The Irtysh is the longest transboundary tributary river in the world. It flows through the territories of Kazakhstan, Russia, and China, which gives it important strategic significance as a connecting link in maintaining its ecological balance, as well as in its potential use for international transit logistics. Together with the Ob River, the Irtysh connects the transport corridor of the New Silk Road with the Northern Sea Route, thereby integrating Eurasian transport corridors into the global transport system.

Reserves of River Logistics

According to Kazakhstan’s Ministry of Transport, the waterway along the river could be integrated into a large-scale multimodal logistics project. Currently, navigation on the Irtysh River within Kazakhstan runs for just over 1,600km — from Lake Zaysan to the border point of Klin with Russia. The navigation season lasts an average of 192 days, from April to November. During this period, river transport carried out a significant volume of shipments, ensuring connectivity between the regions of Eastern Kazakhstan, Pavlodar, and the border areas of Russia.

The riverbank infrastructure includes the Pavlodar River Port, which has a handling capacity of up to 650,000 tons per year and a network of 10 permanent berths – Tugyl, Oktyabrsky, Ust-Kamenogorsk, “Irtyshtrans,” “Gravelit,” and others – that can handle up to 10,000 tons of cargo daily. The river fleet used for cargo transportation consists of about 95 vessels, including barges, tugs, and auxiliary units. Ship repair functions are performed by three specialized enterprises in Ust-Kamenogorsk, Semey, and Pavlodar. However, most of the technical base requires major renovation: equipment and structures are heavily worn, and the fleet of vessels is mostly outdated.

The Irtysh basin remains a key cargo-generating region, accounting for more than 90% of the country’s river freight. In 2024, the total volume of river transport amounted to 1.5 million tons, including 296,000 tons of export cargo to Russia.

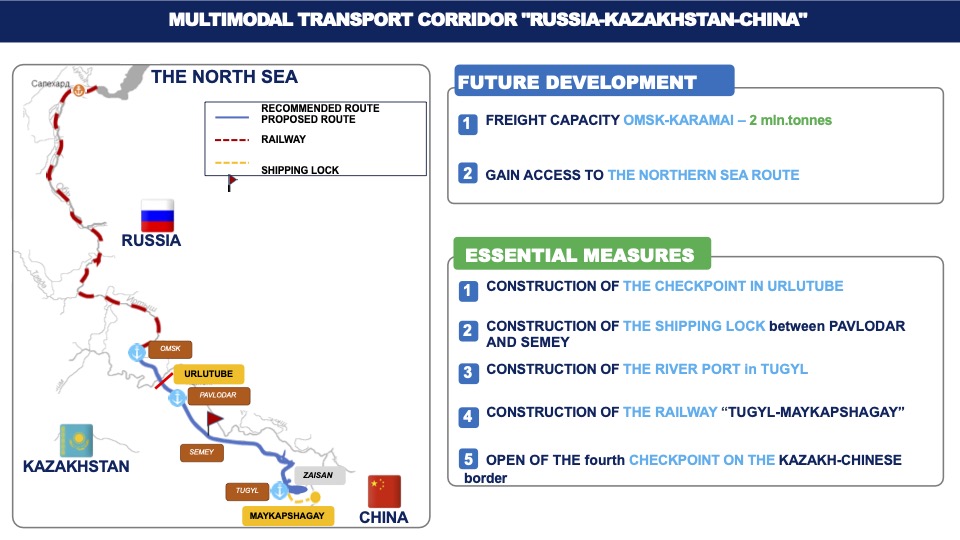

To systematically modernize river transport, in January 2025, a roadmap for the comprehensive development of shipping on the Irtysh River was approved. According to Deputy Transport Minister Maksat Kaliakparov, the main measures include the construction of a new river port in Tugyl, the modernization of existing berths, the purchase of modern transport vessels, the opening of the Urlitobe river crossing point on the border with Russia, and the creation of logistics and multimodal hubs. Plans also include the construction of hydraulic engineering structures, riverbed clearing, and dredging works, which will increase the waterway’s throughput capacity and create conditions for year-round navigation. All this will undoubtedly require significant infrastructure investments, the amount of which, according to the Ministry of Transport, will be specified based on the results of the design and estimate documentation and negotiations with private and foreign investors.

The implementation of these measures opens up opportunities for an even larger project – a multimodal transit corridor between Russia, Kazakhstan, and China, which will involve the movement of ships on the Omsk-Tugyl section with further delivery of cargo by road or rail to China.

