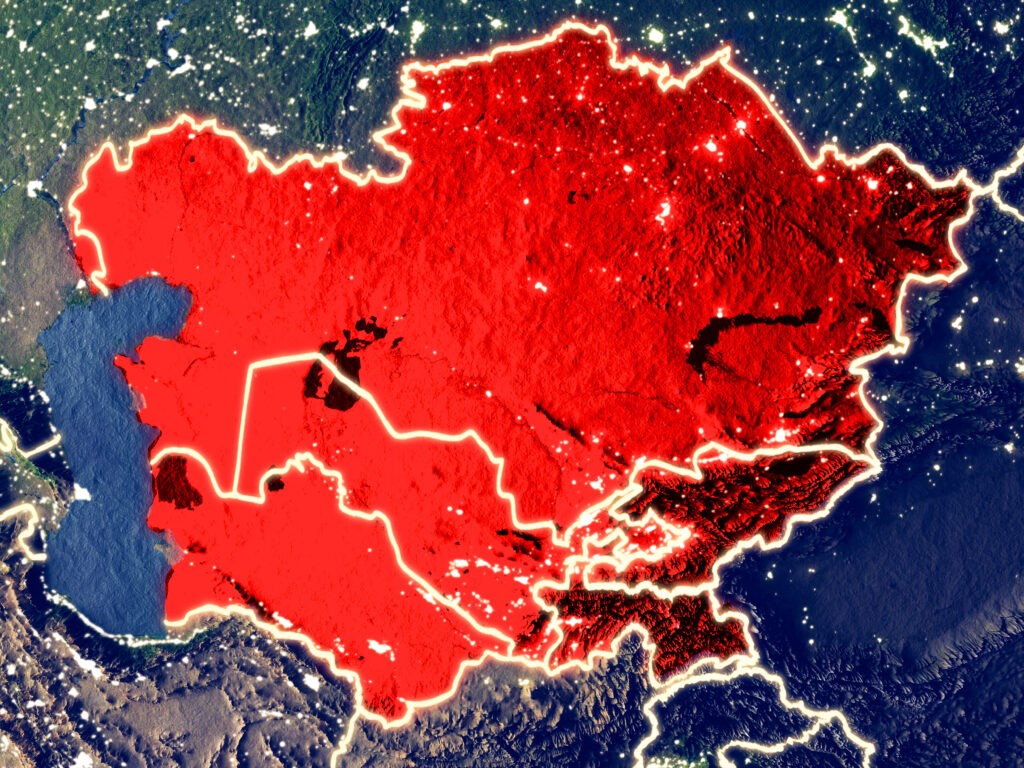

Central Asia, with its rich history as a crossroads of civilizations and a gateway between East and West, finds itself at a crucial juncture in its economic development. The region is showing signs of moving towards becoming a more cohesive economic group, an evolution that could have far-reaching implications for renewable energy development, food security, global commerce and geopolitics. Central Asian states are better positioned than ever to capitalize on their strengths and resources to help the rest of the world deal with climate change, security challenges associated with geopolitical shifts and the ongoing digital transformation of the global economy. Realizing this vast potential will require continued focus, commitment and cooperation from the region’s leaders, as well as long-overdue support from Western leaders for some of the most progressive reforms Central Asia has seen in recent years.

Green energy potential

Rich in natural resources, Central Asia is fast becoming pivotal for the global green energy transition. Leveraging vast reserves of rare earth elements (REEs) and other crucial minerals combined with its significant potential for renewable energy production, the region is increasingly recognized as a key contributor to realizing a more sustainable future.

Kazakhstan, one of the region’s major players, boasts over 56 identified deposits of REEs, with reserves and resources surpassing 450,000 tons. These elements, including lithium and cobalt production, are crucial for battery technologies powering renewable energy applications. This positions Kazakhstan as a significant supplier for the burgeoning green technology industry. Kyrgyzstan and Tajikistan also show promise. Inventory reviews of REE-bearing mineral occurrences and delineation of areas-of-interest suggest these countries could be home to considerable undiscovered resources, further boosting their contribution to green energy transitions.

In addition to its abundant natural resources, Central Asia is an ideal candidate for green hydrogen production. Uzbekistan, with PowerChina and the Saudi company ACWA Power is constructing the country’s first green hydrogen plant. Meanwhile, Kyrgyzstan and Tajikistan, with their surplus hydropower electricity, are well-positioned for hydrogen production. Once again, however, Kazakhstan boasts the most ambitious goal: The country aims to produce two million tons of green hydrogen annually by 2032, marking its intent to become a major player in the global green hydrogen market. In 2022, it inked a $50 billion deal with the German energy grou Svevind to build one of the world’s largest green hydrogen plants supplying Europe.

Kazakhstan, which holds 13% of the world’s uranium reserves, also leads the pack in uranium mining, meeting a significant portion of annual demand from Europe and the U.S.. As nuclear power plays a crucial role in the green energy transition, Kazakhstan’s role is set to grow. The country is exploring new avenues to access the international market. On the other hand, Kyrgyzstan, Uzbekistan and Tajikistan are also known for their uranium deposits but they are currently prioritizing the remediation of past mining sites over active uranium production. This responsible approach underscores the region’s commitment to sustainable development.

Central Asia’s commitment to a greener future extends beyond resource development.. Several states, including Kazakhstan, Turkmenistan, Kyrgyzstan and Uzbekistan, have made commitments to reduce methane emissions as part of the Global Methane Pledge. Kazakhstan has formally joined this initiative, underlining its commitment to global efforts to mitigate the potent greenhouse gas. Turkmenistan has outlined a roadmap towards joining the pledge with Kyrgyzstan and Uzbekistan — Central Asia’s smallest and largest methane emitters respectively — also promising to participate.

