Uzbekistan and China have significantly expanded their bilateral relationship in the last month. The meeting between Presidents Shavkat Mirziyoyev and Xi Jinping on June 17, 2025, in Astana, during the second China–Central Asia Summit, formally endorsed what both states termed a “multi-dimensional strategic partnership.” The occasion marked the conclusion of bilateral negotiations on Uzbekistan’s accession to the World Trade Organization. This membership is both procedural and symbolic, as it signals Uzbekistan’s intensifying participation in global economic architecture. In particular, it serves to legitimize the country’s market-opening reforms in the eyes of international partners.

Strategic Dialogue and the Evolution of Political Ties

The June 2025 summit meeting built upon groundwork laid during Mirziyoyev’s January 2024 state visit to China, when a suite of agreements were reached that catalyzed the creation of a Strategic Dialogue between the two countries’ foreign ministries. A year later, in January 2025, this was formally upgraded to an “all-weather comprehensive strategic partnership”.

This phrase signifies that the dialogue was acquiring operational substance in the form of diversified sectoral initiatives spanning infrastructure, innovation, security, and energy. For Uzbekistan, this initiative marks a sustained effort to define itself not only as a recipient of foreign capital but as a co-architect of regionally significant configurations.

Trade and investment data point to a structurally intensifying relationship. Bilateral trade stood at $14 billion in 2024, up from $13 billion the previous year, with both sides aiming for $20 billion in the near term. As of February 2025, 3,467 Chinese firms were active in Uzbekistan, an increase of over 1,000 from the prior year. However, the $9.8 billion trade deficit in China’s favor remains politically sensitive, highlighting asymmetries even as cooperation deepens.

Sectoral Investment and Institutional Coordination

A joint investment portfolio exceeding $60 billion undergirds this integration. Key projects include special economic zones, technoparks, and localized production of BYD electric vehicles. The sectoral spread extends to renewable energy, mining, logistics, metallurgy, pharmaceuticals, and smart agriculture. Financial institutions such as the Silk Road Fund and China Eximbank are underwriting emblematic initiatives, including the Olympic Village in Tashkent. On June 28, 2025, Uzbekistan’s Deputy Minister of Investments, Industry and Trade met with Chinese leather industry representatives to coordinate manufacturing projects in Andijan and Ohangaron.

These dynamics were further institutionalized at the Uzbekistan–China Interregional Forum held June 1–2, 2025, in Samarkand, where Uzbekistan’s Deputy Prime Minister Jamshid Khodjaev emphasized that Chinese investment has increased fivefold since 2017. Although this was technically a regional event, it reinforced — as a public-facing moment of alignment between central planning and international economic engagement — a national-level policy architecture receptive to external capital, particularly from China.

