BISHKEK (TCA) — On February 25, Prime Minister of Kyrgyzstan Sooronbai Jeenbekov congratulated a Bishkek secondary school teacher, Saiqal Sadirova, who is a participant of the Government’s Affordable Housing 2015-2020 program.

Due to her 1.5 million som mortgage loan, borrowings from the State Mortgage Company have exceeded one billion soms, the Government’s press service said.

Over less than a year, the State Mortgage Company has issued mortgage loans totaling one billion soms, a great achievement for the rapidly developing state company which is a pioneer in mortgage lending in Kyrgyzstan, Jeenbekov said.

Encouraging results

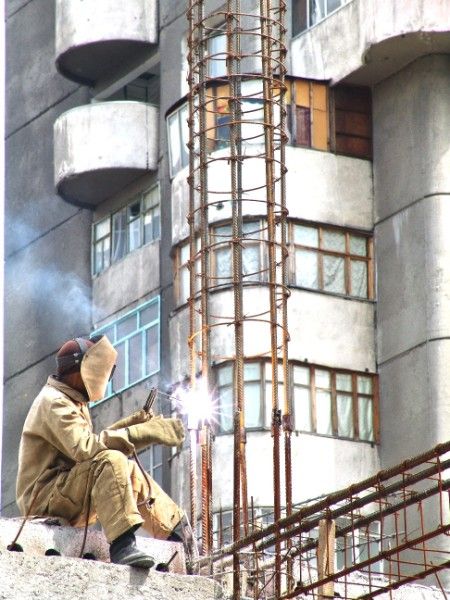

After a downturn, the construction business is booming in Kyrgyzstan. In January 2017, 38.5 thousand square meters of housing were commissioned, which is 1.6-fold more compared to the same month of 2016, the National Statistics Committee said.

According to preliminary estimates, 617.8 million soms were invested in the construction of housing in January 2017, which is 1.4-fold more than in the same period last year. More than 22% of the total amount was invested in individual housing construction (16.4% in January 2016).

Most of individual housing (75.4%) was built in Bishkek and Jalal-Abad, Osh and Chui oblasts, mostly in rural areas (63.4%).

Affordable housing program

The State Mortgage Company was established in 2015 to construct social housing and provide better functioning of the mortgage lending mechanisms to implement the government’s Affordable Housing program. The program aims to create conditions for public sector employees to solve their housing problems through mortgage lending to purchase housing in the primary or secondary markets and construction of economy-class housing.

Mortgage loans are issued for the purchase of ready housing, the construction of individual houses and economy-class apartments. To repay mortgage loans, borrowers should have stable monthly earnings of 17-20 thousand soms for ten years.

However, Kyrgyz parliament members say that school teachers, medical doctors, state and municipal employees complain that their salaries can not afford obtaining mortgage loans at interest rates of 10-12% per year.

As of August 12, 2016, about 4,680 people had applied to the State Mortgage Company, but about 50% of them had withdrawn their loan applications.

Civil servants who get a loan for 15 years will overpay 1.5- to 2-fold, MPs said. For instance, a two-bedroom apartment in Bishkek costs 2 million soms, while the participants in the state mortgage program will pay 4 million soms. MPs advised local banks to change the calculation formula for the mortgage loans, to make them social, not commercial.

Among those who refused from mortgage loans were people who were included in the first list. They were not prepared to repay loans, and there were people from vulnerable groups who could not afford the mortgage, the State Mortgage Company explained. The most recent lists were prepared more efficiently and there are currently few participants that refuse from the program.

From February 1, 2017, the State Mortgage Company has simplified the conditions for obtaining loans for individual housing construction.

Previously, the loans for housing construction were issued at 14% per annum for the first 18 months, with initial payment of 20% of the loan. After completion of construction and the building’s commissioning, the rate will be 10% per annum. Loans are issued for up to 3 million soms for up to 15 years.

Plans

According to the State Mortgage Company, a tender for the construction of apartment houses in the Naryn, Batken, and Jalal-Abad provinces will be announced in the near future as part of the State Mortgage program. Mortgage construction is planned in all regional centers.

According to the project, 5-storey buildings will have 60 apartments each, including one-room and two-room ones. The monolithic houses with brick filling will be offered to the program participants on a turnkey basis, so that they could immediately live in them. The cost of one square meter of the new housing should not exceed 40 thousand soms.

The Mortgage Company’s capital worth 319 million soms is the main source of funding of the program. It is also planned to allocate 2.5 billion soms from the state budget for ten years.

The Mortgage Company is also considering attracting long-term borrowed funds from institutional investors through the issuance of mortgage bonds. Houses and apartments under construction, or mortgages sold at the Kyrgyz Stock Exchange, could be used as collateral for banks.