The Times of Central Asia presents the second part of an interview in Washington, D.C. with Eldor Aripov, Director of the Institute for Strategic and Regional Studies under the President of Uzbekistan. Dr. Aripov sat down with our Washington Correspondent, Javier M. Piedra, to discuss Uzbekistan’s geoeconomic and geopolitical strategic thinking.

The conversation focused on Uzbekistan’s and the region’s efforts to cooperate diplomatically to maintain peace and stability with neighbors, irrespective of historical “hotspots,” cultural sensitivities, or the all-important matter of water resources. Aripov comments on Afghanistan, Chabahar Port (Iran), Ferghana Valley, and business development – key for U.S. investors thinking about Uzbekistan and the broader Central Asian region.

TCA: What message do you have for businesses and private investors who do not have any experience in Central Asia? Many companies are sniffing around at this time – what do you want to tell them?

Aripov: Uzbekistan is ready for committed investors – those who deliver lasting benefits, quality jobs, and shared prosperity. A decade of reforms has strengthened our fiscal discipline, boosted SMEs, and anchored stability. Coupled with our focus on good relations and a secure, integrated Central Asia, we offer a reliable platform for long-term, sustainable investment. While we have more work to do, we invite you to be part of our momentum.

TCA: What are the risks that companies might face when considering long-term investment?

Aripov: No country is immune to downside risks – not only in the developed but developing world. Having said that, downside risks, including trade shocks, commodity price volatility, tighter external financing, and contingent liabilities from state-owned enterprises, are mostly exogenous factors driven by global conditions. Risks are mitigated through political stability, diversification of the economy, prudent macroeconomic management, and reforms to state-owned enterprises and governance. For more in-depth commentary, I refer you to recent IMF, World Bank, and Asian Development Bank assessments about our economic conditions and trends.

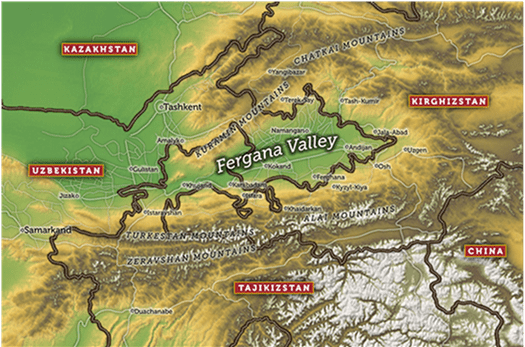

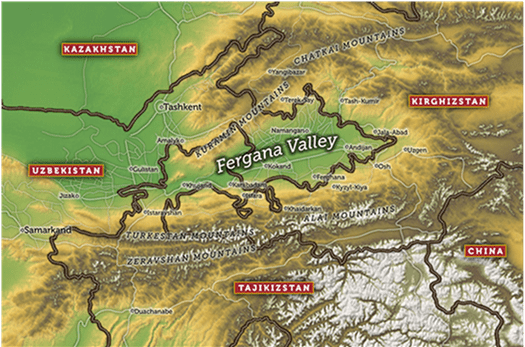

TCA: Let me move on to more regional issues. The first Ferghana Peace Forum was held in October 2025. How can it serve as a replicable model for other regions seeking sustainable peace?

Aripov: First of all, I’d like to put this important forum on everyone’s radar. I’d like to underscore that peace is possible when hard work, respect for others, and a commitment to understanding guide our actions, despite historical memories and past differences. Someone should write a case study about our ability to bring consensus into an otherwise challenging region.

In any event, the inaugural Ferghana Peace Forum brought together over 300 participants from more than 20 countries — representatives of Central Asian governments, international organizations, leading think tanks, research institutions, and local communities. A joint communiqué was adopted, confirming the intention to institutionalize the Forum as a permanent platform with rotating hosts.

This broad participation highlighted an important reality: the Ferghana Valley is no longer viewed as a fragile zone; it is now viewed as a model of pragmatic peacebuilding. The Forum demonstrated how regional leadership — particularly the openness and good-neighborliness promoted by President Mirziyoyev — has transformed a once-sensitive area into a space of trust, connectivity, and shared development.

