ALMATY (TCA) — China’s ambitious plan to install a hardware network, in which rail and road links are crucial, to get its economic clout stretch all across the mega-continent straight to western Europe looks at three main strings: across Siberia in the north, Central Asia in the middle, and the Indian Ocean’s coastal states in the south. Most of the headaches encountered in the process concern the middle route.

On September 6, the president of the International Centre of Border Cooperation Khorgos, Vasiliy Ni, was detained after having been caught red-handed while being handed over a cheque of one million dollars, the Kazakh State Anti-Corruption Bureau announced little later in a press release. The money represented a bribe to make an “investment company” win a tender for the construction of a five-star hotel on the territory of the transit complex on the Kazakh-Chinese border, which is managed by the ICBC. The foiled scheme is thought to have been a kickback.

It is just one more incident drawing attention to the state of lawlessness the states of the former “Soviet belly” have found themselves in ever since the break-up of the USSR. Yet, a sophisticated law control system, along with a profound change in mentality, is exactly what is needed for these states for their trade and industry sectors to fully benefit from China’s master plan and thereby become part of the New Silk Road Belt which is poised to become one the most important global economic developments. Regretfully, hassles and delays at national borders keep hampering the smooth transit gate the Chinese have in mind – and the further south they venture, the bigger they tend to get.

Inconsistencies on the map

The part of Central Asia benefitting most of the northern rail link of China’s network is Kazakhstan. Its first rail link into China located in the central-east dates from 1905, and a second one, which is Khorgos just east of Almaty, in the southeast was completed in late 2013. Both of them link China’s northwestern transport hub of Urumchi to Russia – the northern one to Ufa and the southern one to Orenburg. A high-speed railway line from Moscow to Kazan on the Volga is meant to contribute to the overall east-west fast-track of which Kazakhstan could also benefit.

There is an inconsistency here, though, and it can clearly be seen on the map. A short track of the southern branch of the Trans-Siberian line runs across Kazakh territory (Petropavlovsk in the far north), but it ends on the western side in Samara, not in Kazan, which is a sideline between the northern and the southern branch, with the former leading from Moscow straight to Yekaterinburg, Omsk and further east. If this particular branch “wins” priority in the construction of the high-speed link from Moscow to Vladivostok, it might cost Kazakhstan’s two “gates into China” considerable business loss. Here, the Kazakhs have plenty to be concerned about.

Statistics regarding trade and transportation in the region are not really encouraging. Russia’s transportation sector’s business value was up by 1.4 per cent in the first half of this year as compared with the same period of 2015, and Kazakhstan’s down by 0.1 per cent, according to the CIS Interstates Statistics Committee. Russia exported worth $130.5 billion and imported worth $79.9 billion, down 28.7 and 8.9 per cent on-year respectively. For Kazakhstan, these figures stood at $16.8 billion (down 31.7%) and $11.25 billion (down 28.4%).

Kazakhstan’s railway crunch

But there is a profound difference in corporate performance behind all this between the national railway corporations of China and Russia which manage their balance sheets in a rational way and those of Central Asia’s national railway companies. Thus, Kazakhstan’s national railway company Kazakhstan Temir Zholy (KTZ) saw its revenue and profits plummet through the year 2015, resulting in a net loss of more than 17 billion tenge (close to half a billion US dollar according to current exchange rates) in the first quarter. Profits were subsequently restored to nearly 74 billion tenge over the first half of the year, but the deeper causes for the corporate slump remain in place, according to observers.

Looking for investors

The immediate reason for the move was a “state-orchestrated” bond issue (meaning that the state bought the bulk of the paper) to cope with the enterprise’s threatening default on a loan provided by the European Bank for Reconstruction and Development. The company’s liquidity position have thus been saved, but Moody’s as well as other rating agencies tend to stress that KTZ remains overleveraged and that its mid-term payables exceed its receivables by up to eight times. To improve KTZ’s liquidity, the government plans to sell half of the shares minus one vote of its subsidiary KazTemirTrans which owns all the rolling stock to an investor which has yet to be identified but clearly points in the direction of China.

