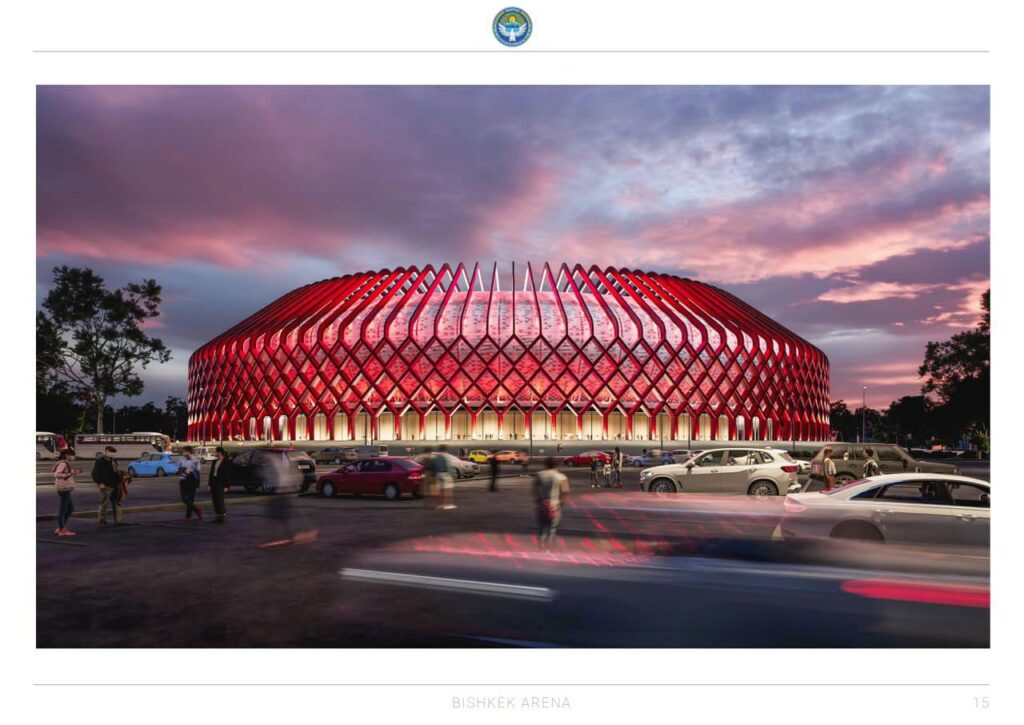

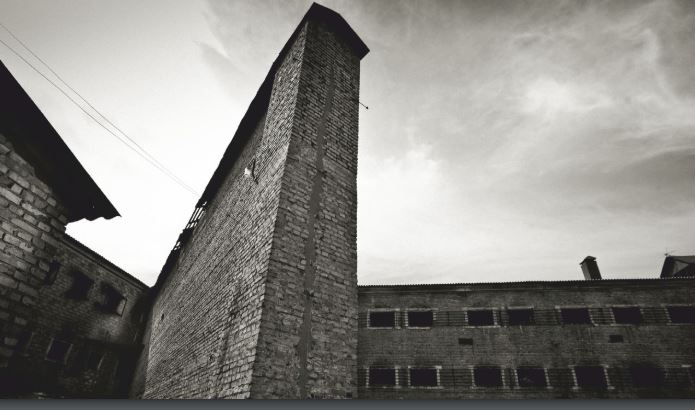

Britain’s foreign secretary is in Central Asia this week, seeking deeper ties with a part of the world seen as increasingly vital to international security, energy flows and efforts to combat climate change. The trip, which David Cameron described as overdue, followed criticism that Britain had neglected what the envoy’s own office describes as a “pivotal region of the world.” Cameron´s visit comes months after a British parliamentary committee report said there was a perceived “lack of seriousness” in Britain’s engagement with Central Asia. The committee said Russia and China were courting the region, while Britain was “a leading enabler for corrupt Central Asian elites and a key node for capital flight out of the region.” Cameron spent the first day of his trip in Tajikistan, meeting President Emomali Rahmon in Dushanbe and visiting the Nurek hydropower project, which supplies about 70% of the country’s electricity. He will also visit Kyrgyzstan, Uzbekistan, Turkmenistan, Kazakhstan and Mongolia. “These countries aren’t often talked about in the U.K., so you might ask why,” Cameron said on Monday. “Well, these countries are sandwiched between China, Russia, Afghanistan and Iran. They’re making a choice of who to work with, and in a more competitive and contested world, if you want to protect and promote British interests, you need to get out there and compete.” Britain intends to provide investment funds for small businesses as well as “green” projects that can mitigate the effects of climate change, Cameron said. Without providing specifics, he told Tajik television that he and Rahmon discussed security and “all the difficulties and conflicts in the region.” The Islamic State group, which is said in some quarters to have increasingly recruited Central Asians into its ranks, claimed responsibility for the killing of more than 140 people by gunmen who attacked the Crocus City Hall in Moscow on March 22. Several Tajik migrants are among the detained suspects. Cameron will “advance discussions on sanctions circumvention, human rights and reform,” his office said. Britain is a staunch supporter of Ukraine in its war against Russia, which has had success in dodging Western sanctions, partly by trading with Europe via Central Asia. For example, British firms´ exports to Kyrgyzstan have soared by over 1,100%, Sky News reported. “Major European economies are quietly continuing their economic cooperation with Moscow by circumventing sanctions to take advantage of the vacated market,” says a commentary in the Center for European Policy Analysis, which is based in Washington. “And they’re doing it by finding partners in the South Caucasus and Central Asia.” Cameron praised the Nurek Dam as an example of the kind of “great schemes” that can help reduce the use of coal-fired power plants and drive down carbon emissions by providing clean energy from Central Asia to South Asia under the CASA-1000 project. On the second leg of his tour, Cameron arrived in Kyrgyzstan later on April 22, where he met with President Sadyr Japarov. They exchanged views on the prospects for Kyrgyz-British cooperation in the political, trade,...