Kyrgyzstan is taking a significant step toward building a greener and more resilient economy. On September 9, state-owned Eldik Bank and the United Nations Development Programme (UNDP) signed a memorandum of understanding to deepen cooperation in sustainable finance.

The agreement aims to mobilize climate-related investments, develop sustainable financial products, and integrate Environmental, Social, and Governance (ESG) principles into Kyrgyzstan’s banking sector. It also outlines plans for joint research and knowledge exchange in climate finance, including the creation of tools to assess climate risks in lending operations.

This initiative supports Kyrgyzstan’s updated Nationally Determined Contributions (NDC 3.0) under the Paris Agreement, which commit the country to reducing greenhouse gas emissions, expanding renewable energy, and enhancing climate resilience. It also aligns with the National Development Program through 2030, which prioritizes expanding the regulatory framework for green finance.

“UNDP supports the development of sustainable finance solutions that reduce the carbon footprint of the economy, enable the green transformation of businesses, and create new opportunities for investment,” said Alexandra Solovieva, UNDP Resident Representative in Kyrgyzstan.

For Eldik Bank, the partnership represents more than a financial commitment; it is a strategic step toward becoming a catalyst for climate-conscious economic development. “Together with UNDP, we aim to introduce products that promote green growth and sustainable business development for our clients,” said Ulanbek Nogaev, Chair of the bank’s Management Board.

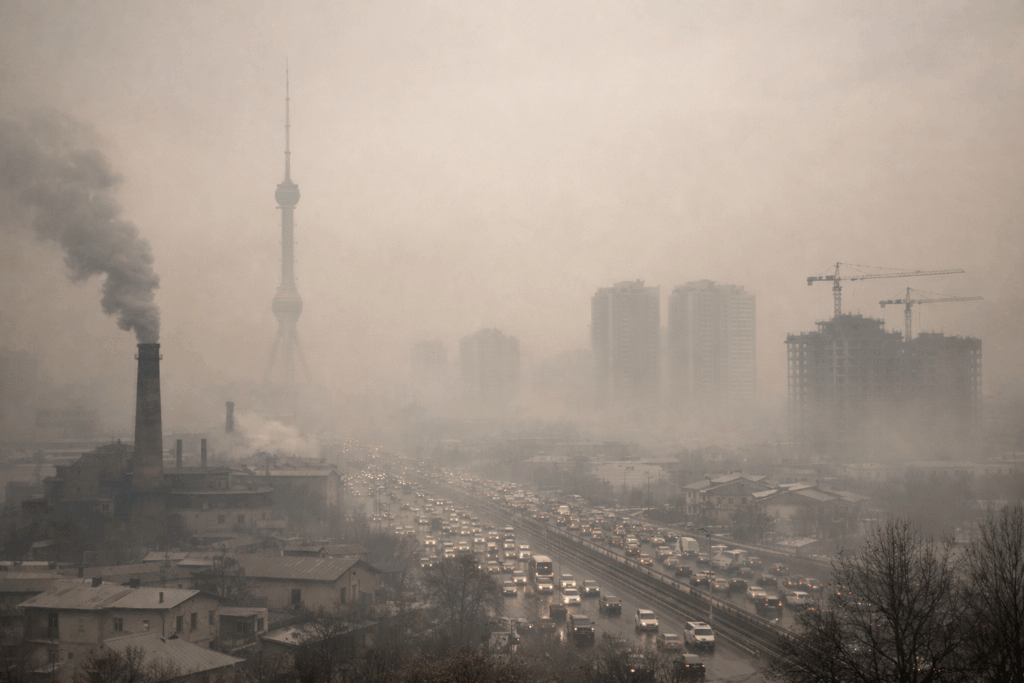

Green finance is gaining traction across Central Asia, a region still heavily reliant on extractive industries but increasingly vulnerable to climate risks such as water scarcity, extreme weather, and glacial melt. Kyrgyzstan’s efforts to empower domestic financial institutions signal that achieving climate goals will require more than policy declarations; it will demand concrete investments and innovation.

The Eldik Bank-UNDP partnership also underscores the importance of regional cooperation. Similar initiatives are under discussion in neighboring countries, as Central Asia seeks to attract international capital for renewable energy, sustainable agriculture, and green infrastructure projects.

If effectively implemented, Kyrgyzstan’s model could serve as a regional benchmark, demonstrating how national banks can help transform global climate commitments into tangible, growth-oriented outcomes.