How Tokayev’s Kazakhstan Bridges Global Powers

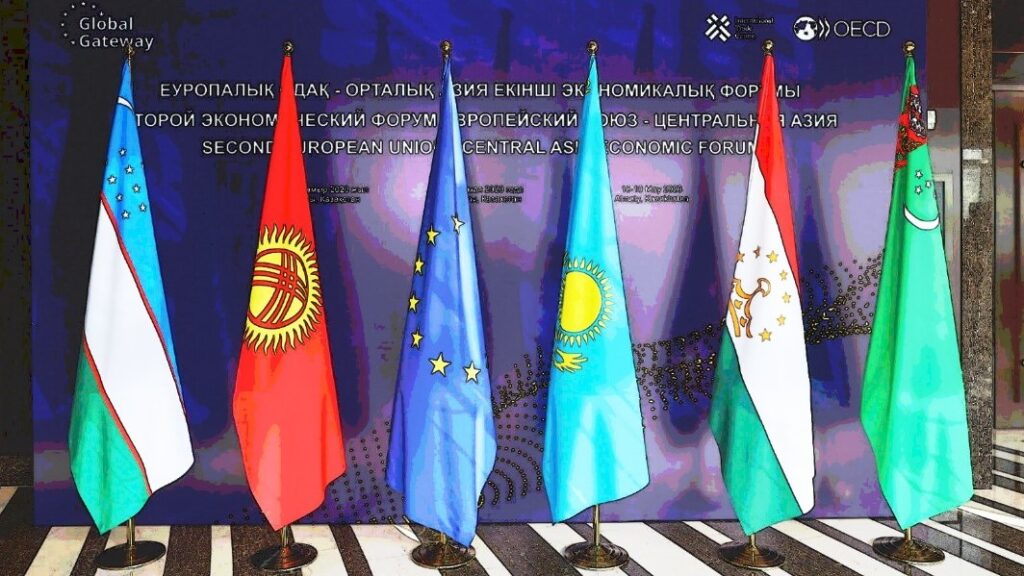

Amid the ongoing reshaping of the global order, Kazakhstan is seeking to enhance its role as an emerging middle power. Preserving strong relations with all key geopolitical actors, strengthening its position as a de facto leader in Central Asia, and developing closer ties with other influential states on the world stage appear to be Astana’s top foreign policy priorities. The largest Central Asian state is one of the few countries that maintains good relations with geopolitical rivals such as China and the United States, as well as Russia and the European Union. At the same time, Astana is actively developing closer ties with the Turkey-led Organization of Turkic States, while firmly upholding its longstanding commitment to international law. It is, therefore, no surprise that, during the recently held EU- Central Asia summit in Samarkand, Kazakhstan, along with Turkmenistan and Uzbekistan, backed two UN resolution from the 1980s that reject the unilaterally-declared independence of the Turkish Republic of Northern Cyprus and deem all secessionist actions there legally invalid. Such a policy perfectly aligns with Kazakhstan President’s Kassym-Jomart Tokayev’s 2022 statement, in which he affirmed Astana’s non-recognition of Taiwan, Kosovo, South Ossetia, or Abkhazia, and the entities he described as quasi-states, namely Luhansk and Donetsk. “In general, it has been calculated that if the right of nations to self-determination is actually realized throughout the globe, then instead of the 193 states that are now members of the UN, more than 500 or 600 states will emerge on Earth. Of course, it will be chaos,” Tokayev stressed. In other words, Kazakhstan upholds the principle of territorial integrity for all UN-member states, a stance similar to China’s policy. Despite their history of often supporting the right to self-determination over the principle of territorial integrity, Russia and the West do not seem to oppose Tokayev’s approach. As a result, the President of Kazakhstan remains one of the few world leaders who can attend the May 9 Victory Day parade in Moscow, regularly meet with EU officials, and participate in China-led initiatives. As the first Central Asian leader to speak with newly elected U.S. President Donald Trump in December 2024, Tokayev is also signaling his intention to deepen relations with the United States. All these actions demonstrate that, for Kazakhstan under Tokayev, the well-known multi-vector foreign policy remains without an alternative at this point. Although it is Nursultan Nazarbayev, Kazakhstan’s first president, who initiated this approach, it is Tokayev who has been actively implementing it since he came to power in 2019. That, however, does not mean that "multivectorism" has become Astana’s official ideology. It is rather a tool the energy-rich nation’s policymakers are using to improve their country’s position in the international arena. Nowhere is that more obvious than at the Astana International Forum – an annual summit taking place in Kazakhstan’s capital – where leaders from diverse countries, often with differing goals and values, come together to discuss global challenges, foster dialogue, and seek common ground. The fact that this year Astana will host...