The uniqueness of this experience lies in its practicality, i.e., success was a function of being able to reach a practical, verifiable compromise acceptable to all parties.

The Ferghana model is built on concrete agreements and workable mechanisms: open borders for people and trade; joint resource management, including water; and continuous dialogue among governments, experts, and communities. This approach addresses the root causes of conflict by creating tangible economic benefits and predictable relations among neighbors. It also allows for dialogue to resolve differences when they may arise.

Image: Silk Road Research, Ferghana Valley

TCA: But you would agree that without political will, success is largely ephemeral, right?

Aripov: You are correct, but, fortunately, here in Central Asia, there is, without a doubt, the political will. Maybe our success in bringing peace to the Ferghana Valley is a result of our practicality. Central Asian leaders have chosen cooperation over competition, consensus over unilateral actions, and development over tension — reviving a historical “code of harmony” that shaped the Ferghana Valley for centuries. The Forum amplified this reality by giving a platform not only to officials and experts, but also to women and youth initiatives, emphasizing that sustainable peace grows from the bottom up.

The model shows that peace is achievable when countries focus on interdependence rather than dividing lines. It demonstrates that even deep-rooted challenges — border disputes, resource competition, social fragmentation — can be resolved through sustained political dialogue, shared economic incentives, and inclusive participation.

TCA: When and where will the next forum take place, and what ideas are being considered to make the agenda more substantive?

Aripov: Preparations for the next Forum are underway, with several cities in the Ferghana Valley — including Khujand and Manas — being considered. Consultations with Kyrgyz and Tajik partners are ongoing. The next meeting will be even more results-oriented, with expanded discussions on transboundary clusters in logistics, agriculture, water resources, and digital technologies. A special focus will be placed on youth, education, and local initiatives. The idea of introducing the “Ferghana Principles” – good neighborliness, equality, and mutual respect – as a conceptual framework to support other fragile regions is also being explored.

