The pandemic of 2020-21 took a toll on civil aviation worldwide, and Central Asia was no exception. However, since then and post-February 2022, the region’s leading economies – Kazakhstan and Uzbekistan – have improved passenger air transport through low-cost carriers and made themselves more attractive for air cargo. In addition, Russia is steadily exiting the market due to sanctions, whilst Beijing is looking to fill the void.

Air cargo: Kazakhstan and Uzbekistan

Less than a month ago, the Silk Road in the Sky—Kazakhstan Cargo Hub regional forum on cargo transportation and logistics took place. It was held under the auspices of the International Air Cargo Association (TIACA) with the support of Kazakhstan’s Ministry of Transport and the country’s Aviation Administration.

The forum hosted talks between various organizations, with documents signed between Astana, Karaganda, and Aktobe airports with MNG Airlines, MSC Air Cargo, Coyne Airways, and Alpha Sky (Kazakhstan). Memorandums of cooperation were also concluded between TIACA and the airports of Aktau, Aktobe, Astana, Karaganda, Uralsk, and SCAT Airlines, as well as between TIACA and the Joint Authorities for Rulemaking on Unmanned Systems (JARUS). More than 300 participants from 30 countries attended the forum, representing organizations across the freight transport chain, including shippers, forwarders, ground service providers, airports, airlines, manufacturers, and IT service providers. According to the Civil Aviation Committee under Kazakhstan’s Ministry of Industry and Infrastructure, the cooperation of local companies with the international community, as well as their use of advanced technologies, is expected to boost Kazakhstan’s trade with the other countries of Central Asia by 2.4 times – from $6.3 billion to $15.0 billion – amid a $560 million increase in Kazakhstani exports.

The Government of Uzbekistan, meanwhile, began looking into the idea of making the country a regional transshipment hub back in September 2022, when Central Asia was seeing an influx of emigrants from Russia, especially Russian men fleeing mobilization.

The lion’s share of Uzbekistan Airways cargo traffic represents China-Europe deliveries transiting through Uzbekistan. For these deliveries, the company has operated routes such as Tianjin–Athens, Hong Kong–Amsterdam, and Shenzhen–Chalons-Vatry (Paris), with plans to increase freight volumes with the routes Tashkent–Guangzhou–Tashkent (currently being implemented), Tashkent–Lahore–Tashkent (to be launched in 2025-26), Tashkent–Xi’an–Tashkent (launch scheduled for this year), Tashkent–Chengdu–Tashkent (planned for 2026), and Tashkent–Dhaka–Tashkent (to be launched in 2027).

Foreign players have shown increased interest in Uzbekistan’s transit potential, as well. For example, Poland’s SkyTaxi has launched cargo transportation from China through Uzbekistan to Europe. The first plane landed in Tashkent back on June 11, 2022. Indeed, Tashkent Airport has gained importance as a transfer point for technical stops and refueling. On July 7, 2022, Azerbaijan’s Silk Way West cargo carrier made its maiden flight on the Baku–Navoi–Hong Kong route. The company delivers goods from Europe to Asia, as well as from the U.S. to Africa.

In 2020, an open skies policy was introduced across all regions of Uzbekistan, giving international airlines access to the country’s airports and ground services. Meanwhile, Kazakhstan’s open skies policy was extended last year until 2027.

Kazakhstan and FlyArystan

The importance of low-cost carriers (LCCs) in Central Asia rose significantly during the pandemic. This year, analysts from the Asian Development Bank (ADB) published a report on opportunities for LCCs in Central Asia and the state of civil aviation there broadly, with separate case studies on Kazakhstan, Kyrgyzstan, and Uzbekistan.

According to ADB analysts, the air transport market in Kazakhstan in general and the LCC FlyArystan in particular demonstrated impressive performance in 2019-22. Back in 2021, when quarantine measures had already been significantly relaxed, the Kazakhstani air transport market was the fastest growing in the world, with passenger traffic up 30% in 2021 versus 2019. The unrest in January 2022 cooled this growth, with the week-long closure of Almaty Airport alone reducing passenger traffic by 50% in that month versus December 2021.

