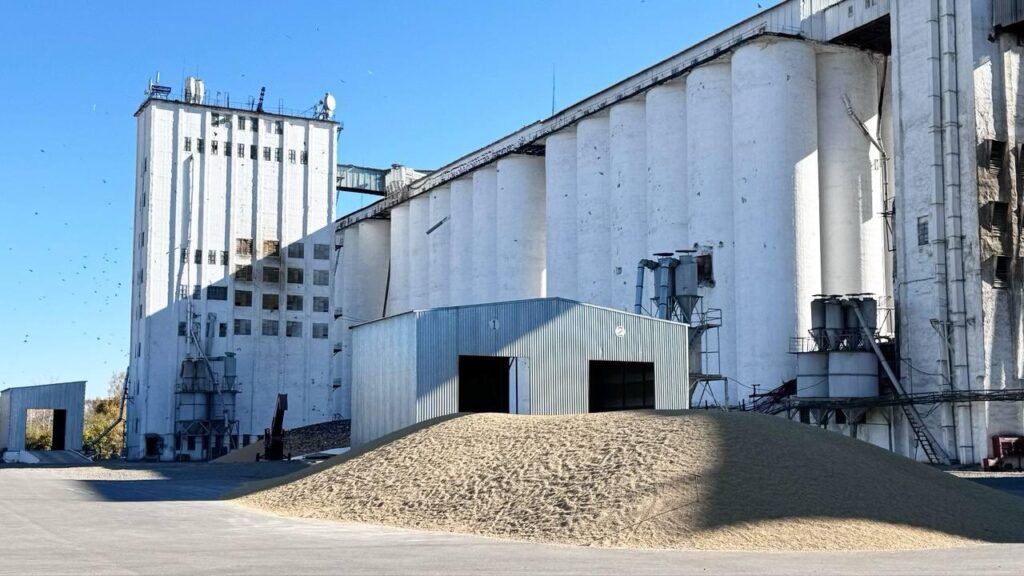

The fall brought two headaches for Kazakhstani farmers: a rich grain harvest that coincided with an oversupply of grain on world markets, and Russia's ban on exporting Kazakh wheat to and transiting through Russia. Experts complain about the 40% failure of Kazakhstani grain exports, and representatives of farmer associations complain about low prices and high production costs and ask the government to buy their surplus products. The background is talk of a grain war between Moscow and Astana. Phytosanitary ban According to Kazakhstan's Ministry of Agriculture, this year the harvested area of crops amounted to 23.3 million hectares, of which 16.7 million were sown with cereals. Fieldwork has been completed by 99.7%. 26.5 million tons of grain were threshed. Proponents of the opinion that the agricultural authorities of Kazakhstan and Russia have entered into a hidden confrontation for external grain markets argue that Kazakhstan is a victim of this trade war. They cite the restrictions imposed by Rosselkhoznadzor in October as evidence. On October 1, the Russian agency asked Kazakhstan's Ministry of Agriculture to suspend the issuance of phytosanitary certificates for grain and its products, tomatoes, peppers, and sunflower seeds exported to the Russian Federation. On October 3, journalists asked Vice-Minister of Agriculture Ermek Kenzhekhanuly about the stage of fulfillment of this wish. He replied that the Russian side received a reply letter requesting evidence of phytosanitary control violations. According to him, Rosselkhoznadzor had not responded as of October 3. On October 17, the Russian Federal Service for Veterinary and Phytosanitary Surveillance temporarily banned imports of several types of agricultural goods from Kazakhstan. Transit of wheat, lentils, and oilseed flax seeds through Russia's territory is allowed. Still, a phytosanitary certificate for the country of final destination must be issued, and grain must be transshipped directly from railcars into the ship's holds. At the same time, deliveries of tomatoes, peppers, sunflower seeds, and melons from Kazakhstan are prohibited, even for transit. Obstacles in response to the ban However, let's carefully review the Kazakhstani press. We will find that as early as September 3rd, Kazakhstani farmers sounded the alarm—Russia is pushing our grain out of traditional markets. Representatives of the Grain Union of Kazakhstan discussed the problems Kazakh traders face with the transit of domestic grain through the territory of the Russian Federation at a session with journalists at the Agricom forum. However, they cited only two cases of such restrictions but tried to convey another message—Russia has introduced hidden obstacles because of Kazakhstan's ban on grain imports from the Russian Federation, which was imposed as early as August 1. As reported by Kazakhstan's Ministry of Agriculture, the restrictions imply a complete ban on wheat imports by all modes of transportation. Previously, the restrictive measures provided for a ban on imports of goods by road, water, and rail (except for imports to poultry and flour mills) since April. The decision was made because, despite the previous ban, grain imports from Russia exceeded 1.1 million tons in six months. Experts considered...