Breaking Down Kazakhstan’s Claims Against International Oil Consortiums

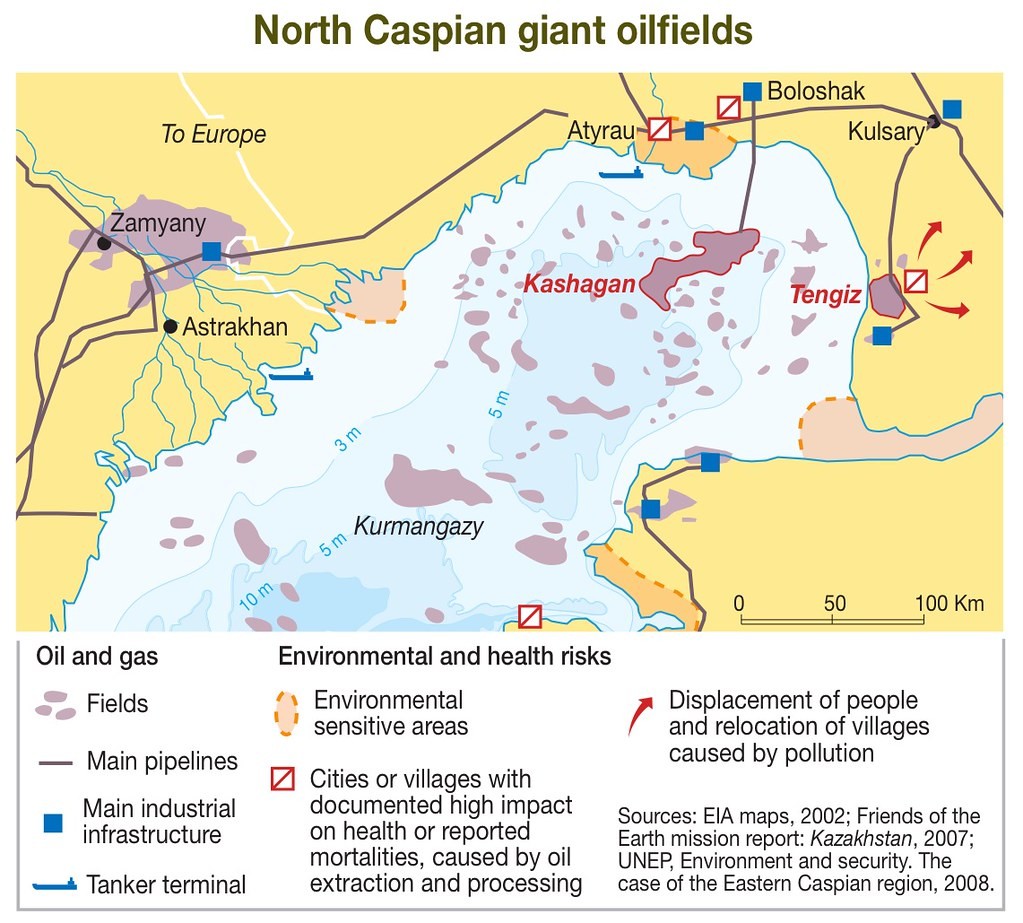

The total amount of claims brought against the consortiums, North Caspian Operating Company (NCOC) and Karachaganak Petroleum Operating (KPO) is the largest in the history of Kazakhstan. In March 2023, PSA LLP, the authorized state institution overseeing these projects, brought forward claims in international arbitration in relation to Kashagan and Karachaganak for $13.5 billion and $3.0 billion, respectively. In addition, the Atyrau Region environmental regulator filed a claim for $5.1 billion against the NCOC consortium for storing too much sulfur on site, discharging wastewater without treatment, etc. The claims of PSA LLP cover the period 2010-19 and relate to the oil consortiums’ costs for carrying out large projects, as well as tenders and insufficient work completed. The shareholders of NCOC, which is developing the offshore Kashagan Field, include: KMG Kashagan (16.877% stake), Shell Kazakhstan Development (16.807%), Total EP Kazakhstan (16.807%), Agip Caspian Sea (16.807%), ExxonMobil Kazakhstan (16.807%), CNPC Kazakhstan (8.333%) and INPEX North Caspian Sea (7.563%). Their total investments over the period have not been disclosed, but, according to various estimates, exceed $60 billion – meaning the state is currently calling into question about 23% of all costs. The KPO consortium is Shell (29.25%), Eni (29.25%), Chevron (18.0%), Russia’s Lukoil (13.5%) and Kazakhstan’s state-owned KazMunayGas (10.0%). Investments in this oil and gas condensate field are estimated at $27 billion, hence the filed claim is significantly smaller both in absolute terms and as a percentage of costs, standing at about 11%. A production sharing agreement was signed in 1997 for Karachaganak and in 1998 for Kashagan, with the contracts to be in effect for 40 years. In 2022, the sole participant in PSA LLP became Samruk-Kazyna Trust Corporate Fund, part of the state holding National Welfare Fund Samruk-Kazyna, while Kazakhstan’s Ministry of Energy is currently entrusted to run PSA LLP. NCOC and KPO dominate the industry through control of three fields. Tengiz, Kashagan and Karachaganak are the largest oil and gas fields in Kazakhstan. The country’s oil and gas condensate production in 2023 amounted to 89.9 million tons (about 1.8 million barrels per day), with the share of the “three whales” – as these projects are called – accounting for 67% of oil production: Tengiz with 28.9 million tons, down 1% versus the 2022 level; Kashagan with 18.8 million tons, a 48% increase; Karachaganak with 12.1 million tons, up 7% year-on-year. The stabilization contract for Tengiz was one of the first signed at the dawn of Kazakhstan’s independence in 1993, also for a term of 40 years, meaning it should be the first to expire in 2033. The shareholders of the Tengizchevroil JV are Chevron (50%), ExxonMobil (25%), KazMunayGas (20%) and Lukoil (5%). After completion of its FGP (Future Growth Project), Tengiz should produce about 900,000 barrels per day, a significant figure even by world standards. It is surprising that Kazakhstan has not yet raised or voiced any claims against TCO, even though the FGP budget has swelled from an initial $12 billion to $25 billion – due to the addition...