One of the key elements of the project being developed by the ministry in Kazakhstan will be the construction of a river port with a transport and logistics center in the settlement of Tugyl, as well as the fourth railway border crossing point with the construction of a new railway line between Tugyl and Maikapchagai.

“If the project is implemented, cargo turnover is expected to grow to 3.5 million tons per year and export routes will be expanded with access to northern seaports,” says Kaliakparov.

Water transport amid climate challenges and growing demand for water

In addition to being environmentally friendly, water transport is characterized by low costs. It is 2-3 times cheaper than rail transport and can be five times cheaper than road transport. However, will the three countries be able to find common ground that will satisfy the needs of their economies when water transport is linked to issues of water resources in the transboundary Irtysh River?

The upper part of the Irtysh basin and its sources are located in China. Given this country’s plans for large-scale development of its western regions, which include the completion of the Black Irtysh-Karamay canal in the Xinjiang Uyghur Autonomous Region (XUAR) to transfer part of the water to the oil field near the town of Karamay, and increasing water withdrawals for agricultural needs due to expansion of cultivated areas, the country plans to actively build canals, reservoirs, dams, hydroelectric power plants, and other hydraulic structures.

Meanwhile, in Kazakhstan, the water resources of the Irtysh and its tributaries provide for the livelihoods of almost 30% of the country’s population. About 45% of the country’s agricultural production is produced within the basin, and the Irtysh cascade of hydroelectric power plants provides 10% of the country’s total electricity generation. For Russia, the water management activities of the countries in the upper reaches of the river – Kazakhstan and China – pose serious challenges for the socio-economic development of the city of Omsk and the surrounding region.

Climate change also contributes to the challenges in maintaining the water balance, which affects the water level of the Irtysh River. Besides the transit waters coming from China, the river is significantly fed by tributaries, snow reserves from the mountains of Eastern Kazakhstan, and precipitation. At the same time, signs of a reduction in the replenishment of groundwater and surface waters are observed. This reduces the predictability and stability of the river’s management and requires a flexible and scientifically sound water management strategy.

To minimize ecological impact, annual studies of the river are conducted, and all work is coordinated with state authorities in the fields of ecology, water resources, industrial safety, and local executive bodies. As part of scientific support, mathematical modeling has been carried out, designs of hydraulic structures have been tested, and environmentally safe dredging technologies have been developed. In addition to transport goals, these measures contribute to restoring the hydro-ecological balance.

Kazakhstan is negotiating with Chinese and Russian partners to restore full navigation on the river and jointly use the transit potential of the Irtysh.

“The Russian and Chinese sides have expressed preliminary interest in participating in the project. Today, together with the Omsk Region’s government, we are working on a pilot voyage along the Omsk-Tugyl route. Discussions are underway with China on the construction of a railway line and the opening of a new border crossing at Maikapchagai-Zimunai, which will provide a direct logistics link with western China,” said Kaliakparov.

The development of river navigation on the Irtysh River for Kazakhstan, in addition to the transit of goods through its territory, will allow a number of regions to cease to be dead ends and join the transit chain in cargo and passenger transportation. The project will give impetus to the development of small and medium-sized businesses, tourism, and other sectors of the economy.

Tourism along the river

The deputy minister notes that passenger excursion shipping on the Irtysh River is gaining significant popularity, especially during the tourist season.

“As you know, the East Kazakhstan region has a unique natural landscape, from mountain ranges to cascades of reservoirs. This opens up great opportunities for river trips, weekend tours, and tourism. The most popular routes are along the Ust-Kamenogorsk and Bukhtarma reservoirs and excursions on Lake Zaisan. A fleet of pleasure boats is being developed in the region, piers are being built, and the range of tourist services is expanding. Small and medium-sized businesses are actively investing in the development of water tourism. In the future, it may be possible to create river tourism clusters that are integrated into interregional routes and included in international tourism programs,” says Kaliakparov.

The development of waterways along the Irtysh River, as well as cross-border tourism and trade, will be facilitated by the construction of two airports in the region – in Zaisan and Katon-Karagai – and the completion of the reconstruction of the Kalbatao-Maikapshagai highway, which together will lay the foundation for the creation of a major tourist and logistics hub.

Overall, the three countries still have considerable work ahead to expand transport cooperation, develop effective water resource management measures that meet shared interests, foster economic integration, and address social and environmental issues while minimizing water deficit risks and ensuring water security.

The proposal to connect Russia and China with a new transport route, which could serve as an alternative to maritime, road, and rail routes, is planned to be discussed at the upcoming meeting of transport ministers of the Shanghai Cooperation Organization in China this July.