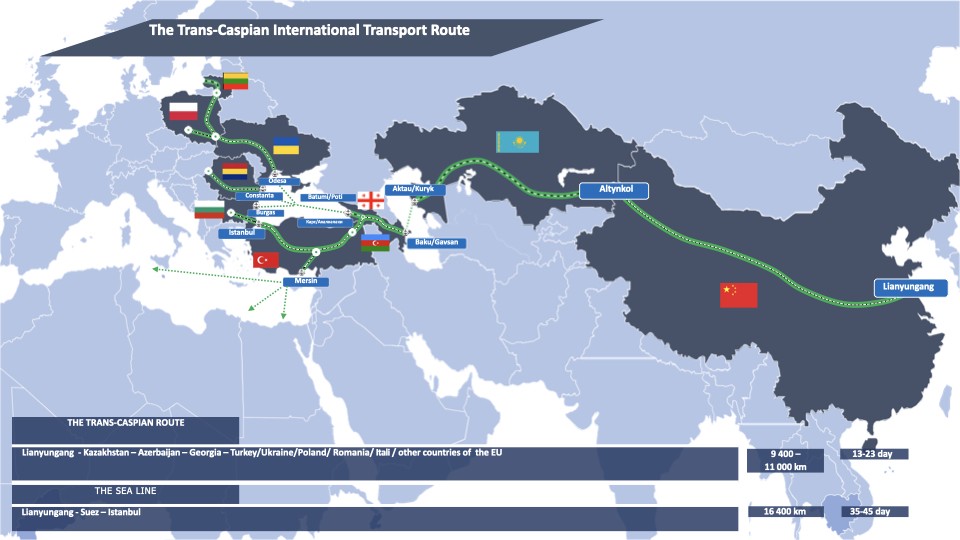

With the outbreak of Russia’s war in Ukraine and the subsequent sanctions against Russia, the traditional logistics corridor between East and West has significantly narrowed. In order to ensure the safe and uninterrupted export of locally produced goods and attract transit cargoes, the Kazakh government is therefore developing new routes. One of these is the Trans-Caspian International Transport route. But, given the aggravated geopolitical situation in the region and growing competition for cargo transportation between the East and West, will the Caspian transport corridor – also known as the Middle Corridor – allow the government to meet its ambitions?

Infrastructural vector of the Caspian Sea

Logistics have focused on the transportation route across the Caspian Sea, considerably increasing the role of the Middle Corridor, which is facing a huge increase in demand. The countries along which the TITR route runs have started building their transport infrastructure capacities, replenishing their maritime fleets, and pooling capital and competencies in logistics and transportation. In particular, at the end of 2022, a Road Map on synchronous elimination of so-called “bottlenecks” along the route along the territories of Kazakhstan, Azerbaijan, and Turkey for 2022-2027 was signed. A joint venture, the Middle Corridor Multimodal, was established by the railway administrations of Kazakhstan, Azerbaijan, and Georgia to increase the volume of cargo transportation. A unified approach to infrastructure development by all route participants has been formed, and several projects are planned to improve the transportation infrastructure of the road’s Kazakh, Azerbaijani, and Georgian sections.

For the development of transportation on TITR through the seaports of Aktau and Kuryk, Kazakhstan plans to create a container hub in the port of Aktau, dredging, construction of additional berths in both harbors, restoration of oil infrastructure and renewal, as well as re-equipment of the transshipment park in the port of Aktau. In addition, a grain terminal will be built at Kuryk’s seaport. Implementing these measures will increase the throughput capacity of Kazakhstan’s sea harbors to 27.3 million tons per year and increase cargo traffic along the Middle Corridor. Ten oil barges, eight ferries, six tankers, and a container ship will start operating in the Caspian Sea by 2030.

Furthermore, the construction in Aktau has attracted investment from the Chinese company, LLC GC Port Lianyungangan, which manages one of the largest ports in China and has signed an agreement to create a container hub at the seaport. Additionally, in partnership with the Singaporean company PSA Eagle Pte., a joint venture called KPMC Ltd has been established at the Astana International Financial Center. This venture aims to attract more cargo to the Middle Corridor, develop a digital transport corridor to optimize transportation processes, enhance the competitiveness of routes, streamline interactions, integrate partners along the cargo flow path, and improve supply chain management.

Work is being undertaken to expand the presence of companies from the Caspian region in global markets. Establishing such transport and logistics enterprises along the Middle Corridor will improve transportation organization and build efficient logistics chains. The willingness of large enterprises, including Chinese partners, to invest in the infrastructure of the TITR transport corridor essentially guarantees its cargo flow and indicates their readiness to participate in the route’s development.