Infrastructure and Energy

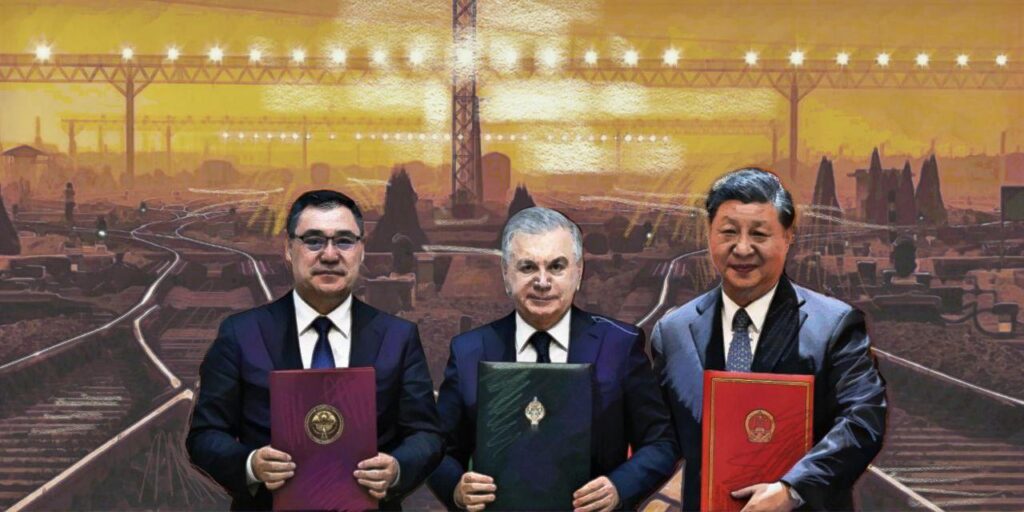

At the infrastructural core of bilateral cooperation stands the China–Kyrgyzstan–Uzbekistan (CKU) railway. Both presidents re-emphasized the project’s strategic relevance, identifying it as essential to transcontinental logistical continuity from East Asia to Europe. The project has not only economic but also geopolitical significance, situating Uzbekistan as a connective node rather than a peripheral conduit. If completed on time, it may also reduce Uzbekistan’s dependency on northern or western transit corridors.

Uzbekistan’s natural gas exports to China saw a substantial increase of over 60% year-on-year in the first five months of 2025. According to official data from Uzbekistan’s National Statistics Committee, gas exports to China reached $288 million between January and May 2025. Interestingly, physical volumes have not been officially reported or unofficially hinted at. Based on typical regional prices, however, a reasonable estimate of quantities would be 1.0–1.5 billion cubic meters (bcm), or an annual rate of 2.4–3.6 bcm. This development reinforces the dual commercial and energy linkages that increasingly characterize the bilateral channel.

China’s expanding role in Uzbekistan’s energy sector now also includes a strategic shift toward green infrastructure and technological modernization. Since 2023, Chinese state and private enterprises have committed to over 5,000 megawatts (MW) of new solar and wind capacity in Uzbekistan, including flagship facilities in Andijan, Karakalpakstan, and Jizzakh. Uzbekistan’s Atomic Energy Agency is also in exploratory talks with China National Nuclear Corporation to deploy small modular reactors and expand uranium production, signaling a long-term alignment on low-carbon energy strategies.

Human Mobility and Soft-Power Engagement

Effective June 1, 2025, a mutual 30-day visa-free regime was implemented for citizens of both countries. Announced by Foreign Ministers Wang Yi and Bakhtiyor Saidov, the policy aims to facilitate not just tourism and business but also people-to-people connectivity. The agreement is expected to normalize short-term mobility for professionals, students, and cultural figures. In this connection, Beijing has established a branch of Northwest Agricultural and Forestry University and the International Mathematics Center with Peking University in Uzbekistan.

Public sentiment within Uzbekistan remains, nevertheless, cautious. A mid-June 2025 incident in which a local official appeared to suggest farmland transfers to Chinese investors ignited controversy. The Ministry of Agriculture swiftly denied any such transactions, but the viral video triggered a broader reaction over land sovereignty and, by extension, economic dependency. These concerns are not new but have gained visibility as China’s economic footprint expands. Tashkent has sought to manage public discourse with narratives emphasizing national benefit and regulatory oversight, all while denying the reports. While elite consensus remains favorable toward Chinese investment, societal perception introduces an enduring constraint, shaping how far and how fast integration can proceed without risking political backlash.

Beyond trade and infrastructure, the relationship is being expanded to issue areas of human and social development. The two governments have pledged cooperation on poverty reduction initiatives, aligning with Uzbekistan’s domestic policy agenda. Coordination in smart agriculture, logistics, and green energy development has also been framed as a long-term platform for mutual benefit. Whether such diversification will insulate the relationship from any geopolitical shocks remains uncertain, but the effort to institutionalize its breadth is evident.

Balancing Growth and Sensitivities

Uzbekistan and China have consolidated a high-density bilateral relationship, combining formal diplomatic upgrades with tangible projects and policy coordination. The July 2025 milestone of mutual visa liberalization and expanding logistical access serves as both a signal and substance of this convergence. However, structural asymmetries and public sensitivities temper the otherwise smooth trajectory.

The Uzbek government must now navigate between the material benefits of Chinese capital and the symbolic costs perceived domestically. Going forward, the pace of implementation, particularly of the China–Kyrgyzstan–Uzbekistan railway, and the durability of public consent will serve as bellwethers for the sustainability of this accelerated bilateralism. Much will hinge on whether economic gains are sufficiently distributed to justify the strategic momentum.