The Middle Corridor: How Kazakhstan is Carving its Niche in Europe-Asia Transport

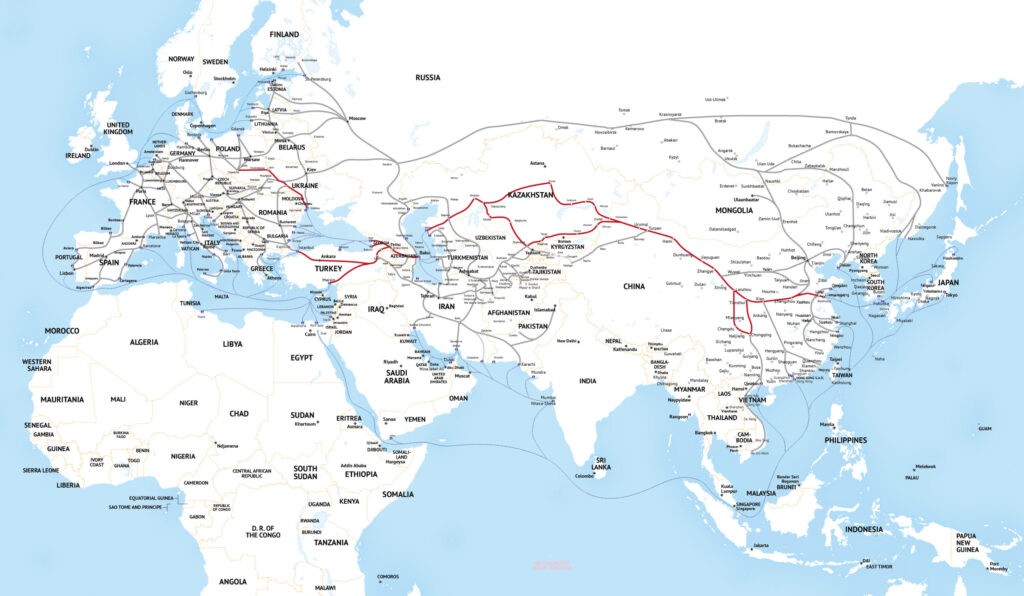

In the aftermath of the pandemic and amid rising geopolitical tensions and sanctions – leading to the breakdown of traditional shipping and logistics chains – the need to develop new, alternative routes for trade has gained particular importance. One such route is the Middle Corridor, or Trans-Caspian International Transport Route, which has become a priority project for Kazakhstan and its neighbors. In this overview we look at the prospects for this multi-modal transnational route. The Trans-Caspian International Transport Route (TITR), or Middle Corridor, starts in China, passes through Kazakhstan, the Caspian Sea, Azerbaijan, Georgia and Turkey, before reaching Europe. Last year, more than 2.7 million tons of cargo was transported along the TITR, up 86% on 2022, whilst it is expected to carry 4 million tons this year. Drivers of growth This growth in volumes has been facilitated by the conflict in Ukraine and restrictions on the transport of goods through Russia, which previously represented the main land route connecting East and West. As a result, in 2022 the volume of container traffic via the TITR grew 33% year-on-year. In addition, amid the geopolitical tensions that have effected the safety of traversing the Suez Canal and the Red Sea – the central and shortest trade route between Asia and Europe – many shipping companies have been forced to go around the southern tip of Africa. This has led to an increase of 14-18 days in the delivery time of goods, as well as additional costs. Because of attacks by Houthi rebels, the number of container ships passing through the Suez Canal each week was down 67% year-on-year in 2023, according to the UN. Meanwhile, in the first two months of 2024, trade volumes along the route decreased 43%. According to data from the UN Conference on Trade and Development, last year the cost of transporting goods from Shanghai to European countries by sea roughly tripled. At the same time, shipping goods by rail from inland Chongqing to Europe was a third cheaper than by sea. Experts note that over the past decade, the total cost of transporting goods between China and Europe by rail has fallen 30%. All this opens wide opportunities for the further development of the TITR, which should be taken advantage of by countries along the route. Middle Corridor countries working together Today, to ensure safe and uninterrupted exports, as well as to attract more flows through Kazakhstan and other TITR countries, measures are being taken. Indeed, the route is considered a strategic initiative for the development of the entire region’s transport potential. During a recent visit to Azerbaijan, Kazakh President Kassym-Jomart Tokayev said that in the future the volume of cargo transported via the TITR should increase to 10 million tons, which is to be facilitated now by both existing demand and technology. At the end of 2022, a roadmap for 2022-27 was signed to eliminate bottlenecks along the route in Kazakhstan, Azerbaijan and Turkey, while to boost the volume of cargo transported by rail a...