EU’s Kaja Kallas: Russia Must Not Use Central Asia to Bypass Sanctions

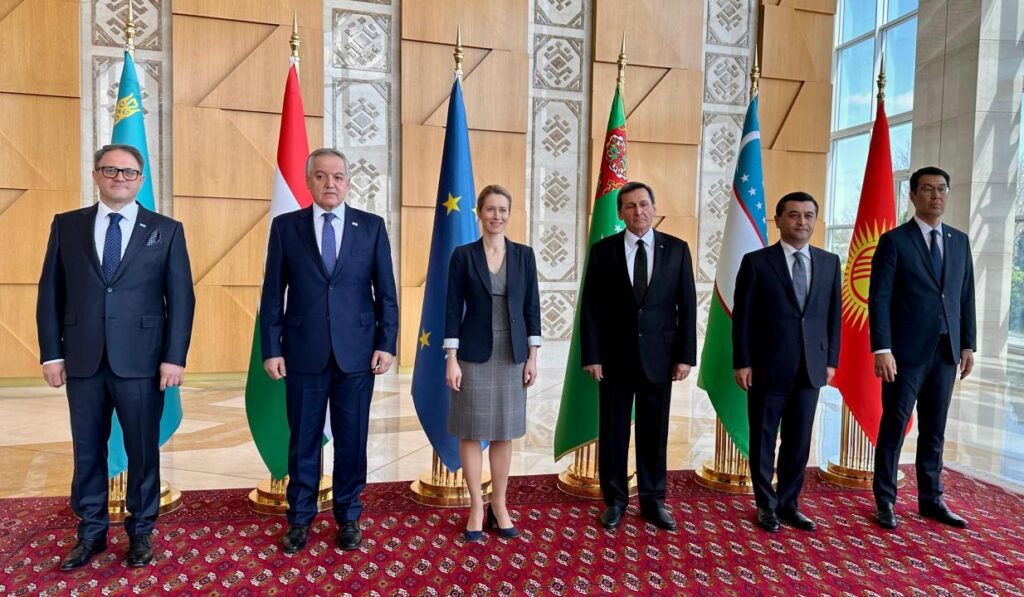

European Union sanctions against Russia are affecting Central Asian economies, but the EU remains determined to prevent the region from being used to circumvent those measures. This was emphasized by EU High Representative for Foreign Affairs Kaja Kallas during the 20th EU-Central Asia Ministerial Meeting held in Turkmenistan's capital, Ashgabat. “The EU has introduced 16 sanctions packages to weaken Russia’s military machine, and we are working on the 17th,” Kallas stated. “I understand these sanctions impact your economy, but we all want this war to end. Russian companies must not use Central Asia to bypass these restrictions.” The ministerial meeting on March 27 brought together the foreign ministers of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. Discussions centered on preparations for the upcoming EU-Central Asia Summit, scheduled for April 2025 in Samarkand. Strengthening U.S.-Uzbekistan Ties In a parallel development, U.S.-Uzbekistan relations are showing signs of deeper engagement. On March 26, Ambassador Furkat Sidikov hosted a Congressional Breakfast with U.S. Representative Trent Kelly, focused on trade and investment opportunities. Congressman Kelly praised Uzbekistan’s ongoing reforms and expressed support for lifting the Jackson-Vanik Amendment, a Cold War-era restriction on trade. A Shift in U.S. Strategy Toward Kazakhstan Meanwhile, experts are calling for a more nuanced U.S. approach to Kazakhstan. Dr. Robert M. Cutler, Times of Central Asia correspondent, noted that Kazakhstan’s close ties with Russia and China stem from geopolitical necessity rather than ideological alignment. He urged Washington to maintain consistent engagement with Kazakhstan and prioritize economic and strategic cooperation over political pressure.