EDB Database Reveals How Crucial Central Asian Countries Are To Eurasian Transport Network

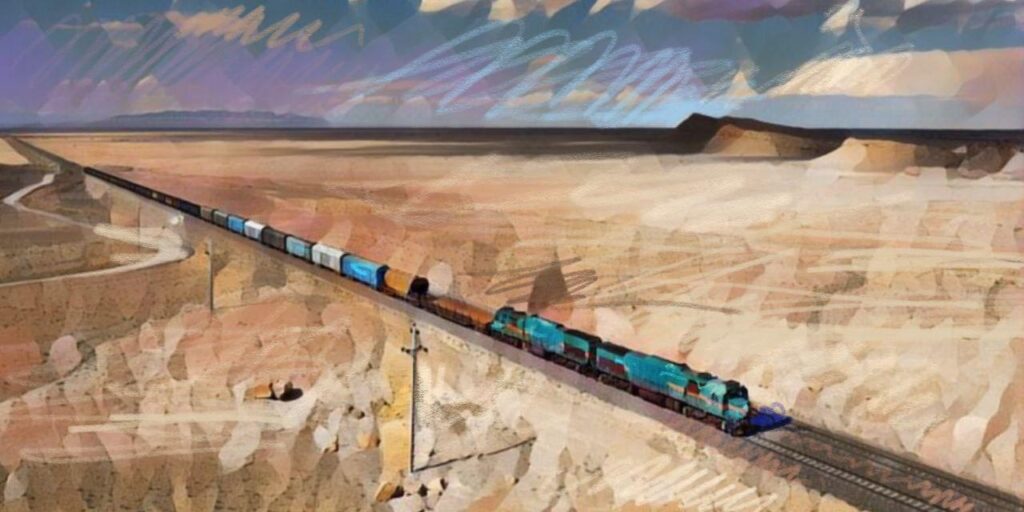

The Eurasian Development Bank (EDB) has unveiled the Eurasian Transport Network Observatory, a comprehensive database monitoring infrastructure development across 13 countries in the region: Azerbaijan, Armenia, Afghanistan, Belarus, Georgia, Iran, Kazakhstan, Kyrgyzstan, Mongolia, Russia, Tajikistan, Turkmenistan, and Uzbekistan. As of July 1, 2025, the database includes 325 infrastructure projects both ongoing and planned, with a total estimated investment of $234 billion. Over 51% of these projects are in the road transport sector. Russia accounts for seven of the ten largest infrastructure projects within the network. The Northern Eurasian Corridor is the most capital-intensive, requiring $78 billion, more than one-third of the network’s total projected investment. Central Asia plays a pivotal role, representing over 22% of total investments in the Eurasian Transport Network. The region hosts or plans 90 infrastructure projects valued at approximately $53 billion. Kazakhstan alone accounts for roughly 44% of these initiatives. Nearly two-thirds of Central Asian investments are allocated to highway infrastructure, underscoring the strategic priority placed on enhancing road connectivity to support regional trade and international integration. Top 10 Transport Projects in Central Asia: China-Kyrgyzstan-Uzbekistan Railway - $4.7 billion Tashkent-Andijan Toll Highway (Uzbekistan) - $4.3 billion Balykchy-Kochkor-Kara-Keche-Makmal-Jalal-Abad Railway (Kyrgyzstan) - $4.1 billion North-South Railway (Tajikistan) - $3.9 billion Center-West Highway (Kazakhstan) - $2.6 billion Ashgabat-Turkmenabat Highway (Turkmenistan) - $2.4 billion Serakhs-Mary-Serkhetabat Highway (Turkmenistan) - $2.2 billion Dostyk-Moyinty Rail Section Modernization (Kazakhstan) - $2 billion Sherkhan-Kunduz-Mazar-i-Sharif-Herat-Turgundi Railway (Tajikistan-Afghanistan-Turkmenistan) - $2 billion Zhezkazgan-Arkalyk-Petropavlovsk Motorway Reconstruction (Kazakhstan) The EDB notes that international development banks and other multilateral institutions are well-positioned to offer both technical and financial support, particularly in landlocked and mountainous countries where infrastructure gaps are most acute.