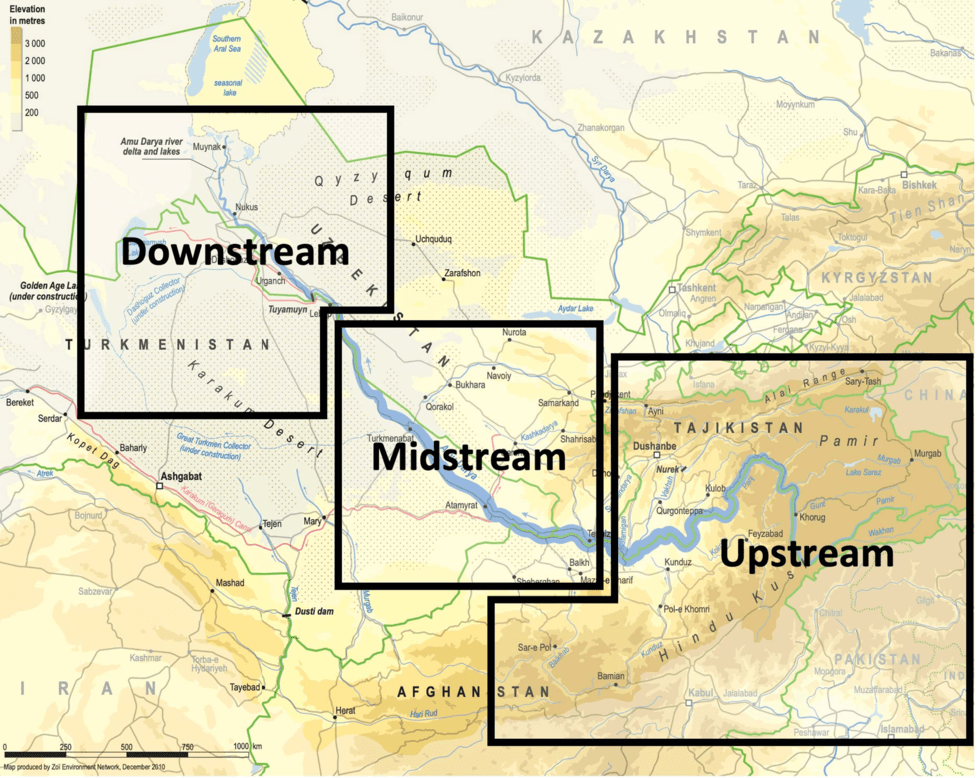

TCA: Water management issues remain complex. Many fear that Afghanistan’s 285-km Qosh-Tepa Canal – a priority project for the Taliban-run government of Afghanistan – will divert a significant portion of the Amu Darya River – the largest river in Central Asia – and reduce water inflows into Uzbekistan and Turkmenistan. How is your dialogue with Afghanistan progressing?

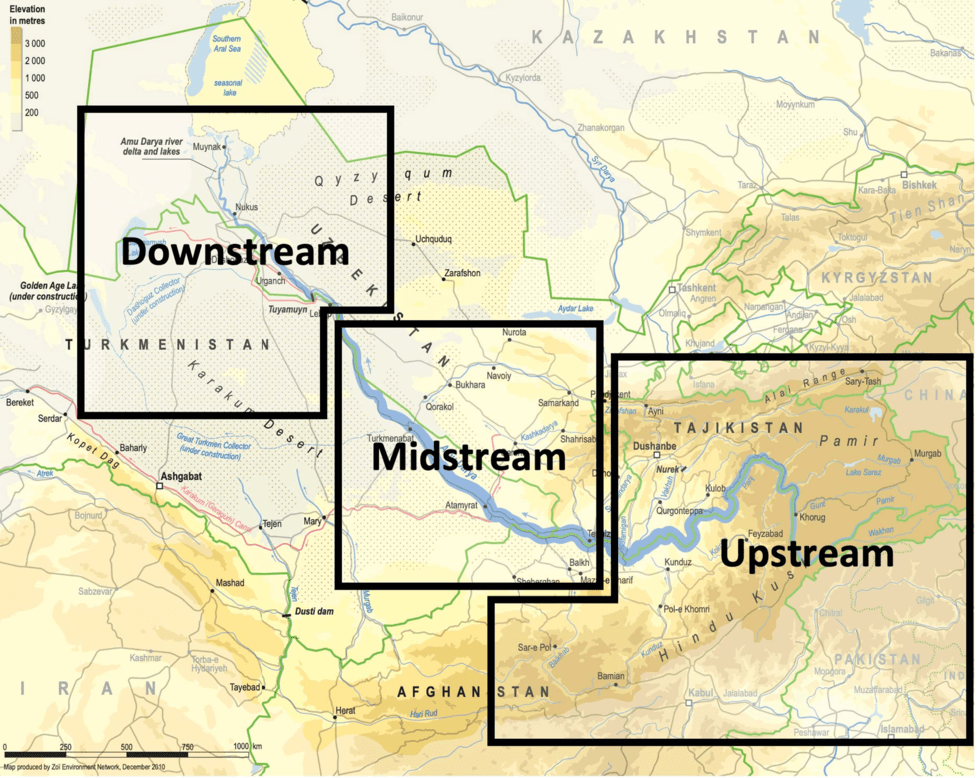

Aripov: Concerns regarding the Qosh-Tepa Canal are understandable. The Amu Darya basin is already under pressure from climate change, population growth, and rising irrigation needs. Experts are worried that “too much” water removal from the river – remember that Uzbekistan and Turkmenistan are downstream – affects the entire regional ecosystem, agricultural landscape, and community relations. This is a delicate issue, but one that is being addressed calmly and responsibly.

Uzbekistan has chosen a principled, forward-looking approach — prioritizing dialogue, cooperation, and mutual understanding with Afghanistan. We believe in common sense and diplomacy.