But it is far from sure whether the Chinese are ready for it. Urumchi is China’s only logistic hub both to Kazakhstan and, eventually, the rest of Central Asia. Only one line links it to the dense and well-developed network of northeastern China. A parallel route crossing the existing line to Tibet to the southeast of China only exists on paper – most of all since the terminal of China’s utmost-western town of Kashgar remains a dead end and also leads to Urumchi.

China is faced with a complex of planning problems compared to which the issues concerning Kazakhstan look simple.

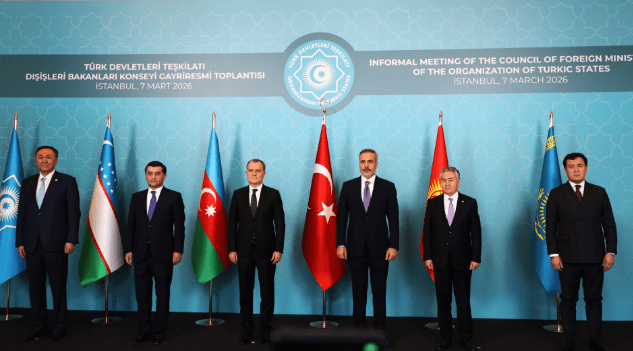

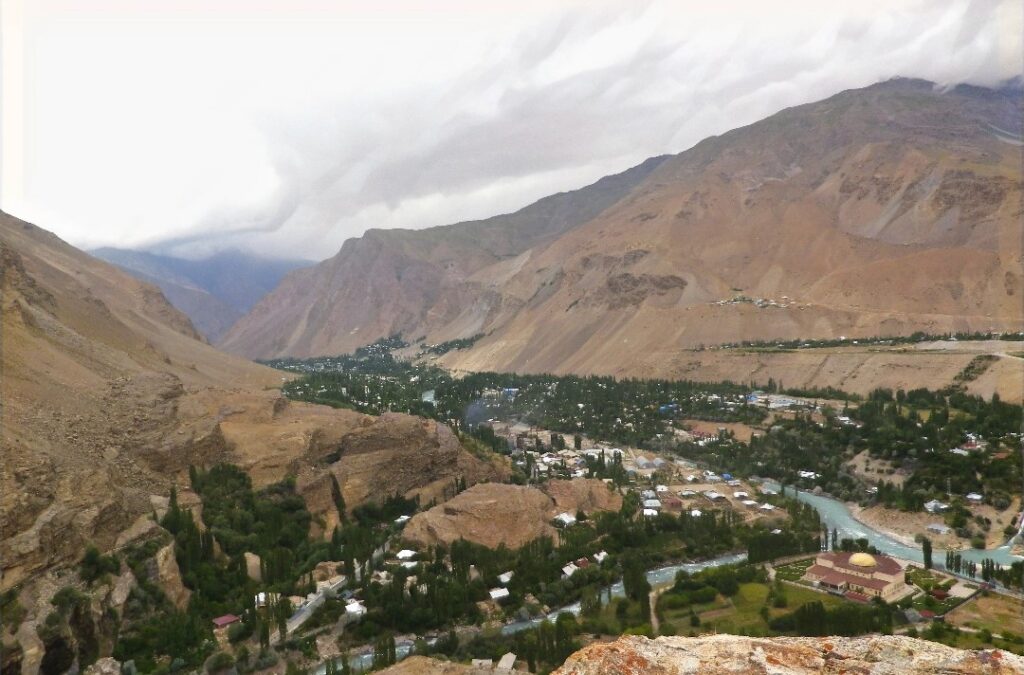

This is the second part of a series of articles focusing on railway projects connecting China, Central Asia, Russia, and Europe. The first article can be read here. The third article will focus on railways across Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan.