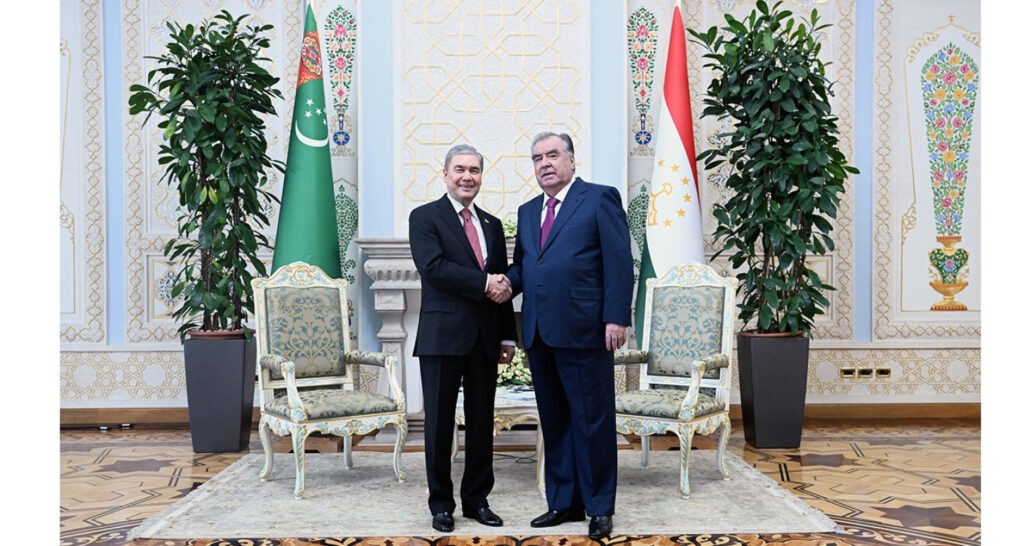

Despite loud statements and reports, alternative routes for transporting oil from Kazakhstan and Central Asia to Europe remain only intentions. The desire of the EU to diversify its hydrocarbon suppliers is running into internal bureaucracy and a lack of understanding of how things work in Central Asia, which is in fact seeking to ship its energy in different directions. Lost gas To start, it is worth recalling the Turkmenistan-Russia gas dispute of 2009. Before that, Gazprom bought gas from Central Asian countries at the border, swapping some volumes of domestic supplies with Kazakhstan, Turkmenistan and Uzbekistan, and buying gas at prices lower than EU export rates. Gazprom explained this practice rather simply: there is no economic sense in transporting the gas through Russian territory, so at the border the price cannot be European (minus transportation) – this gas was consumed in Russia or supplied at preferential prices to Ukraine, while Russian gas was sent to Europe. In 2008, Turkmenistan produced 70.5 billion cubic meters (bcm) of gas, exporting 47 bcm, with an increase in production and exports planned for 2009. According to the Energy Institute, gas consumption by European countries in 2022 amounted to 498.8 bcm, meaning Turkmenistan alone, assuming export volumes stabilized at 50 bcm per year, could cover 10% of Europe’s needs. That amount, 50 bcm of gas, is the annual consumption of Switzerland, Sweden, the Czech Republic, Greece, Portugal, Slovakia, Slovenia, Bulgaria, Croatia, Denmark, Estonia, Finland, Ireland, Latvia, Lithuania, Luxembourg, Norway and North Macedonia combined. However, Turkmen gas would never reach Europe. When an agreement on the volumes and prices of gas purchases by Gazprom failed to be reached, 15 years ago, on April 9, 2009, there was an explosion and fire on the eastern branch of the Central Asia-Center (CAC) gas pipeline, at CAC-4. Subsequent negotiations to resume the transport of Turkmen gas between Russian President Dmitri Medvedev and Turkmen leader Gurbanguly Berdimuhamedov, which took place in September 2009 in Moscow, could not resolve the dispute. All these years, the media and European leaders have been talking about building the so-called Nabucco gas pipeline, which was to go from Central Asia, along the bottom of the Caspian Sea, through Azerbaijan and on to Germany and Austria. Its design began back in 2002. Note that by 2009, had the project been energetically implemented, Nabucco could have been built and the first deliveries would have begun. In 2022, gas consumption in Germany and Austria amounted to 77.3 bcm and 7.9 bcm, respectively, meaning supplies from Central Asia could cover at least half of their needs. This seemed like the perfect opportunity for a large-scale gas pipeline. The Central Asian countries wanted to supply gas to Europe via alternative routes, receiving European prices for their commodities, and Europe could have significantly diversified its gas imports. Another player, however, was closely watching Europe’s red tape and indecision – China. Hidden dragon China understands how to work with Central Asia, and in 2007 construction of the first line of...