BISHKEK (TCA) — Parliament deputies and experts are dissatisfied with the results of the state mortgage program in Kyrgyzstan because it is not affordable for state employees.

The monthly salary of a teacher with three years of experience is about 6,500 soms ($93), and with 30 years of experience — about 15,000 soms. With such salaries, they cannot afford a state mortgage loan, MPs said.

The State Affordable Housing program started in March 2016 to improve the issuance of preferential mortgage loans to state employees. Loans are provided by banks, which are compensated for the difference between market and preferential loan rates.

Since November 1, 2018, the rates on newly issued loans under the program have been reduced to 7-9% per annum. Previously, they were from 8% to 12%. The State Mortgage Company OJSC (SMC) is the program operator.

According to the SMC head Baktybek Shamkeev, if a citizen wants to obtain a 1 million soms loan, the total family income should be 22-24 thousand soms (around $330) per month. If a person receives a loan of 2 million soms, the total monthly income should be 45-50 thousand soms. Most civil servants in the country do not have such an income, MPs said.

Poor program implementation

The State Mortgage Company is working poorly on the implementation of the Affordable Housing program because only a limited part of solvent citizens who work in the public sector have received mortgage loans, concluded the Accounting Chamber following the results of the company’s audit.

The unavailability of state mortgage for the public sector was affected by the high interest rate resulting from the conclusion of agreements with partner banks with the provision of an added 5% annual rate along with a 3% rate (previously 5%) of a budget loan received from the Finance Ministry.

The auditors advised to reduce the cost of state mortgage by reducing the income of the State Mortgage Company and commercial partner banks.

Overpriced loans

The Affordable Housing program may become unavailable, MP Marlen Mamataliev said. The State Mortgage Company has not achieved good performance due to very high down payment amount and interest rates, he explained.

The SMC says that loans are issued at 9%, but in reality people get loans at 14-16%. In addition, the cost of apartments in the houses the company provides is very high, which does not comply with the principles of the Affordable Housing program. For instance, an apartment in a house built in Naryn costs $34.8 thousand. If a teacher or doctor receives it at 9%, he will have to pay 12 thousand soms per month for 15 years. After 15 years, the apartment will cost him $67 thousand.

Shamkeev told MPs about the SMC plans to create its own housing stock. Replenishment of capital is planned due to the Government’s contribution, he added.

According to the program, it was planned that construction companies would build housing at their own expense, and SMC would redeem. However, not all companies can afford building of social housing, since it is more profitable for them to build luxury homes.

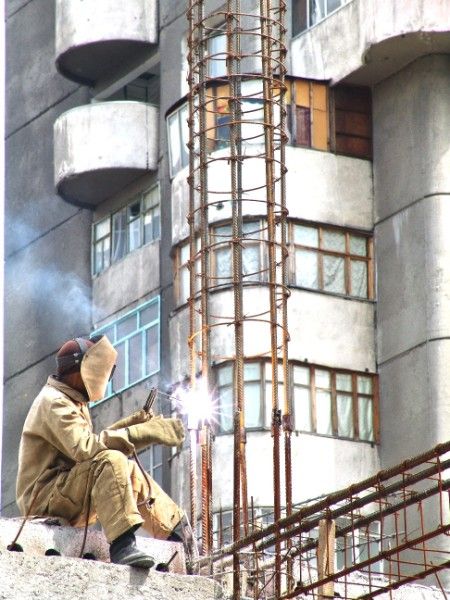

Therefore, the State Mortgage Company began to build pilot houses in Naryn and Bishkek as part of a lease mechanism with subsequent purchase, which will be completed in April-May 2019.

According to the Government, the price of state mortgage should not exceed 40 thousand soms per square meter. If this price excessed, losses should be assumed by the State Mortgage Company.

A construction company undertook to build a five-story house in Naryn for 93 million soms, but after making changes, the construction cost increased to 172 million soms. Program participants refused from housing due to the high cost and unsuccessful planning of apartments.

Deputies asked to review the rate and conditions of the state mortgage housing program, as well as to cancel the mortgage down payment.

New program

Kyrgyzstan’s Government intends to create “a company that will help citizens save for a down payment and get a mortgage at 8-9% per annum for up to 13 years”. Such a company may be established before the end of 2019.

To solve the housing problems of citizens, the Economy Ministry proposed to create a Savings and Loan Company in Kyrgyzstan. The Ministry has submitted amendments to the Law “On Collateral” for public discussion. The new program will be funded by citizens who want to get a mortgage.

“Given the lack of access to long money, existing financial institutions offer mortgage lending services for a short time and with high interest rates. These financial services are not available to all segments of the population. The existing State Mortgage Company will not be able to satisfy all the population’s demand for mortgage loans. Therefore, it is necessary to create a housing savings company,” the bill says.

According to the new program, each citizen can buy housing now but not just government employees as the State Affordable Housing program requires.

To purchase housing, a citizen of Kyrgyzstan will save a down payment in the housing insurance complex (30% of the loan amount), and this money will be kept as a deposit with an annual rate from 3% to 4.5%. As soon as the citizen accumulates the initial amount, the State Mortgage Company will issue a mortgage loan to him for the purchase of an apartment. If a person does not save enough money for a certain period of time, the money will be returned to him.

Official data

The housing stock area is growing rather slowly in Kyrgyzstan. There were 13 square meters per citizen of Kyrgyzstan in 2005, compared to 13.2 square meters in 2017. For instance, the area of housing per person has increased from 17.5 square meters to 21.4 square meters in Kazakhstan over this period.

According to the State Mortgage Company, 3.8 thousand mortgage loans were issued for 4.2 billion soms over the company’s work, of which 30% were loans for teachers, 30% — for municipal employees, and 17% — for doctors. More than 14 thousand citizens have been provided with accommodation.

The SMC intends to issue 1.5 billion soms of loans in 2019. By the end of the year, the interest rate will drop to 6-8%.

The company is attracting non-budgetary funds. The German Development Bank will allocate 11 million euros, according to the agreement between the governments of Kyrgyzstan and Germany.