Overall, FlyArystan has played an important role in the growth of the Kazakhstani air transport market, the ADB report notes. The company, having commenced operations in May 2019, carried around 700,000 passengers in 2019, with this figure rising to 3.26 million in 2022. That made FlyArystan the third largest airline in Central Asia, behind only its parent company, Air Astana, and Uzbekistan Airways.

Another important factor in FlyArystan’s development was its launch of international flights. By the start of 2023, it was operating regular flights to five international destinations: Baku, Dubai, Istanbul, Kutaisi, and Samarkand. In the summer of last year, five more destinations were added: Ankara, Bishkek, Delhi, Tashkent, and Urumqi. To cope with the increased load, the low-cost airline plans to expand its fleet to 26 aircraft by 2026, up from 18 at the end of 2023.

Uzbekistan and Uzbekistan Airways Express

The air transport market in Uzbekistan has also become one of the fastest growing in the world, largely thanks to reforms launched in 2018. In 2017-19, domestic passenger traffic increased 50%. As part of the reforms, the aviation sector was significantly liberalized. In particular, the country moved away from a heavily vertical management structure, while the conditions for the creation of new private airlines were significantly improved and the rules for foreign air carriers looking to enter the market were relaxed.

Uzbekistan Airways Express, a subsidiary of the state flag carrier Uzbekistan Airways, became the first local LCC. The airline’s main destination is Russia, with flights connecting nine cities of Uzbekistan with Moscow and other parts of Russia, which remains a key destination for the parent company, too: about 50% of Uzbekistan Airways passenger traffic is attributable to routes involving Russia.

In addition, public-private partnerships (PPPs) in airport management are expanding in Uzbekistan. Samarkand Airport became the first facility run under a PPP, with a joint venture between the state-owned Uzbekistan Airports and private-sector investor, Air Marakanda, while a new airport in Tashkent is also set to be a PPP.

ADB analysts separately note the importance of a “massive” airport modernization program, including $1 billion in upgrades to existing airports planned set to be completed by the end of 2024. Among the bank’s recommendations was the continued liberalization of visa policy to attract more tourists.

Kyrgyzstan and Air Manas

Kyrgyzstan’s aviation sector, according to the report, is the most liberalized across Central Asia, though the country is the only one in the region without its own state flag carrier. State-owned Air Kyrgyzstan ceased operations in 2017.

Low-cost carriers have been operating in the Kyrgyzstani domestic air transport market for about a decade. In this regard, the country was well ahead of its neighbors, though the small size and unprofitability of the domestic market have limited the market’s growth. In 2019-22, passenger traffic in the Kyrgyzstani domestic market increased from 600,000 to 800,000, a far less dynamic increase than Kazakhstan’s FlyArystan.

The first local LCC was Air Manas. Initially, the company was called Pegasus Asia, with 49% of the company owned by Turkey’s Pegasus Airlines. The main route of Air Manas over the years was Bishkek–Osh. In different periods, it also offered flights to Istanbul, Almaty, Urumqi, Moscow, and Delhi. Before 2022, Air Manas held a 20% share of the domestic market. However, sanctions against Russia created severe headwinds for the company – specifically, it ran into issues operating a Russian-owned aircraft it had leased. The company managed to resume operations only in 2023.

The main problem for aviation in Kyrgyzstan remains the deteriorating infrastructure. ADB analysts say most of the country’s airports, especially the two biggest, Bishkek and Osh, need modernizing.

