An independent audit of Tajikistan’s flagship Rogun Hydropower Plant (HPP) has flagged serious financial reporting concerns, including a possible understatement of the company’s share capital. The findings, cited by Asia-Plus from the auditor’s conclusion, point to broader risks in the management of one of Central Asia’s most ambitious infrastructure projects.

The audit, covering Rogun’s 2024 financial statements, was conducted by Baker Tilly Tajikistan, a registered member of the international Baker Tilly network. The auditors issued a qualified opinion, meaning they were unable to fully confirm the accuracy of the company’s accounts and highlighted several material issues. The audited report has been published on the official Rogun HPP website.

Among the key concerns, auditors stated they had not been involved in scheduled or annual inventories of cash, fixed assets, or other inventories as of December 31, 2024. This limited their ability to verify the existence and condition of parts of the company’s assets through alternative procedures, raising the risk of potential misstatements in the financial records.

The audit also noted that Rogun’s fixed assets had not been revalued in recent years, despite signs that their book value may significantly differ from their fair market value. Under International Financial Reporting Standards (IFRS), such assets are required to be revalued periodically. The failure to do so may distort the company’s true financial position.

A particularly striking finding involved discrepancies in the company’s reported share capital. Rogun’s financial statements list share capital at 40.03 billion somoni, while the Unified State Register of Legal Entities records it at 45 billion somoni. The difference, 4.97 billion somoni, or approximately $540 million, may indicate that the company has understated its equity. According to the audit, Rogun’s management did not provide adequate documentation to support the lower figure.

As of the end of 2024, Rogun reported total assets of 49.48 billion somoni, up from the previous year. The bulk, 35.33 billion somoni, was classified as construction in progress, reflecting the plant’s ongoing development phase. The book value of fixed assets stood at 9.28 billion somoni, with most 2024 expenditures directed toward equipment and construction work.

The company reported 2024 revenues of 258.4 million somoni, primarily from electricity sales. However, operating costs exceeded income, totaling 367.4 million somoni, resulting in a net loss of 277.3 million somoni. This marks a modest improvement over 2023, when the net loss was 332.8 million somoni. The auditors described these losses as systemic, emphasizing that the plant has not yet reached full operational capacity.

Despite the loss, Rogun HPP generated a positive operating cash flow of more than 3.2 billion somoni in 2024. This was largely attributed to increased liabilities from founders and settlements with state institutions. Baker Tilly stressed that the company’s continued operation depends heavily on sustained government support, which is regularly allocated through Tajikistan’s state budget.

The auditors also issued a warning over material uncertainty regarding the company’s ability to continue as a going concern. However, Rogun’s management maintains that the project is a strategic national asset, vital to Tajikistan’s long-term energy security and plans for future electricity exports.

