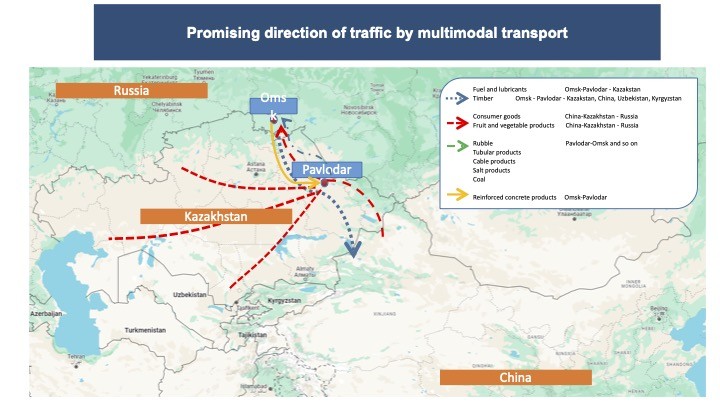

Kazakhstan’s inland waterways run to 4,302 km with an infrastructure that includes inland ports in Atyrau and Pavlodar, along with small cargo wharves and docks with access roads and ferry lines. Inland navigation is concentrated in the Ural-Caspian, Ili-Balkhash, and Irtysh river basins, and the Irtysh River is navigated via three locks at Bukhtarma, Ust-Kamenogorsk, and Shulbinsk. As such, Kazakhstan's inland waterways have great potential. Transporting cargo and passengers by ship is cheaper and more environmentally friendly than overland alternatives and has a significant multiplier effect on the development of recreation and tourism in surrounding areas. However, there are a number of challenges to realizing this potential, including the unsatisfactory condition of navigable routes, an insufficient amount and high wear of coastal infrastructure, the state of the inland fleet and waterway locks, and a shortage of specialists. Over time, the Kazakh government's lack of proper attention to developing inland waterways has translated into falling transportation volumes along the country’s main navigable rivers. In turn, the lower handling volumes have led to a dearth of funds to update and repair port facilities, along with a deterioration of coastal infrastructure on navigable waterways, industrial ships, and waterway locks. In the last five years, Kazakhstan’s inland waterway fleet has decreased from 171 to 150 vessels. Meanwhile, 70% of those in operation are past their service life, while the existing coastal infrastructure is unable to process modern types of cargo at the pace required by the market. As reported by Kazakhstan’s statistics agency, in the first half of 2024, 156,300 tons of cargo and 74,200 passengers travelled on inland waterways, down 40.8% and 40.1%, respectively, from the same period last year. A key problem lies in the lack of a comprehensive analysis of the classification and volume of cargo carried through inland waterways. Current developments in shipping are focused around the Irtysh, home to the inland fleet and the main cargo base from which crushed stone is exported to Russia. On the Russian side, plans are in place to further increase shipped imports of both stone and other inert materials, alongside a proposal to import timber to Kazakhstan from Khanty-Mansiysk. The shipment of petroleum products to Chinese refineries from Kazakh and Russian plants is also being explored in tandem with the Chinese side sending back construction materials and consumer goods. At the initial stage, the volume of cargo transportation along the Irtysh is estimated at 350,000-400,000 tons a year, which could be ramped up to 1.5 million tons in the future. Experts note the important role of a strategic task set by the government to develop the transit logistics of integrating inland waterways into the multimodal logistics chain. This is especially relevant amid congestion on Kazakhstan’s railways and roads, the gravitation of export-import cargo to the transport system, and energetic discussions on developing the Russia-Kazakhstan-China transit corridor using the Irtysh. The project entails shipping cargo via the river to Lake Zaysan where reloaded onto trains, it continues its journey through a new Maykapshagay–Jeminay border...