BISHKEK (TCA) — With China being the only buyer of Turkmen natural gas after the suspension of gas supplies to Iran early this year, Turkmenistan is striving to find new sales markets for its gas, and a planned trans-Caspian pipeline to Azerbaijan seems to be a promising option for Ashgabat. We are republishing this article by David O’Byrne on the issue, originally published by EurasiaNet.org:

After close to 30 years of haggling over the legal status of the Caspian Sea, the five littoral states appear to have finally settled their differences and agreed on delineating their maritime borders. If finalized, the deal could pave the way for the export of Turkmenistan’s vast natural gas reserves to Europe.

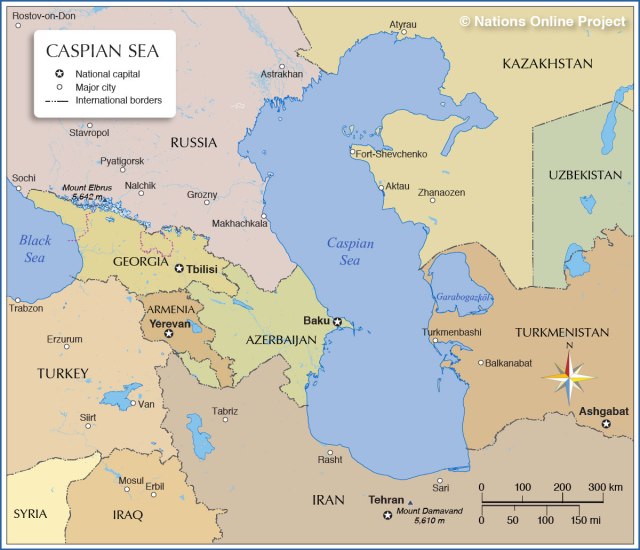

Details of the agreement have not been released and some elements may only be finalized when the final text is signed next year by the heads of the five states: Russia, Kazakhstan, Turkmenistan, Iran and Azerbaijan.

“We have found solutions to all the remaining open, key issues related to the preparation of the draft Convention on the legal status of the Caspian Sea,” Russian Foreign Minister Sergey Lavrov said after a meeting with his Caspian counterparts in Moscow on December 5. “The text of the document is, in fact, ready.”

A compromise by Turkmenistan over how its maritime border with Azerbaijan is determined appears to be the breakthrough that made finalization of the pact possible.

Under the compromise, Ashgabat reportedly would drop its claim to part of Azerbaijan’s Azeri-Chirag-Guneshli oil field, and would also likely lead to talks over other disputed assets like Kapaz/Sardar, an oil and gas field located midway between Azerbaijan and Turkmenistan and claimed by both. “In the coming months the two countries will also start discussing joint oil and gas projects and perhaps some form of production sharing agreement regarding the Kapaz/Sardar field,” said Efgan Nifti, director of the Washington-based Caspian Policy Center.

The agreement also appears to remove the ability of Russia or Iran to block the development of a pipeline to transit Turkmen gas across the Caspian to Azerbaijan and possibly on to Europe.

Azerbaijani Deputy Foreign Minister Khalaf Khalafov said the deal that has been reached stipulates that pipeline projects only need to be approved by the countries whose waters the pipeline would traverse.

“At least on the legal level, no one can now object if Azerbaijan and Turkmenistan decide to build a pipeline,” Nifti said.

It’s not clear what might have led Russia, which has for years strenuously opposed the construction of a pipeline across the Caspian, to make this concession. Russian officials have not publicly addressed the issue. Alexander Knyazev, a pro-Kremlin analyst, told the newspaper Nezavisimaya Gazeta that Russia could resort to old-fashioned saber-rattling techniques to disrupt the construction of any pipeline that Moscow opposed.

“The issue [of a pipeline] isn’t eliminated, but if the project is realized, conflict could take place, most likely, in less civilized forms,” Knyazev said. “And in that case, the Russian Caspian Flotilla, which de facto dominates the sea, does not require the agreement of other countries.”

Proposals for a pipeline to carry Turkmen gas to Europe are nothing new. Such plans first surfaced in the late 1990s, when the European Union started seeking to open a “Southern Gas Corridor” (SGC) as a means of lessening European dependence on Russian gas.

Backed by a consortium of Bechtel, Shell and GE plans for a “Trans Caspian Pipeline” (TCP) progressed as far as Turkey signing a deal in 1999 for state gas importer Botas to take 16 billion cubic meters per year of Turkmen gas. But those plans were shelved after the discovery of Azerbaijan’s Shah Deniz gas field led Baku to develop its own reserves instead.

Interest in Turkmen gas surfaced again in 2009, during negotiations over the Nabucco pipeline project, which was backed by the EU under its SGC ambitions. Ultimately, Turkmenistan and Azerbaijan never came to an agreement.

Eventually Nabucco, too, was shelved and Baku opted to develop its own pipeline routes: the Trans-Anatolian Pipeline (TANAP) across Turkey, and the Trans-Adriatic Pipeline (TAP) through Greece and across the Adriatic to Italy.

Under current arrangements, TANAP will carry 16 billion cubic meters of gas per year from Azerbaijan’s Shah Deniz field, of which 6 billion cubic meters will go to Turkey and the remaining 10 billion to Italy via TAP. That leaves some spare capacity in the pipelines: 15 bcm/year for TANAP and 10 bcm/yr for TAP. Both pipelines could, under their current legal frameworks, accept Turkmen gas.

Any moves to develop a pipeline to feed Turkmen gas into TANAP and on to Europe would be sure to receive the full support of the EU.

However much has changed since the various trans Caspian proposals were first mooted.

“Declining gas demand across Europe, new interconnector construction in the Balkans and rising liquid natural gas capacity have reduced prices and increased competition. The landscape is very different from that when TCP was first envisaged,” said William Powell, editor in chief of Natural Gas World.

In short, Turkmen gas would face strong competition for customers in what is currently a declining market dominated by Russia’s Gazprom.

In addition, because TAP is being developed under EU rules that require the pipeline to be open to any suppliers, Gazprom could fill any extra capacity, thus leaving Turkmen gas with no route to European markets.

Even if European gas markets eventually recover, Turkmen gas would still be more likely to be sold, in fact, in Azerbaijan. “Azerbaijan has committed so much gas for exports that it can’t keep pace with domestic demand,” said John Roberts, an independent consultant specializing in Caspian energy issues.

“And with the next big investment in Azeri upstream not likely for another eight to 10 years, the only source available is Turkmen,” Roberts said.