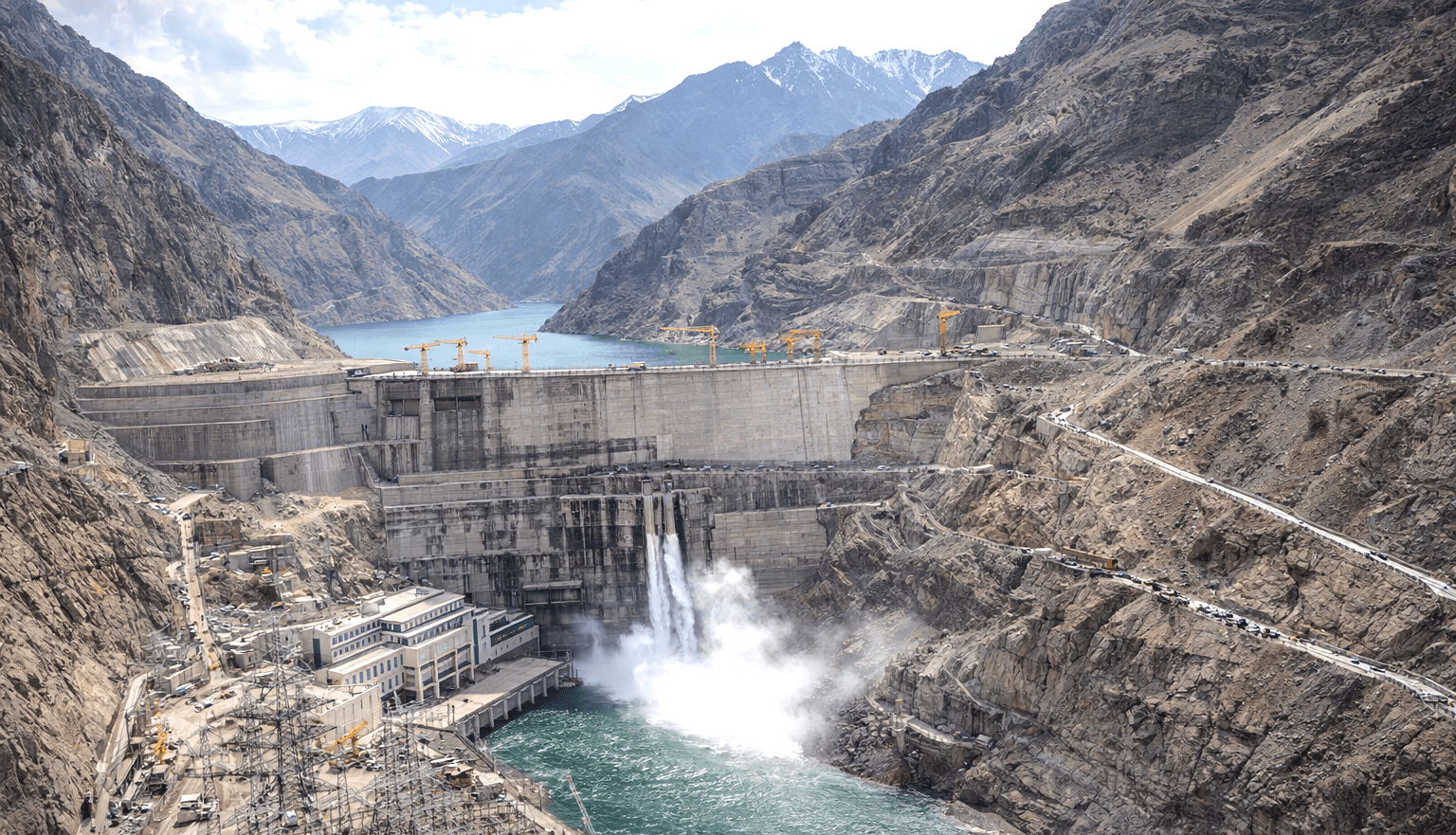

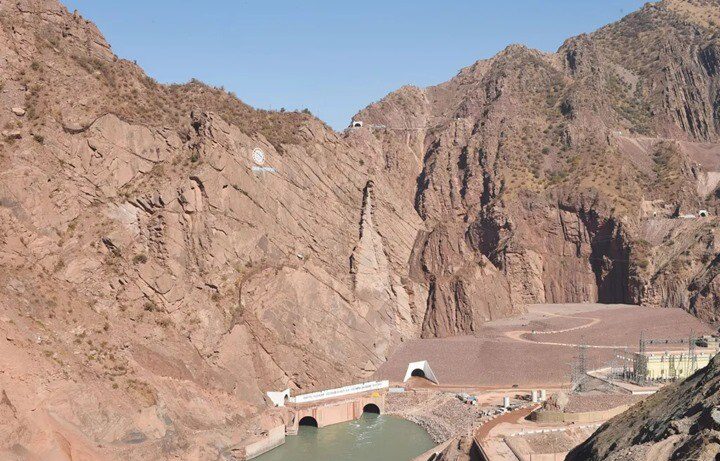

With an installed capacity of 3,780 megawatts, Rogun is expected to become the largest hydropower plant in Central Asia. Once fully operational, it is projected to generate over 14.5 billion kilowatt-hours of electricity annually. The final turbine is scheduled for commissioning in 2029.