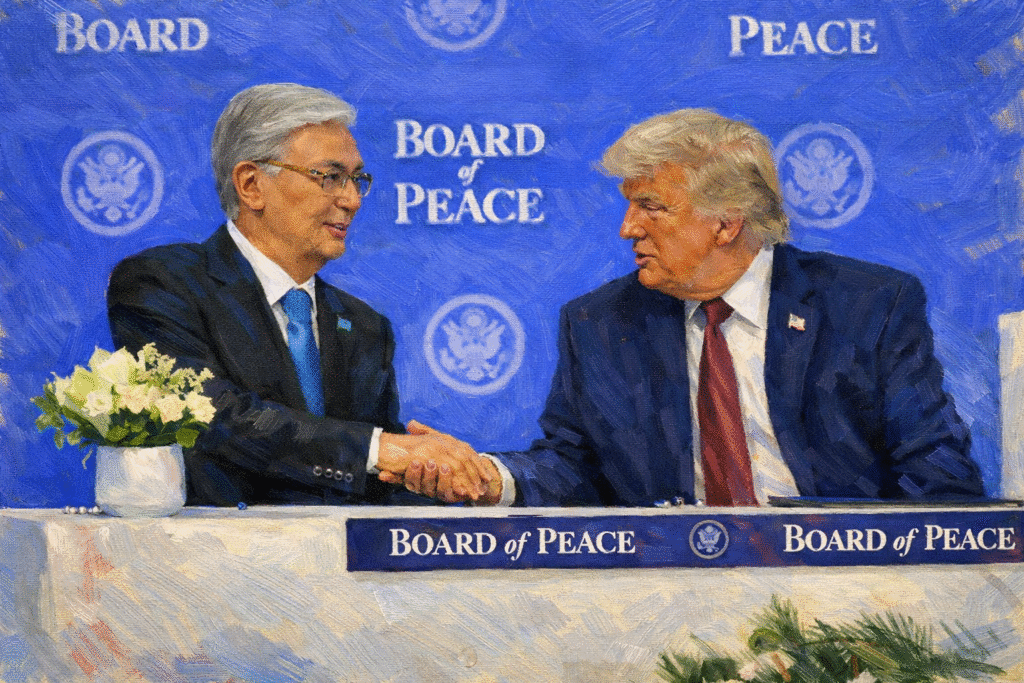

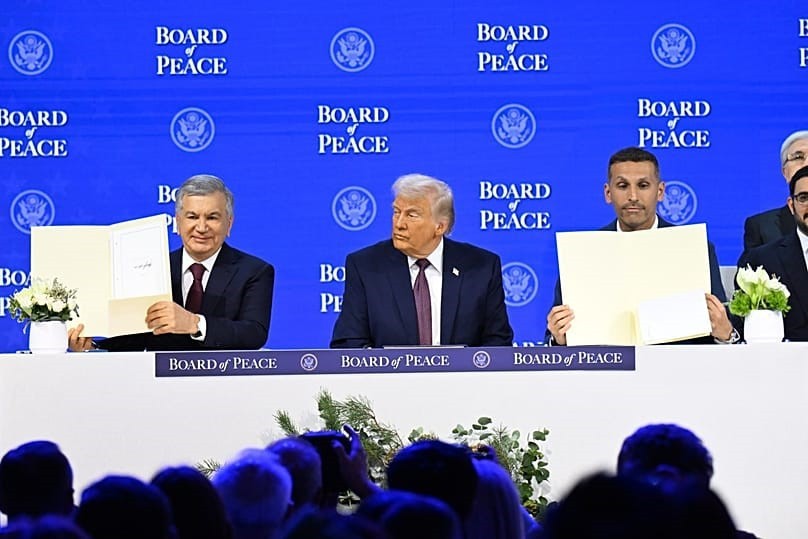

After 15 years of litigation worldwide, a long-standing dispute between Kazakhstan and Anatol and Gabriel Stati, businessmen from Moldova, has ended. The Ministry of Justice of Kazakhstan has reported that the government, the National Bank of Kazakhstan, and representatives of Stati have signed a framework agreement. The parties, with the support and consent of leading creditors of Tristan Oil, have concluded a legally binding framework agreement on a peaceful and mutually acceptable resolution of the long dispute over oil and gas assets in Kazakhstan.

As reported by the Ministry of Justice, the signatories have reached an agreement on mutually favorable terms that will lead to the termination of all legal proceedings and stop ongoing lawsuits in all jurisdictions. The specific terms of the agreement remain confidential.

Daniel Chapman, CEO of Argentem Creek Partners, said, “We support the framework agreement and applaud President Kassym-Jomart Tokayev’s decision to build a ‘Just Kazakhstan’ as part of his admirable reforms. The settlement of this dispute demonstrates Kazakhstan’s compliance with international treaty obligations, which opens the door to increased investment and enhances its economic growth potential. We welcome a new era for Kazakhstan.”

