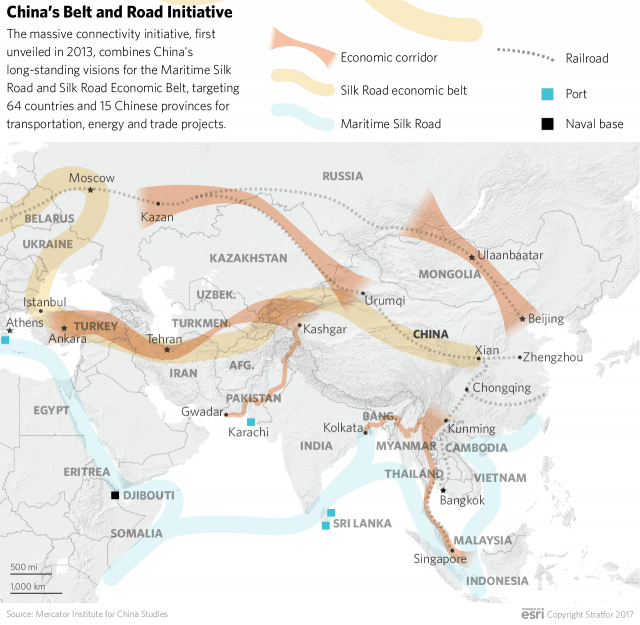

In an interview with the newspaper, Egemen Qazaqstan, President of Kazakhstan, Kassym-Jomart Tokayev spoke about political reforms in Kazakhstan, the country’s economic course, plans for the construction of a nuclear power plant, relations with China, and whether he will participate in the next presidential election. Tokayev said he believes that 2023 was full of significant events for Kazakhstan, including the completion of major political reforms, the establishment of the Constitutional Court, the holding of elections of deputies to the Mazhilis (parliament) and Maslikhats (local councils) at all levels according to new rules, and the first ever elections of akims (mayors) to districts and cities of regional significance. Kazakhstan has begun to build a fair and competitive economic system, Tokayev said, diversifying and demonopolizing the economy, updating infrastructure, supporting business, and attracting investment. In Tokayev’s words, Kazakhstan will continue with a constructive and balanced foreign policy; in 2024, the country will chair several authoritative international organizations: the Shanghai Cooperation Organization, the Collective Security Treaty Organization, the Conference on Interaction and Confidence Building Measures in Asia, the Organization of Turkic States, the International Fund for Saving the Aral Sea, and the Islamic Organization for Food Security. This year, Kazakhstan will also host the World Nomad Games. Asked about the country’s new economic course for a Fair and Just Kazakhstan and the goal of doubling the size of the economy to $450 billion by 2029, Tokayev said it is completely achievable. “According to analysts from the International Monetary Fund, by the end of 2023, GDP in Kazakhstan should be over $259 billion, which is 15% more than in 2022. This is the most significant nominal growth in Central Asia. Positive dynamics are also registered in GDP per capita. According to the IMF forecast, by 2028 this figure will increase by a third – up to $16,800.” The President explained his position vis-à-vis plans for the construction of a nuclear power plant, saying that he pays special attention to the issue given that Kazakhstan is the world’s largest uranium producer and generates its own nuclear fuel. “As many in Kazakhstan are critical of the construction of nuclear power plants given the tragic consequences of tests at the Semipalatinsk nuclear test site, I proposed submitting the issue to a national referendum,” Tokayev said. “Citizens must consider and discuss all the experts’ arguments in order to make a balanced, thoughtful decision during the free expression of their will. This will be the decision of the people.” Commenting on relations with China, the President said that today, relations between Kazakhstan and China are developing in the spirit of friendship, neighborliness, and strategic partnership. Kazakhstan firmly supports the Belt and Road Initiative, Tokayev stated, emphasizing the unprecedented growth of bilateral trade, which reached $24.3 billion from January-October 2023. China is also one of the largest investors in the Kazakhstan, with direct Chinese investment having reached $24 billion. The common border with China and favorable geographical position of Kazakhstan as a bridge between the East and West opens up broad prospects for...