S&P Keeps Uzbekistan’s Credit Rating as “Stable”

The global credit rating agency S&P has maintained Uzbekistan’s sovereign credit rating at “BB-/B” (stable outlook).

Its latest report on Uzbekistan mentions that:

- In 2024-2027, the average economic growth is forecasted to be 5.2%, slightly lower than last year’s 6%. Financial and governance reforms, including a planned increase in energy tariffs, will support the country’s investment prospects.

- Decision-making remains centralized. Although the perception of corruption is improving, it remains high.

- Growth in Uzbekistan is mainly due to domestic and international investments, which accounted for about 43% of the GDP last year.

From 2021 to 2023, Uzbekistan has seen strong real GDP growth, averaging around 6.4% annually, and we expect the outlook to remain strong, supported by public and private investment. Investments drive growth in Uzbekistan, and last year, investments were one of the highest in the world, accounting for about 43% of GDP. Within the “Uzbekistan – 2030” strategy framework, state, and public structures are activating energy, transport, telecommunications, agriculture, and tourism expenditures. At the same time, they are consistently continuing the work of reforming the energy sector, privatization, and improving the tax-budget policy.

Uzbekistan’s economy continues to weather the effects of the Russia-Ukraine war well, though remittance flows and remittances from Russia have declined from their 2022 peak. The flow of remittances was estimated to be approximately $11 billion in 2023 (11% of GDP) but was still nearly 40% higher than in 2021 and up 9% year-over-year in the first quarter of 2024. Russia remains Uzbekistan’s largest remittance source, at 78% of total remittances in 2023. In addition, the total volume of trade with Russia has increased. In the first quarter of 2024, compared to the same period in 2023, it was about 16%. Given the sanctions imposed on Russia by the Western Union, Uzbekistan’s exports to Russia have increased to meet the growing demand. In addition, Uzbekistan signed a two-year contract with Russia’s Gazprom in October 2023, importing 9 million cubic meters of gas daily.

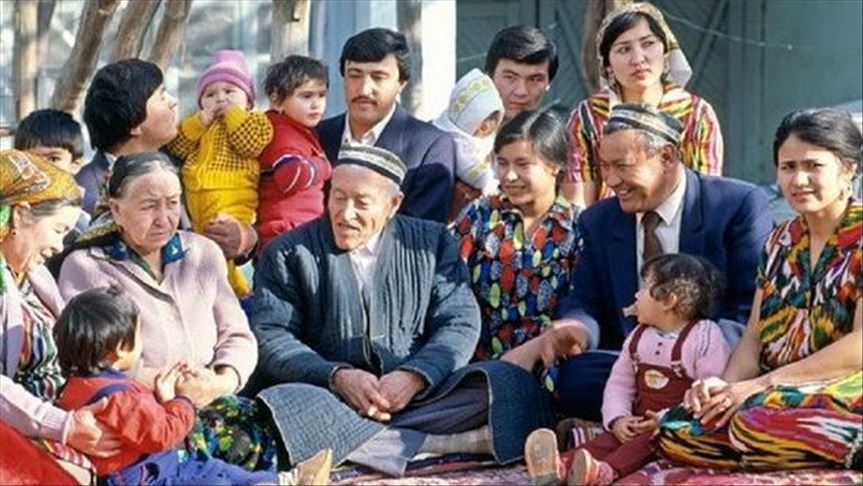

Despite strong growth rates, our sovereign ratings for Uzbekistan remain limited by a low per capita GDP, projected to be $2,600 in 2024, compared to other countries globally. The country benefits from favorable demographics with a young population. Almost 90% of the population is of working age or below, providing an opportunity for growth based on labor supply. However, analysts say job growth will need help to keep up with demand. The weakness of the Russian economy, where most permanent and seasonal migrants in Uzbekistan are employed, may exacerbate this issue.

The effectiveness of Uzbekistan’s monetary policy has improved in recent years. One of the most significant reforms was the exchange rate liberalization in September 2017. The central bank intervenes in the foreign exchange market from time to time to moderate volatility and assess the appreciation of the local currency through large purchases of gold.