President Mirziyoyev has repeatedly emphasized that stability and predictability in the Amu Darya basin are impossible without Afghanistan’s involvement as a full-fledged partner in negotiations and in the region. Uzbekistan was the first country in the region to initiate structured consultations with Kabul on water management.

The livelihoods of millions — farmers, rural communities, and entire sectors — depend on the stability and predictability of water flows. For this reason, we advocate a science-based approach, transparency in water usage, and its equitable and fair distribution. Domestically, we are accelerating the adoption of modern irrigation, water-saving technologies, and digital monitoring. We want to lead by example, and that is why responsible stewardship begins at home.

The broader stability of Central Asia will depend on how effectively the region engages Afghanistan, which is recovering from years of instability. President Mirziyoyev’s position has been consistent and well-received: only dialogue, mutual interests, and the gradual institutionalization of cooperation can preserve the Amu Darya as a vital artery for all.

Towards this end, an important step to reaching mutual understandings was the International Conference on Water Diplomacy held in Tashkent on 10 April 2025, where Afghanistan participated with a high-level delegation and expressed readiness for constructive engagement. Discussions are ongoing, and we have every expectation that issues regarding water usage will be addressed to the benefit of all.

Map of the Amu Darya River; image: Zoi Environment

TCA: Uzbekistan and Afghanistan maintain relations at the ambassadorial level. Why does Uzbekistan view the integration of Afghanistan into Central Asian processes as a positive step for security and economic development?

Aripov: As I alluded to earlier, for Uzbekistan, Afghanistan’s integration into regional processes is not an abstract geopolitical concept — it is a practical question of security and development.

Our position rests on a simple principle: The more isolated Afghanistan is, the higher the risks for Central Asia; the more it is included in regional mechanisms, the more stable the region becomes.

From a security perspective, Uzbekistan believes that vacuums generate threats. When a country lacks economic opportunities, international partnerships, and pathways to integration, conditions arise for radicalization, illegal migration, and narcotics trafficking. This is why involving Afghanistan in transport, energy, and trade projects is not a gesture of goodwill but a strategic investment in shared stability.

Economically, Afghanistan remains the shortest route to the ports of the Indian Ocean. Access to these markets reduces transport distances, lowers cost structures, and increases the competitiveness of Uzbek exports — all central to our diversification strategy.

Most importantly, regional thinking is changing. Central Asian leaders declared in Tashkent recently that Afghanistan is historically, culturally, and economically part of our region.

Uzbekistan’s approach has been not only consistent but optimistic: integrating Afghanistan is possible and will reduce risks that lead to instability. Integration will create new economic opportunities and strengthen interdependence — the foundation of a resilient region. A stable Afghanistan means a stable Central Asia, and Uzbekistan is playing an active role in this process.

