Canadian Silvercorp to Develop Major Gold Deposits in Kyrgyzstan

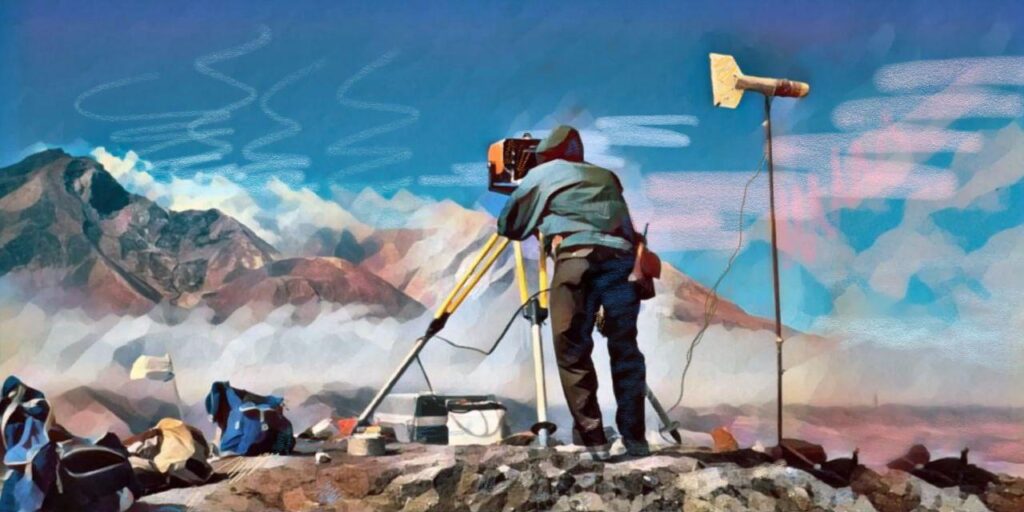

A Canadian mining company is set to develop two of the largest undeveloped gold deposits in western Kyrgyzstan’s Tien Shan gold belt. Silvercorp Metals Inc., a diversified producer of silver, gold, lead, and zinc, announced it has signed a Share Purchase Agreement with Chaarat Gold Holdings Limited, along with a Cooperation Agreement with the National Investment Agency under the President of the Kyrgyz Republic. Under the agreements, Silvercorp will acquire a 70% stake in Chaarat ZAAV CJSC for $162 million. Chaarat ZAAV holds the mining license for the fully permitted Tulkubash and Kyzyltash gold deposits, covering approximately 7 square kilometers, as well as exploration licenses spanning an additional 27.42 square kilometers, which include the Karator and Ishakuld gold zones. Silvercorp has also signed a Share Purchase and Shareholders Agreement with Kyrgyzaltyn, the state-owned gold company. Upon completion, ZAAV will become a joint venture between Silvercorp and Kyrgyzaltyn, with the Canadian firm maintaining a 70% stake and serving as the operator. As part of the deal, the Kyrgyz government will waive its pre-emptive rights and extend the mining license through June 25, 2062, enhancing long-term investment stability. Located about 490 kilometers southwest of Bishkek, the Tulkubash and Kyzyltash projects will be developed in two phases. Phase One (2026-2028) will focus on the Tulkubash deposit. Silvercorp plans to invest around $150 million to construct an open-pit mine with a processing capacity of 4 million tons of ore annually. Commercial production is expected between 2027 and 2028, with annual output estimated at 110,000 ounces of gold over an initial mine life of three to four years. If the Karator exploration license is converted to a mining license in 2026, this phase could be extended by at least two more years. Phase Two (2028-2031) will develop the Kyzyltash sulfide deposit. This stage is expected to require about $400 million in investment and will include both open-pit and underground operations with a capacity of 3-4 million tons per year. Once fully operational from 2031, Kyzyltash is projected to produce between 190,000 and 230,000 ounces of gold annually for more than 18 years. The antimony-gold mineralization at the site was first discovered by Soviet geologists in the 1970s. Since 2002, Chaarat Gold has invested approximately $174 million in exploration, technical studies, and infrastructure, including roads, camps, and support facilities. Silvercorp becomes the second Canadian mining firm to operate in Kyrgyzstan, following Centerra Gold’s development of the Kumtor mine in the Issyk-Kul region. Kumtor was nationalized in 2021, and in August 2022, Kumtor Gold Company was designated a 100% state-owned enterprise. At a ceremony marking the launch of underground mining at Kumtor in August 2025, President Sadyr Japarov stated that Kyrgyzstan had received only $100 million in dividends during 28 years of foreign management, compared to $441 million paid to the state in the three years following nationalization. The Silvercorp transaction marks one of the largest foreign mining investments in Kyrgyzstan since the Kumtor nationalization and is seen as a key test of the country’s ability to...