Aviation and geopolitics

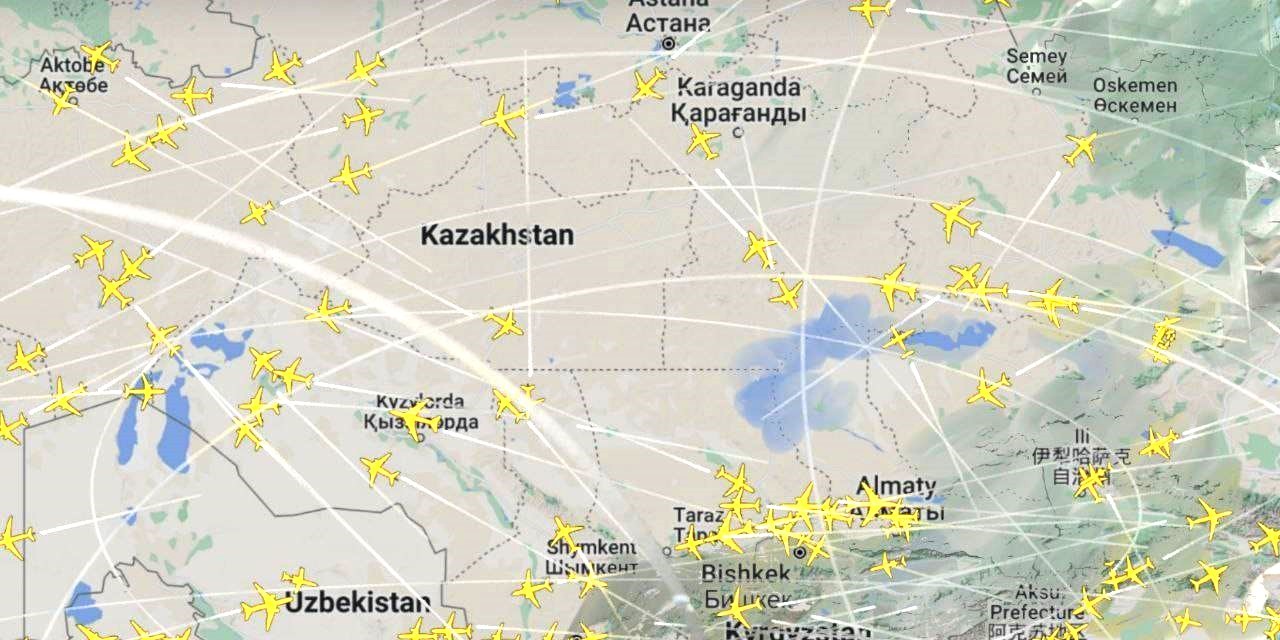

Since Russia’s 2022 war against Ukraine, Central Asia has seen a renaissance in civil aviation. The number of flights to and from the region has jumped as airlines which previously flew over Russia now use Central Asian routes to reach Southeast Asia and the Middle East. New government-backed carriers have emerged to capitalize on this increase in traffic.

Since early on in the Ukraine conflict, Russian airspace has been closed to many Western countries. As a result, flights between many European countries and, for example, Uzbekistan, according to the European Organization for the Safety of Air Navigation (known as Eurocontrol), more than doubled from 2019 to early 2023, and rose 36% in 2022 alone. Meanwhile, Kazakhstan’s Aviation Administration has reported that passenger traffic was up 16.5% in year-over-year terms as of early 2023, while Air Astana posted record earnings that year with an after-tax profit of $78.4 million.

China is now actively pursuing air links with Central Asia. A month ago, regular flights were launched for the first time to two Central Asian countries using China’s ARJ21 regional jet: on June 6, China’s YTO Cargo Airlines flew a cargo-converted ARJ21-700F (maximum payload 10 tons; range 2,780 km) from Yining in Northwestern Xinjiang to Tashkent; and the next day, Chengdu Airlines used an ARJ21 to carry passengers on a new weekly flight connecting China and Tajikistan, from Kashgar (Xinjiang Uyghur Autonomous Region) to Khujand.

Considering that Tajikistan, in the 30 years since its independence, has seen its civil aviation sector virtually disappear (out of 30 domestic flights, only one remains: Dushanbe–Khujand), China will likely fill the void in the country. The historical irony is that Russia, which created civil aviation in Central Asia in the 1930s, has today completely lost its influence in this sphere due to sanctions. With Tajikistan and Kyrgyzstan requiring outside assistance and significant investment to develop their aviation sectors, China, Turkey, and probably European countries will likely occupy this niche within a few years, definitively displacing Moscow.