Open for Business: New Reforms Accelerate Investment in Uzbek Companies

Uzbekistan’s business sector is in a period of rapid transformation. The catalyst for this is the government’s newest set of economic reforms, through which it is seeking to attract long-term investment. New legislation, targeted incentives for enterprises, and an influx of international partnerships are changing the way that companies operate and invest.

A key part of this transformation is the government’s effort to create a more predictable and transparent regulatory environment. The World Bank has noted that Uzbekistan’s reform strategy is centered on expanding trade integration and accelerating the long-planned privatization of state assets. The country’s priorities include accession to the World Trade Organization, which has brought about legal adjustments designed to align Uzbek standards with global norms.

Investor confidence has been encouraged by new policies that now make it easier to live and work in Uzbekistan. A five-year “golden visa” now makes it possible for foreign nationals who invest at least $250,000 to receive residency. This simplifies procedures for those developing long-term projects.

Another focus for the government is financial liberalization. The International Monetary Fund recently noted that state ownership of banks is expected to fall to around 40 percent next year, which creates space for potential private lenders and foreign capital.

Recent data suggests that these reforms are beginning to bear fruit. In the first quarter of 2025, Uzbekistan attracted about $8.7 billion in new foreign investment, according to figures published by UzDaily, with the total inflow this year projected to reach $42 billion. The Times of Central Asia has reported that over the past eight years, the country has absorbed more than $113 billion in foreign capital. These numbers highlight the nation’s growing appeal to international investors.

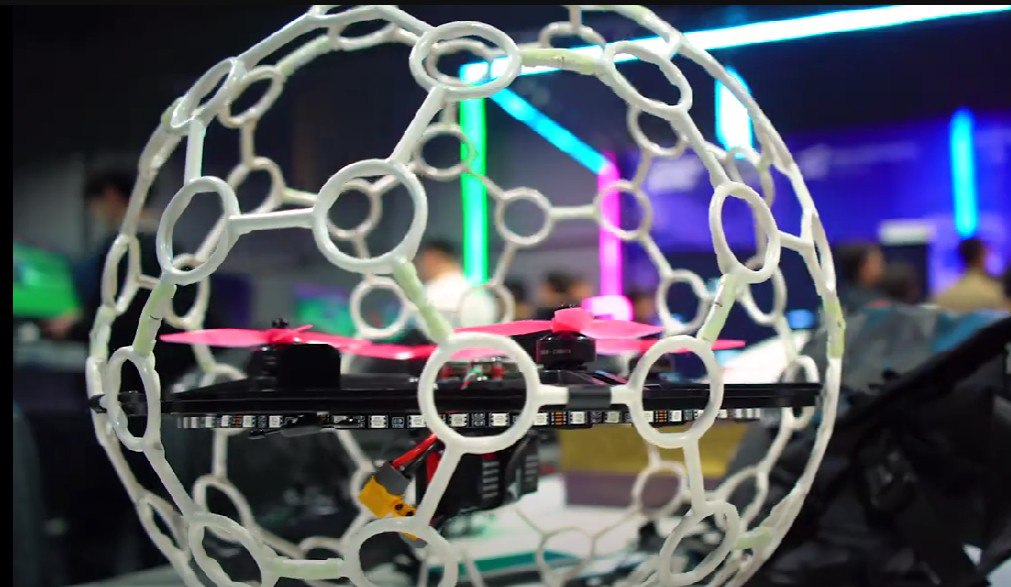

Alongside the surge in foreign activity, the authorities are developing policies to encourage domestic entrepreneurs. There are now more than 370,000 registered small and medium-sized businesses in Uzbekistan, which now receive more support from the government through simpler registration rules and targeted tax incentives. Private industrial parks in Tashkent and Samarkand are driving innovation in the textiles, IT and construction sectors, and creating prospective local jobs.

The business community has taken notice of these reforms. At the Tashkent International Investment Forum in June, European delegates described Uzbekistan as a country “undergoing large-scale transformation”, with a growing array of opportunities for international investors. Guests in Tashkent praised efforts to increase transparency in business and cut back on beaurocracy. At the same time, they stressed the need to be consistent in their implementation across regions.

Despite tangible progress, challenges remain. Inflation has remained high, and analysts continue to point to structural issues hampering growth. These include an underdeveloped financial system and a large informal economy. Foreign businesses operating in Uzbekistan are also advised to pay close attention to compliance and labor law as the legal environment evolves.

Two of the government’s priorities stand out in the short term. The first is the privatization of major state assets in the energy, transport and telecommunications industries — part of the 2025 national economic program outlined by Invexi. The second is diversification beyond commodities, with policymakers encouraging investment in lesser sectors such as manufacturing, agricultural technologies, and digital services, to strengthen the country’s export resilience.

Uzbekistan’s reforms are ambitious but becoming more and more coherent. If the current trends continue over the next decade, the country could consolidate its position as one of Eurasia’s most competitive and investment-friendly economies.