The total amount of claims brought against the consortiums, North Caspian Operating Company (NCOC) and Karachaganak Petroleum Operating (KPO) is the largest in the history of Kazakhstan.

In March 2023, PSA LLP, the authorized state institution overseeing these projects, brought forward claims in international arbitration in relation to Kashagan and Karachaganak for $13.5 billion and $3.0 billion, respectively. In addition, the Atyrau Region environmental regulator filed a claim for $5.1 billion against the NCOC consortium for storing too much sulfur on site, discharging wastewater without treatment, etc.

The claims of PSA LLP cover the period 2010-19 and relate to the oil consortiums’ costs for carrying out large projects, as well as tenders and insufficient work completed.

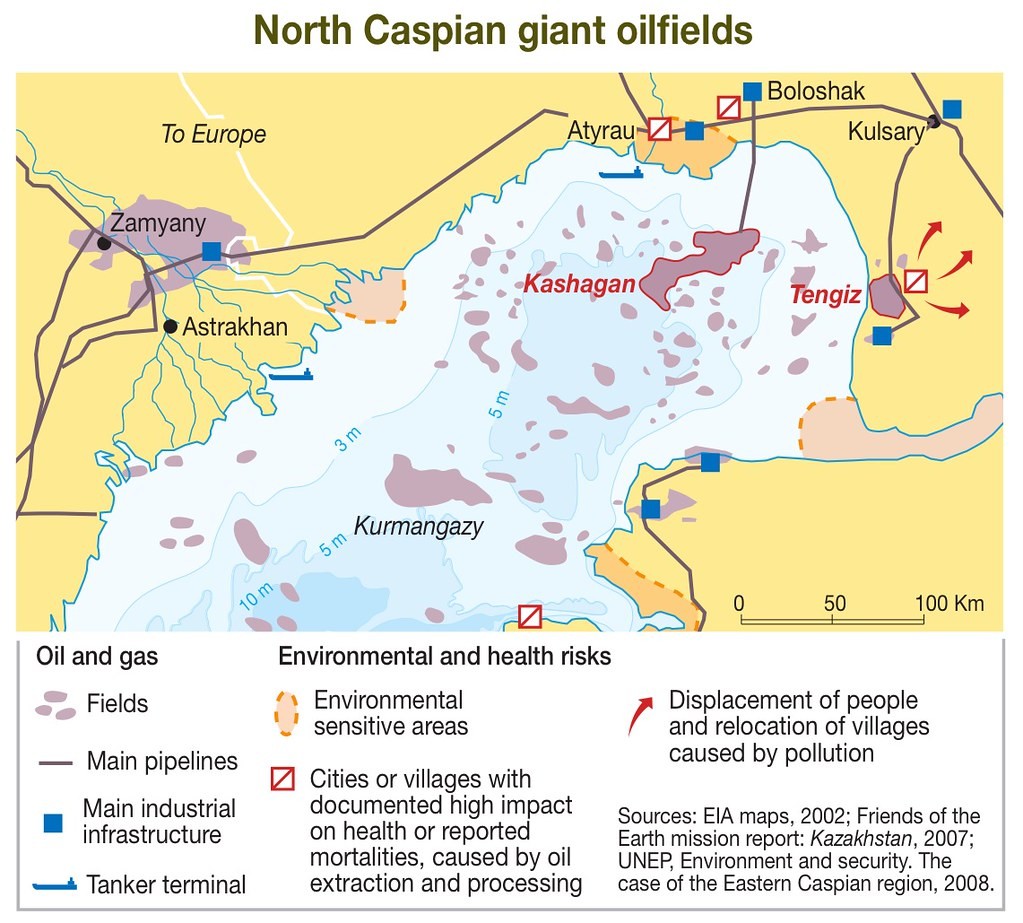

The shareholders of NCOC, which is developing the offshore Kashagan Field, include: KMG Kashagan (16.877% stake), Shell Kazakhstan Development (16.807%), Total EP Kazakhstan (16.807%), Agip Caspian Sea (16.807%), ExxonMobil Kazakhstan (16.807%), CNPC Kazakhstan (8.333%) and INPEX North Caspian Sea (7.563%). Their total investments over the period have not been disclosed, but, according to various estimates, exceed $60 billion – meaning the state is currently calling into question about 23% of all costs.

The KPO consortium is Shell (29.25%), Eni (29.25%), Chevron (18.0%), Russia’s Lukoil (13.5%) and Kazakhstan’s state-owned KazMunayGas (10.0%). Investments in this oil and gas condensate field are estimated at $27 billion, hence the filed claim is significantly smaller both in absolute terms and as a percentage of costs, standing at about 11%.