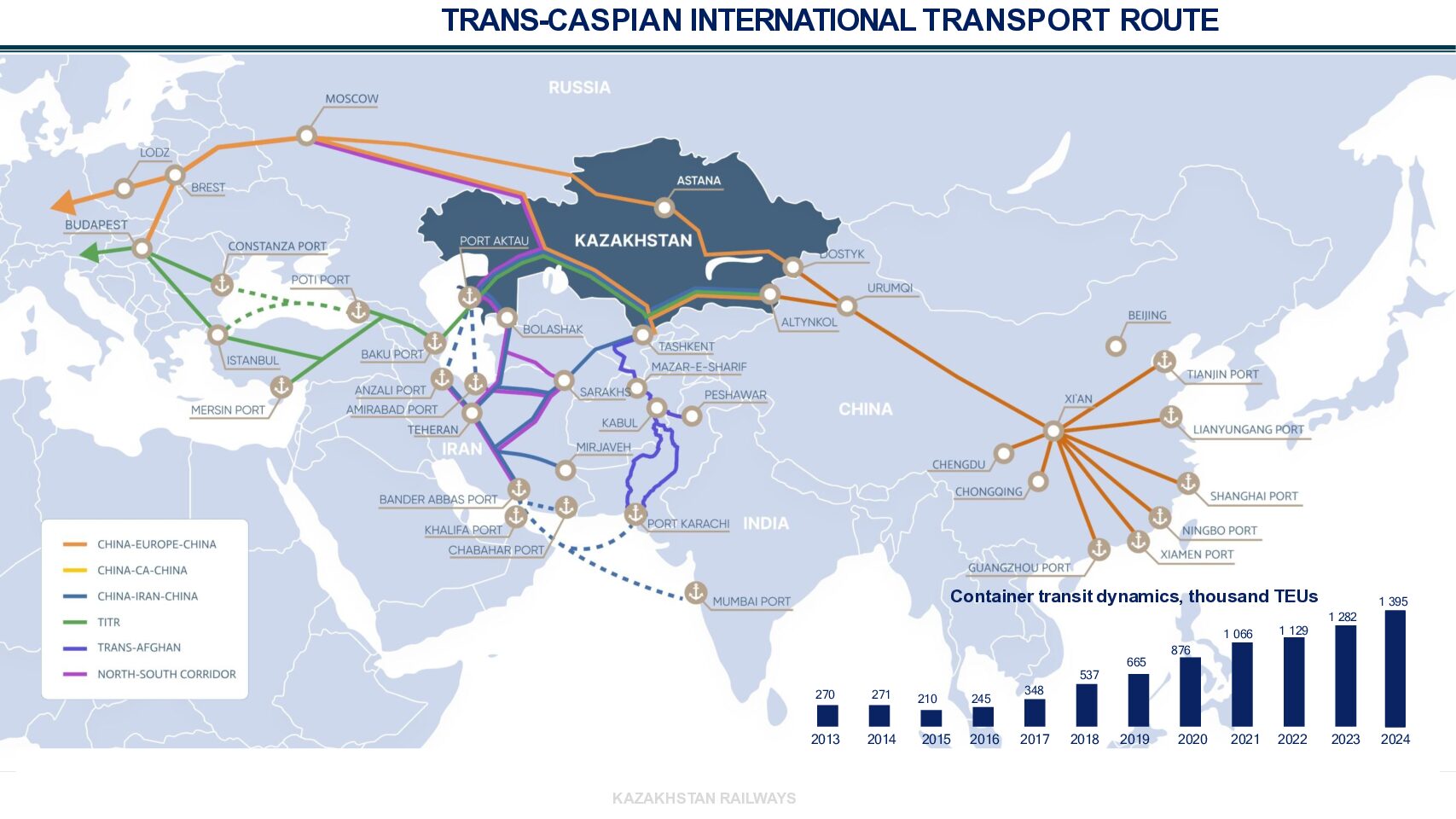

TCA: India has signed a 10-year agreement for the management of the Chabahar port. Assuming the U.S. does not cancel its sanctions waiver on the use of the port, how do you assess the importance of Chabahar for Uzbekistan’s trade flows alongside the Middle Corridor?

Aripov: For Uzbekistan, the question has never been “either–or.” For a double-landlocked country, every new route is not merely an economic advantage but an element of national resilience.

India’s decade-long agreement, the reopening of its embassy in Kabul, and the U.S. sanctions waiver all signal that Chabahar will remain operational and connected to global markets. This is critical for us: predictability and long-term guarantees are the key factors for investors, exporters, and logistics operators.

Chabahar complements — rather than replaces — the Middle Corridor, the Trans-Afghan route, and our growing network of logistics links with the Gulf states.

Together, these routes form an architecture of connectivity that reduces transport costs, expands export geography, and strengthens economic independence.

There is also a geopolitical dimension: the more connected Central Asia becomes with different regions, the more stable and predictable it is. This fully aligns with President Mirziyoyev’s vision of Central Asia as an open, integrated, and dynamic region.

For part one of our interview with Dr. Eldor Aripov, click here.