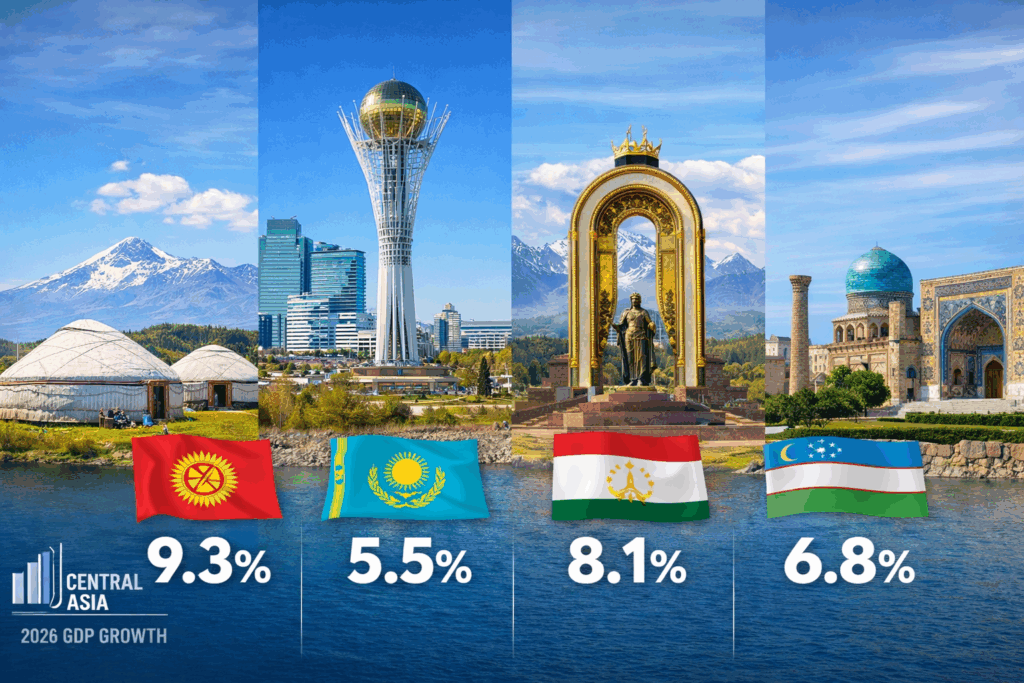

The Kyrgyz government has reported strong economic performance in 2025, highlighting robust GDP growth and strengthened public finances. At a year-end meeting, Chairman of the Cabinet of Ministers Adylbek Kasymaliev announced that all state objectives had been met despite challenging conditions. According to Kasymaliev, gross domestic product is expected to grow by more than 10% by year’s end, positioning Kyrgyzstan among the global leaders in economic growth. The country’s GDP reached $20.5 billion, and for the first time in its history, the consolidated budget surpassed $11.5 billion. A budget surplus of $392 million was recorded, which Kasymaliev described as a sign of growing financial stability. He emphasized the country’s accelerated infrastructure development, with 341 new facilities commissioned in 2025. Projects include roads, parks, cultural and sports centers, and residential buildings, many implemented under State Mortgage Company initiatives. Notably, for the first time, development expenditures outpaced social expenditures, a shift aligned with the recommendations of international financial institutions. Macroeconomic improvements were also supported by data from the National Bank of Kyrgyzstan. As of the third quarter of 2025, the banking sector showed strong lending growth: the overall loan portfolio rose by 10.5% over the quarter and approximately 33% year-on-year. Consumer loans made up the largest share at 16.6%, followed by mortgages at 10.5% and agricultural loans at 3.1%. Expansion in the construction sector has been driven by both state spending and foreign investment. Meanwhile, the dollarization of the loan portfolio continued to decline, falling to 17.8% from over 20% at the start of the year. “High activity among the population and businesses has contributed to an increase in lending in the national currency over the nine months of 2025,” the National Bank stated.