In general, despite the measures taken, due to the logistical complexity of the route which involves changes to modes of transport when transporting cargoes across the Caspian Sea, experts believe that there is a need for the further expansion of transport capacities of countries participating in the route, facilitation of tariff policy and attraction of cargoes, as well as strengthening the synchronization of measures taken and cooperation along the entire corridor.

Coordination and cooperation are needed

The prospects for the Middle Corridor are demonstrated not only by heightened interest from foreign countries, but also by the recent increase in attention from international financial institutions. For example, the European Bank for Reconstruction and Development and the United States Agency for International Development signed a Memorandum of Understanding in May of this year on the development of TITR for further expansion of communication between Asia and Europe through the South Caucasus. According to the Bank’s estimates, given the implementation of investment projects and ensured uninterrupted communication via TITR, the volume of container transportation along the route could expand rapidly. Only in the first quarter of this year did the route launch more than 70 container trains going East-West.

According to a report published at the end of November last year by the World Bank, the competitiveness of this multimodal rail-sea corridor is increasing, with the potential to triple trade volumes and halve travel time along the route by 2030. At the same time, the bank’s experts emphasized strong coordination and cooperation as the underlying principle for further development of the route.

According to the report’s authors, by 2030 total trade turnover between China and Europe is expected to increase by about 30%. At the same time, the trade imbalance will remain with westbound cargo flows accounting for 62% of total trade. Aggregate trade from Azerbaijan, Georgia, and Kazakhstan will grow by 37%, mainly due to exports from Kazakhstan, while trade between these three countries and Europe will grow by 28%. In general, if the Middle Corridor’s operational efficiency improves, by 2030 the traffic volume on the route through the Caspian Sea will triple compared to 2021, amounting to 11 million tons.

Among the existing problems on this route, World Bank analysts highlight high and unstable current cargo transportation costs and duration compared to the northern route through Russia. They also emphasize delays, particularly at sea crossings, shortage of sea vessels, unpredictability in terms of rail transportation, lack of tracking systems, problems with transshipment and delivery at the “last mile,” and the poor quality of rolling stock and logistics centers.

According to the World Bank’s forecast, with the right combination of investment and operational improvement measures, the Middle Corridor can contribute to the economic and political sustainability of transcontinental trade, develop the potential of Central Asia and the South Caucasus, and, through access to seaports, provide a reliable route to China, Europe, and other parts of the world.

Focusing on development strategy

The current geopolitical situation in the region, Russia’s war in Ukraine and ensuing sanctions, have led to the breakdown of traditional transportation and logistics chains between Europe and Asia. This has stimulated the region’s countries to search for and develop alternative communication and cargo delivery routes and diversify their supplies. Under these conditions, the Middle Corridor has begun to be regarded as a strategic direction for developing the region’s transit and transportation potential.

However, the existing geopolitical processes that have influenced transport, including transit and routes that have received large cargo flows, are temporary. Sooner or later, the situation will stabilize, before which the participant countries of this route need to build a system of relationships attractive to all parties. Since land transport corridors, by their qualitative and cost parameters and throughput capacity, can surpass the Middle Corridor – which is characterized by its complexity – pragmatism will inevitably force shippers to choose between routes.

Thus, Kazakhstan, positioning itself as a transport and logistics hub of the Central Asian and Caspian regions, has a unique chance not only to attract new transit cargo flows, but also to qualitatively reset relations with countries participating in the route, both at governmental and business levels.

According to the international association, Trans-Caspian International Transport Route, the volume of cargo transportation along the corridor in 2023 amounted to more than 2.7 million tons, 86% more than in 2022. According to the results of the first half of the current year, over 1.6 million tons were transported along the route.

Despite the relatively positive prospects of the route, it should be remembered that it involves many participants, which could be a significant hindrance, slowing down joint reactions. In this regard, developing and adopting a joint strategy for the Middle Corridor is an urgent issue. Such an agreement would allow for the consolidation of the efforts, coordinated responses to changes both within the industry and in the external environment, and, most importantly, businesses would have an opportunity to avoid limitations imposed by national planning systems.

Forming international transport corridors involving states and market participants requires significant resources and effort. Regarding the Trans-Caspian International Transport Route, a substantial amount of work has been accomplished by the participating countries, yielding impressive results. The involvement of such world giants of transport as Abu Dhabi Ports, PSA International Pte Ltd, Lianyungang Port, as well as major international financial institutions, has confirmed not only the viability of the TITR, but also its critical importance for the economies of the countries along the route. It has also served to showcase their readiness to support the provision of technical assistance and investments, indicating positive prospects for the further development of this transport corridor.