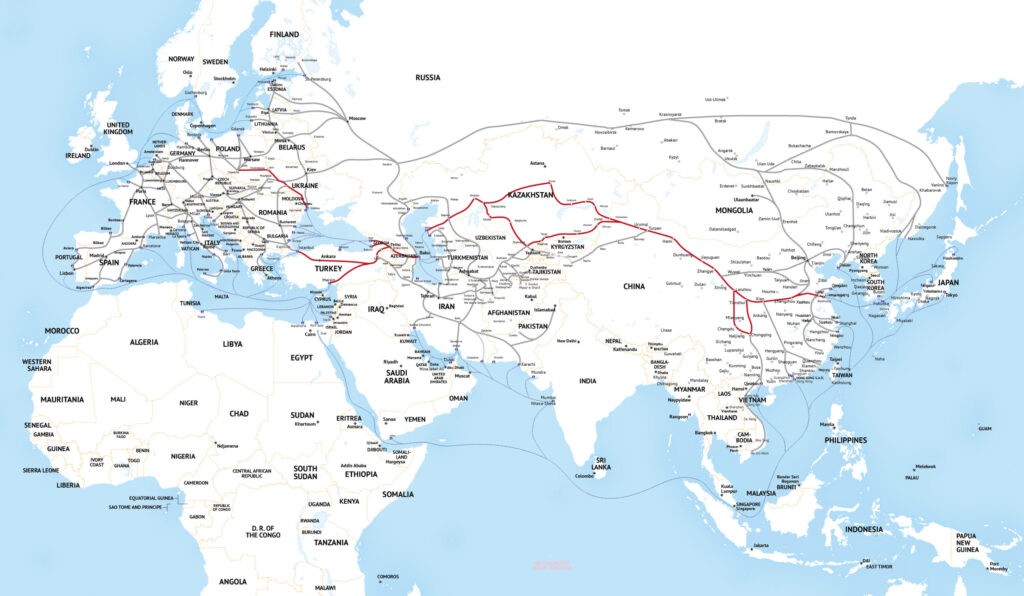

The challenging geopolitical situation in the region, combined with sanctions pressures, has ruptured traditional transport and logistics chains. Finding itself sandwiched, Kazakhstan has had to actively build new routes for transportation and freight, and to diversify its own suppliers. Measures previously taken to develop the transport and logistics industry has made it possible to solve these problems to some extent, though it still faces many challenges ahead.

Kazakhstan’s transport and logistics industry plays an important role in the country’s economy and attracts cargo flows. To transform the country into a transport and transit hub – one of the government’s declared strategic objectives – a number of large-scale measures are being taken today, with investments in the industry of about KZT1.8 trillion (U$4 billion), which are already bearing fruit.

Last year, about 29 million tons of freight passed through Kazakhstan, up 21% year-on-year, the lion’s share of which was transported by rail. Indeed, railways are slated to lead the country’s transit development. To further increase cargo flow, boost efficiency and, most importantly, expand the capacity of railroads, three large-scale projects were launched in Kazakhstan last year: the construction of a railway line bypassing the Almaty station, as well as two other lines – Darbaza-Maktaaral and Bakhty-Ayagoz. Over the next three years, more than 1,300 km of new rail lines will be laid. The projects aim not only at increasing transit traffic through Kazakhstan, but also expanding the country’s export potential and removing existing bottlenecks. Besides modernizing infrastructure, the industry faces many other tasks to spur transit traffic, including updating rolling stock, putting in place modern digital services, establishing competitive tariff rates for the transport of transit freight, etc.

To support cargo flows by road, the most used option, the construction and reconstruction of federal and local highways continues. In 2023, over 10,000 km of road was built or repaired. Such large projects as the BAKAD (Almaty ring road) and the Kandyagash-Makat and Usharal-Dostyk highways were completed. In the coming years, several road projects along federal and regional networks are planned, comprising a total length of about 9,000 km. More attention is to be paid to the quality of the roads under construction, which has been known to raise questions among motorists.

Kazakhstan’s maritime transport industry has also seen much development. In this regard, in the near future the creation of a container hub is planned at the Aktau seaport, along with the reconstruction of its docks and an upgrade of handling equipment. Dredging work is also to be done. The port of Kuryk is also being developed through the construction of a multi-functional terminal. Taken together, this will boost the throughput capacity of Kazakhstan’s seaports by 10 million tons, with container capacity rising to 300,000 TEUs per year. This is especially important in the context of the active development of alternative trade routes, in particular the Trans-Caspian International Transport Route (TITR) and the International North-South Transport Corridor (INSTC), for which both seaports will be used. The potential of these routes is evidenced by the interest of many foreign players. Note that the World Bank published a report in late November 2023 on the outlook for the TITR until 2030, exploring priority measures that could help countries participating in this multi-modal, rail-sea corridor to transform it into an important and reliable trade route.

The country’s airports are also a focus. Currently, the Astana, Almaty, Shymkent and Aktau airports are planning to attract $1.5 billion of foreign direct investment, which should raise the capacity of their cargo terminals from the current 200,000 to 1 million tons per year and create regional air hubs with a full range of services. A special economic zone for the airports is under consideration, a step that global experience shows will help attract cargo flows. In addition, as part of the Open Skies regime, airlines and low-cost carriers from 12 countries have agreed to fly to 13 international airports in Kazakhstan (Astana, Almaty, Taraz, Shymkent, Aktau, Semey, Karaganda, Ust-Kamenogorsk, Pavlodar, Petropavlovsk, Kokshetau, Turkestan and Aktobe), thus increasing competition among carriers, opening international routes, reducing the cost of tickets, developing tourism, and making cities in Kazakhstan more accessible.

Transport and logistics are reaching a new level of development in Kazakhstan and becoming one of the priority areas for the government. In the context of the unstable geopolitical situation in the former Soviet Union, as well as in the Middle East, which has affected global transport flows, Kazakhstan is well positioned to become an important transport and logistics hub between East and West and North and South, providing the shortest, safest routes, and convenient conditions for transporting goods.

Dauren Moldakhmetov

Editor-in-Chief of industry transportation publications of Kazakhstan, railway magazine “Trans-Express Kazakhstan” and business magazine “Trans Logistics Kazakhstan”