Uzbekistan and Korea Forge New, High-Tech Agenda for Strategic Partnership

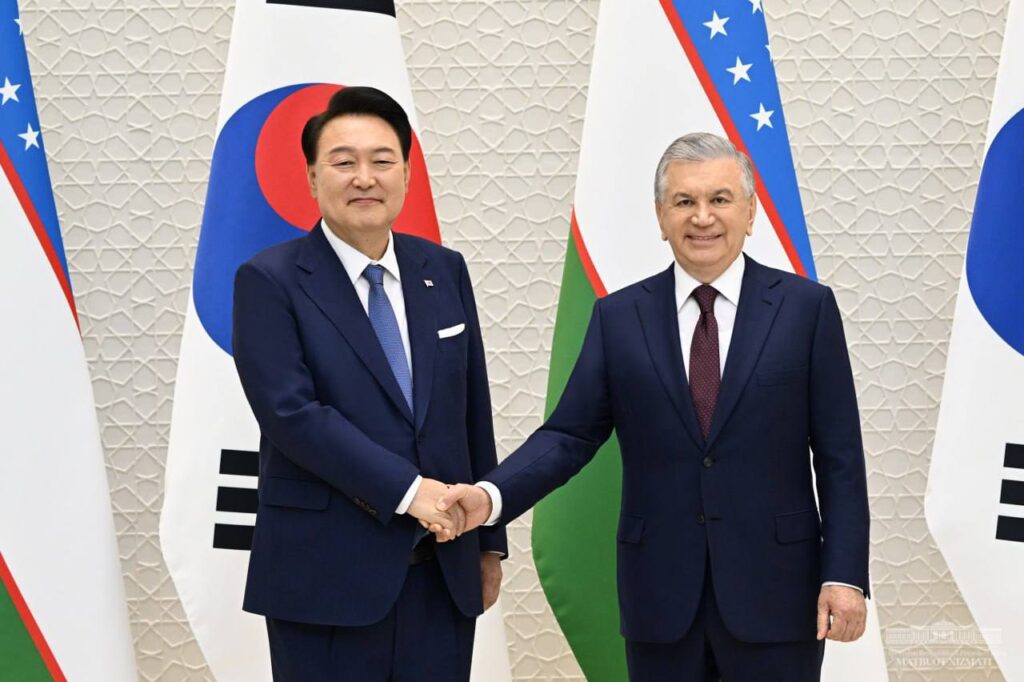

On 14 June, South Korean President Yoon Suk Yeol held talks with Uzbekistan President Shavkat Mirziyoyev. During their meeting in Tashkent, it was noted that the Republic of Korea is among Uzbekistan’s leading trade and investment partners. Last year, bilateral trade turnover reached $2.5 billion, and Korean investments in Uzbekistan now exceed $7.5 billion. Negotiations focused on the formation of a new, high-tech agenda for Uzbek-Korean strategic partnership over the next three years. As a result, the two leaders tasked their governments to prepare a Strategic Program for the creation of a regional high-tech hub in Uzbekistan, with priority given to the following “anchor” areas of the Strategy: Partnership on critical mineral resources with deep processing and creation of a complete added value chain. Strategic cooperation in the field of semiconductors, in which the Republic of Korea is recognized as a global leader, and the implementation of plans to create in Uzbekistan’s first fully-fledged research and production cluster of semiconductor products. Full-scale partnership in the chemical industry, including new projects to produce green hydrogen and ammonia, as well as finished rubber products. Deepening cooperation in mechanical engineering. This spring, an assembly line for KIA cars was launched in Uzbekistan’s Jizzakh region, to be followed next year, by a plant with the capacity to manufacture over 60 thousand vehicles per year. Transfer of technologies to develop “smart” agriculture, including via the digitalization of the agricultural sector, the introduction of “smart” and “green” technologies. Agreements have already been reached on the creation of modern greenhouses and garden complexes in Uzbekistan’s regions based on renewable energy sources. Infrastructure modernization and a program for urban development, based on the high interest of Korean banks and companies in the modernization of transport infrastructure, and the design and construction of residential and commercial real estate in Uzbekistan on the principles of public-private partnership. With regard to developing potential projects in green energy and increase energy efficiency, strategic dialogue is to be resumed between energy ministers and a meeting organized in Uzbekistan in the near future.