Kazakhstan Has a Deal for Tajik Electricity, Now the Wait Begins

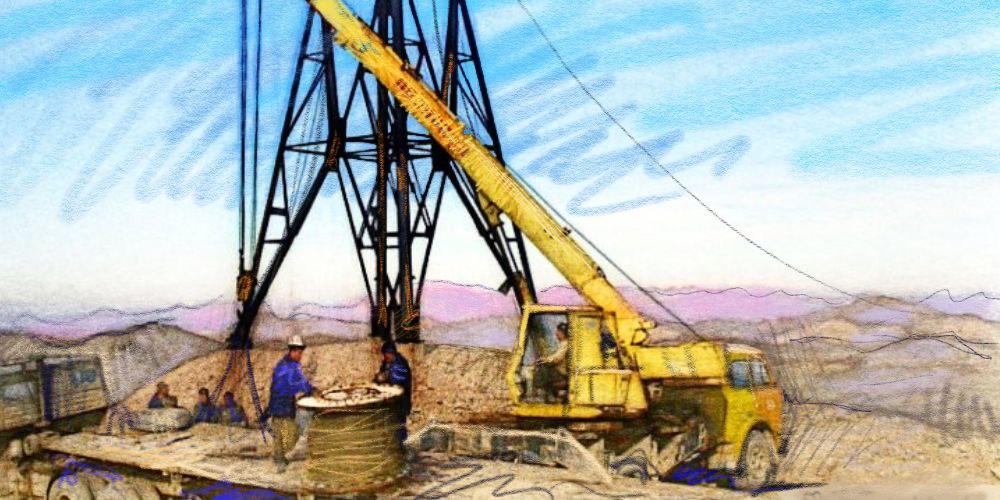

In the latest sign of Central Asian regional cooperation, Kazakhstan has signed a long-term deal to import electricity from Tajikistan. However, that electricity might not reach Kazakhstan anytime soon, as there are some important details that need to be worked out by Tajikistan before supplies can begin. Kazakhstan’s energy problems Kazakhstan has been experiencing severe energy deficits for several years now, particularly during winter months. Kazakh Senator Suyindik Aldashev said in late February this year that Kazakhstan would be short some 5.7 billion kilowatt hours (kWh) of electricity in 2025, which would be a 46% increase in the country’s electricity deficit compared to 2024. Kazakhstan was forced to import electricity from Russia during the winter of 2024 to help alleviate energy shortages. These shortages contributed to Kazakhstan's decision to hold a referendum to approve the construction of the country’s first nuclear power plant (NPP). To date, however, there has been no announcement of which company will build the NPP, so additional electricity from that source could be a decade or more away. This has led Kazakhstan to explore importing energy resources from its Central Asian neighbors. The head of Turkmenistan’s Halk Maslahaty (People’s Council) Gurbanguly Berdimuhamedov just visited Kazakhstan and met with Kazakh President Kassym-Jomart Tokayev with Turkmen gas exports to its northern neighbor high on the agenda. Kazakhstan has been in discussions with Tajikistan about electricity shipments for months, and the agreement was finalized toward the end of April. Rogun The source of the electricity Tajikistan intends to export to Kazakhstan is the Rogun Hydropower Plant (HPP) on the Vakhsh River, some 110 kilometers east of the Tajik capital Dushanbe. The Rogun HPP has a history of controversy. It was conceived in the 1960s when Tajikistan was a Soviet Republic. Construction on the project started in 1976, but not much had been done by the time the USSR collapsed in late 1991, and work ground to halt shortly thereafter. Russian company RUSAL signed an agreement in 2004 to invest more than $1 billion and finish building Rogun, but disputes over the project led the Tajik government to cancel the contract in 2007. One of the main differences between the two parties was RUSAL’s insistence the dam wall at Rogun be no higher than 285 meters, whereas the Tajik authorities wanted the original height of 335 meters. At 285 meters, the HPP’s output would have been 2400 megawatts (MW), while at 335 meters, the output would be 3600 MW. Russia’s Inter RAO EES was in talks with Tajikistan about the Rogun project in 2008, but in the end, nothing came from those negotiations. With no hope of foreign backing, Tajik President Emomali Rahmon started portraying Rogun as a project of national salvation, the key to energy independence. Rahmon’s government called on citizens to help finance construction of the HPP and when public support in the poorest country in Central Asia proved insufficient, citizens were pressured into buying shares in the project. The government in neighboring Uzbekistan objected to Rogun’s construction,...