A production sharing agreement was signed in 1997 for Karachaganak and in 1998 for Kashagan, with the contracts to be in effect for 40 years. In 2022, the sole participant in PSA LLP became Samruk-Kazyna Trust Corporate Fund, part of the state holding National Welfare Fund Samruk-Kazyna, while Kazakhstan’s Ministry of Energy is currently entrusted to run PSA LLP.

NCOC and KPO dominate the industry through control of three fields. Tengiz, Kashagan and Karachaganak are the largest oil and gas fields in Kazakhstan. The country’s oil and gas condensate production in 2023 amounted to 89.9 million tons (about 1.8 million barrels per day), with the share of the “three whales” – as these projects are called – accounting for 67% of oil production:

- Tengiz with 28.9 million tons, down 1% versus the 2022 level;

- Kashagan with 18.8 million tons, a 48% increase;

- Karachaganak with 12.1 million tons, up 7% year-on-year.

The stabilization contract for Tengiz was one of the first signed at the dawn of Kazakhstan’s independence in 1993, also for a term of 40 years, meaning it should be the first to expire in 2033.

The shareholders of the Tengizchevroil JV are Chevron (50%), ExxonMobil (25%), KazMunayGas (20%) and Lukoil (5%). After completion of its FGP (Future Growth Project), Tengiz should produce about 900,000 barrels per day, a significant figure even by world standards.

It is surprising that Kazakhstan has not yet raised or voiced any claims against TCO, even though the FGP budget has swelled from an initial $12 billion to $25 billion – due to the addition of the WPMP (Wellhead Pressure Management Project) – then to $37 billion, and now, according to the latest information, to $46.7 billion, with the capacity expansion pushed back to the second quarter of 2025.

Meanwhile, a PSA LLP deputy general director, on an April 2023 episode of the Baidildinov.Oil YouTube program (titled “NCOC, KPO: Battle for the Future”), said the claims are not aimed at revising the contracts, but rather the state is merely pursuing fairness in its relations with the investors, and only through legal channels.

Such attention to NCOC and KPO against a backdrop of silence on Tengiz may be attributable to the fact that Kazakhstan’s share in TCO is owned and managed by the state-owned, KazMunayGas, not PSA LLP. Also of note is that Tengiz has turned out to be such a rich field that American companies are reported to want to extend the agreement for another 20 years. According to unconfirmed reports, consent in principle has been received, with the details now supposedly being discussed with the Kazakh Government.

Oil supplies and petroleum product shortages

Despite its high oil production and big hydrocarbon reserves, Kazakhstan continues to rely on Russian imports of petroleum products. According to the indicative plan of the Ministry of Energy, last year 5 million tons of diesel fuel should have been produced and about 800,000 tons imported, with an almost equal volume of gasoline production at 5 million tons and imports guided at 300,000-350,000 tons. In addition, the domestic market imports 30-40% of the tar and bitumen it needs for road work, with the same being true for jet fuel.

Meanwhile, Kazakhstan’s oil refineries are already operating at capacity (18 million tons per year), and a new refinery is needed. To fill that void, higher volumes of crude oil will be required.

The government has resolved that to meet growing needs, the Shymkent Oil Refinery in the south of the country (operated by PetroKazakhstan Oil Products) will be expanded. It is 51% owned by the Chinese state oil concern, CNPC, and 49% by KazMunayGas. Options to expand the refinery’s capacity from the current 6 million tons per year to 9 or 12 million tons per year are being considered.

However, over-regulation of the domestic market makes it unattractive for suppliers of crude oil. Currently, the state regulates crude oil prices in the domestic market, obliging extractive-industry companies to supply it at $20-25 per barrel.

Excluding the oil and gas condensate production of the “three whales,” production by other companies in Kazakhstan was down 3% in 2023 at 30.1 million tons. Currently, 60% of their production goes to the domestic market, while TCO, NCOC and KPO do not supply oil domestically under the agreements signed in the 90s.

At the end of 2022, President Kassym-Jomart Tokayev instructed the government to look at how an additional 5 million tons per year could be supplied to the domestic market by the large foreign operators. Therefore, a scenario in which Kazakhstan’s claims against NCOC and KPO are related to this should not be ruled out. Nevertheless, the question of regulated domestic prices, as well as how crude oil should be transported to refineries in the country’s south remains open.

It will be a while before we know whether Kazakhstan’s claims will be satisfied in international arbitration, as such proceedings can drag on for years. That said, the country’s ability to meet domestic demand and support budget revenues is limited and largely depends on the “three whales.”

Olzhas Baidildinov is an oil and gas industry expert, member of the Public Council of the Ministry of Energy of the Republic of Kazakhstan, author and presenter of the program “Baidildinov. Oil”, and founder of the Telegram channel, “Baidildinov. Oil”