The prospect of agricultural growth

Central Asia, characterized by a diverse climate and extensive arable land, holds significant potential for agricultural growth. If utilized effectively, this potential could notably strengthen the regional economy and improve global food security.

The region’s varied climatic conditions offer ideal environments for a broad range of crops. The cooler northern regions are suitable for cereals like wheat and barley, while the warmer southern areas are conducive to crops such as cotton, rice, and various fruits and vegetables. This diversity provides numerous opportunities for agricultural expansion and diversification.

Much of Central Asia’s arable land is cultivated either suboptimally or not at all. The region might therefore be able to increase its agricultural production. Principal irrigation sources include Amu Darya and Syr Darya Rivers, but water scarcity is endemic. Investments in water management technologies would help ameliorate the situation.

Central Asia also has a substantial potential to increase agricultural productivity through further modernization. The incorporation of advanced farming methods, the introduction of improved seed varieties, and superior post-harvest processing could result in considerable yield increases. Additionally, such modernization can promote more sustainable and environmentally friendly farming practices. Unlocking this potential relies on upgrading machinery and transportation infrastructure and improving access to credit. Such a transformation could stimulate the regional economy while diversifying global food supply chains.

Central Asia’s rise as a global technology hotspot

Central Asia is fast emerging as a new frontier in the global technology landscape. Over the past few years, and particularly in 2022 and 2023, an increasing number of multinational corporations have moved their operations to the region, transforming it into a hotspot for international businesses.

Several major tech players have established their presence in Central Asia including the Kazakhstani startup Pinemelon, Chinese tech giants Huawei and Alibaba, and US tech giants such as Microsoft while Alawar, EPAM, HH.ru, and Hypha have set up shop in Kyrgyzstan.

The information technology (IT) industries in Kazakhstan, Kyrgyzstan, and Uzbekistan are experiencing rapid growth, attracting an influx of IT professionals. By June 2023, almost 2,000 IT professionals had relocated from Russia and Belarus to Uzbekistan, fueling the growth of Tashkent’s tech scene. This migration of skilled professionals enhances the quality and competitiveness of the region’s IT sector.

With the rise of digital technology and increased internet connectivity, Central Asian countries are experiencing a tech boom that is transforming their economies and societies. The IT industry across Central Asia is already producing hundreds of millions of U.S. dollars in value, fueled by an increasing number of tech startups, advancements in mobile technology, and a focus on innovation and digital transformation. As a result, this budding IT sector is emerging as an engine for economic growth, creating new opportunities for businesses and individuals alike.

Central Asia’s youthful population, with approximately 72 million individuals having an average age of under 30 years, is another critical factor propelling the region’s tech boom. These tech-savvy youth are eager to participate in the digital economy, rejuvenating the workforce, fostering innovation and adaptability, and stimulating consumer spending. They are already driving growth in sectors like education technology (edtech) and finance technology (fintech), where innovative solutions can meet the needs of a dynamic population.

Bridging East and West

Central Asian nations occupy a strategic position as a conduit between the emerging economies of Asia and the established markets of Europe. There is escalating interest in fostering stability and prosperity in the region, and developing an infrastructure that allows Central Asia to become an integral component of East-West supply chains.

China has made substantial investments in Central Asia’s transportation infrastructure, with President Xi Jinping announcing in May 2023 an ambitious development plan for the region that allocates 26 billion yuan (approximately US $3.8 billion). As part of this strategy, China’s Belt and Road Initiative (BRI) is currently implementing 261 projects in Central Asia.

In parallel, the European Union (EU) has launched the Global Gateway initiative with the aim of establishing sustainable transport links between the EU and Central Asia. This investment in infrastructure is anticipated to foster sustainable and digital connectivity, thereby enhancing the region’s economic resilience.

A key component of this EU initiative is the Trans-Caspian International Transport Route (TITR), a multimodal trade and transportation network that connects Central Asia and the Caucasus with Europe. The TITR, serving as a strategic alternative to Russian land routes, has gained traction due to geopolitical shifts and the rising significance of Eurasia as a nexus for global trade.

The spotlight on the TITR has been partly fueled by the G7’s Partnership for Global Infrastructure and Investment (PGII). Established as a counterpoint to China’s BRI, the PGII aims to mobilize up to US$600 billion by 2027 to bridge the infrastructure investment gap in partner countries. Consequently, there has been a substantial increase in foreign investment in the TITR during the G7 Summit. This trade corridor extends through Turkey, Georgia, Azerbaijan, the Caspian Sea and Central Asia, and plays a critical role in diversifying trade routes between Asia and Europe.

Conclusion

Central Asian countries are rapidly unlocking their potentials and becoming significant contributors to the global transition to green energy, thanks not only to their vast natural resources but also to a commitment to their responsible development through sustainable environmental initiatives. At the same time, the region’s ongoing tech boom, marked by heavy investment in digital infrastructure, a thriving culture of innovation, and a dynamic young population, are transforming the economic landscape. As the world digitizes, Central Asia’s tech sector stands on the brink of sustained growth, offering vast opportunities for businesses, investors, and individuals. Its geostrategic location coupled with substantial infrastructure investments from global powers like China and the EU, positions Central Asia as a key player in global trade. The development of alternative trade routes has increased foreign investment, while new initiatives like TITR and PGII all point to a promising future for the region’s contribution to a green transition, global food security, and digital economic growth.