Argentem Creek Partners is the investment manager of specific funds that became lenders to Tristan Oil Limited, the investment vehicle of the Stati parties.

The legal battle between Stati and entities in Kazakhstan started in 2010. Lawsuits have been considered in the Netherlands, Belgium, Luxembourg, Sweden, the UK, and the United States. At one point, the assets of the National Fund of Kazakhstan were even frozen.

The episode began in October 2008, when then President of Moldova,Vladimir Voronin, complained to Nursultan Nazarbayev that businessman Anatol Stati was using money received in Kazakhstan to sponsor the opposition in Moldova. Shortly thereafter, Stati’s relationship with the authorities in Kazakhstan sharply deteriorated. A series of inspections initiated by state began, during which the unlicensed use of trunk pipelines, tax arrears, violations of license and contractual conditions under subsoil use contracts and other issues were discovered.

According to experts familiar with the case against Stati, by that time the Moldovan businessmen had already decided to leave Kazakhstan and were preparing for these inspections, which would result in the termination of contracts. Therefore, by November 2009, they had amassed a lot of materials, which, in the hands of their lawyers could be used to argue that Kazakhstan was in violation of the regime of fair and equal treatment of investors under the Energy Charter Treaty.

On July 21, 2010, the Ministry of Oil and Gas of Kazakhstan terminated the subsoil use contracts of the Stati companies Tolkynneftegaz LLP and Kazpolmunai LLP due to non-fulfillment of license and contractual terms. Five days after receiving the termination notice, on July 26, 2010, Stati filed an investment arbitration claim accusing Kazakhstan of expropriating their investments and violating investors’ rights to fair and equitable treatment. This arbitration dragged on until December 2013, when a Swedish court of arbitration awarded the Stati family $500 million, of which $199 million were funds allegedly related to the costs involving the construction of the Borankol gas processing plant. It should be noted that the Stati’s had demanded $4 billion from Kazakhstan.

Later, thanks to documents obtained in the U.S. through a separate judicial procedure, Kazakhstan obtained evidence that Stati’s claims were based on a major fraud.

In August 2021, Anatol and Gabriel Stati and their companies announced their intention to file a new lawsuit against the republic “in connection with Kazakhstan’s ongoing gross violations of its international legal obligations to pay the final and binding arbitral award rendered in December 2013.” Kazakhstan’s Ministry of Justice stated that Stati’s intention to initiate new arbitration proceedings would provide Kazakhstan and the tribunal with an opportunity for a fair hearing in the case.

On June 14, 2022, the Court of Appeal of The Hague ruled that the Kazakhstan Sovereign Wealth Fund, Samruk-Kazyna’s shares in KMG Kashagan B.V. enjoyed sovereign immunity from enforcement, confirming that the seizure of Samruk-Kazyna’s property was unlawful and invalid. The fund’s rights to independent ownership were restored without any restrictions.

On January 9, 2023, the District Court of Amsterdam denied the Stati’s request for recognition and enforcement of the arbitral award, stating that the businessmen had committed procedural fraud in the arbitration, violating Dutch public policy. On February 8, 2023, the District Court of Amsterdam ruled that the claims of the Stati businessmen and their campaigns against the Samruk-Kazyna Fund were inadmissible. The fund’s press service reported that the court ordered Stati to pay the legal costs incurred by Samruk-Kazyna and Kazakhstan. The Stati’s had argued that Samruk-Kazyna is part of the Republic of Kazakhstan and is, therefore, responsible for the alleged claims under the arbitration award against Kazakhstan.

It is now being reported that the Stati’s have reached an agreement with the government and the National Bank of Kazakhstan. Since its terms are classified, it is unclear which side yielded. However, many experts assume that the Moldovan businessmen ultimately bent to Kazakhstan’s political will.

Kazakhstani political analyst Gaziz Abishev wrote on his Telegram channel that “In the struggle for real improvement of the international investment climate, Kazakhstan has shown political will and ended the long-term confrontation with Moldovan businessmen Stati. The Stati’s filed suits in international courts [which] one after another made decisions unfavorable to Kazakhstan… At the same time, the ‘Stati case’ had a toxic effect on Kazakhstan’s investment image.”

Abishev summarized the unexpected end of the high-profile court saga as such: “One way or another, someone in this story has made some tough financial decisions. Investment attractiveness is a cornerstone of Kazakhstan’s macroeconomic plans. The Stati precedent will change the color of the certificates prepared by consultants for potential investors – from black – ‘They took away assets and continued to sue’ to ‘they constructively resolved the issue.’”