Kazakhstan’s railways are modernizing with a U.S. supplier, while Kyrgyzstan and Uzbekistan are advancing a new trans‑mountain link with China. On September 22, 2025, Wabtec and KTZ announced a multi‑year locomotive and services package worth about $4.2 billion, described by the company as its “largest” agreement. In parallel, China, Kyrgyzstan, and Uzbekistan formalized a joint company to build the long-planned CKU railway, with China holding a 51% stake.

Central Asia’s rail networks are thus being reshaped by two major partnerships – one with the United States and one with China. Rather than a zero-sum rivalry, these projects show how regional governments are pursuing different infrastructure strategies to expand connectivity.

Kazakhstan and Wabtec: Modernizing an Existing Network

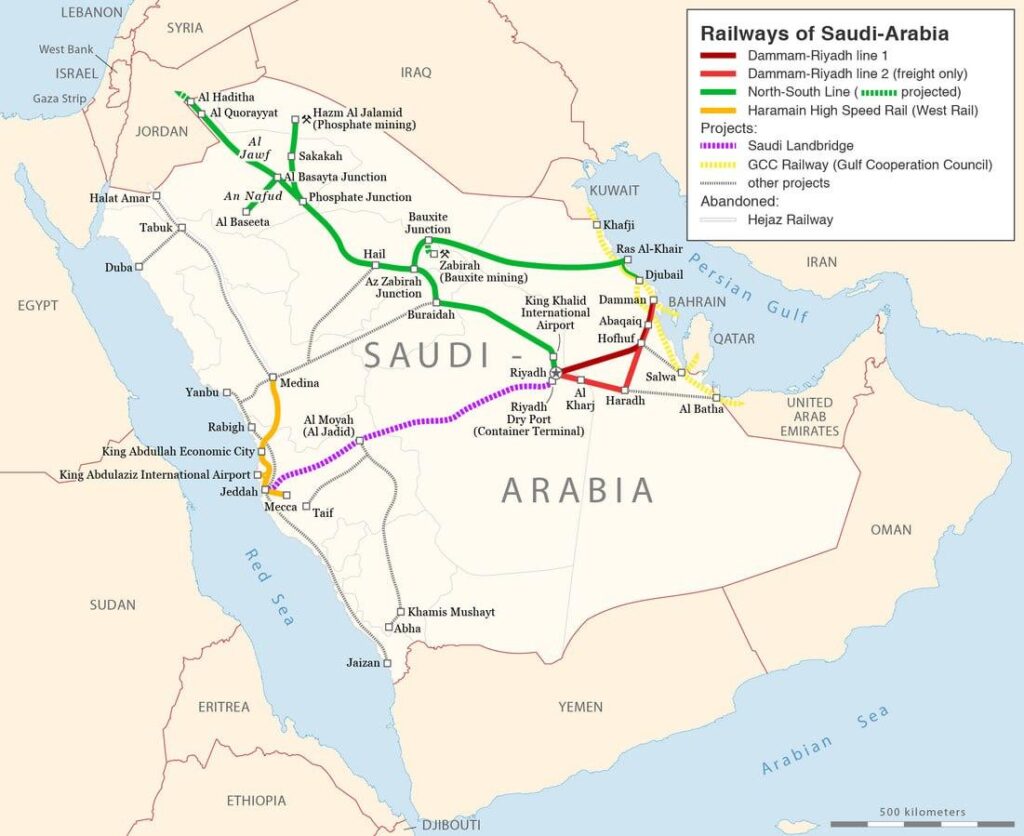

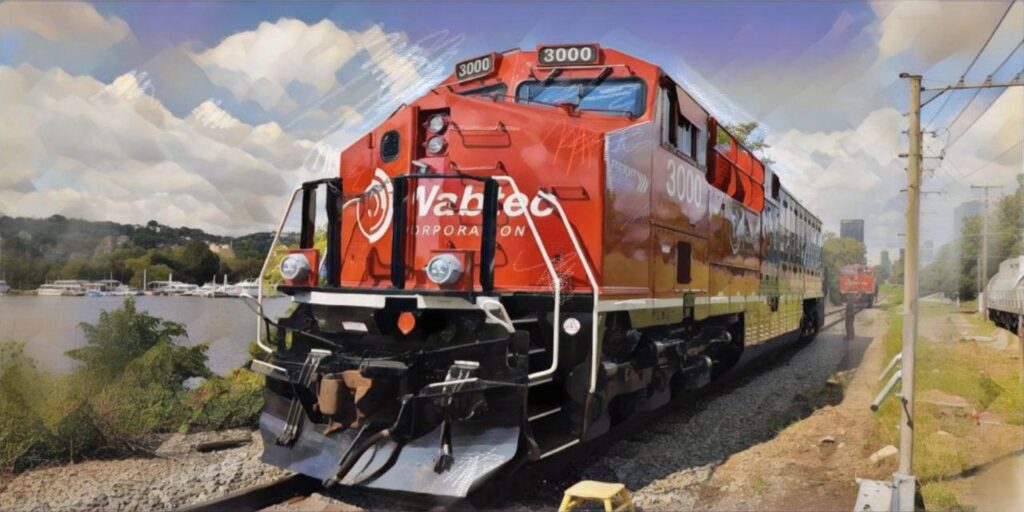

In September 2025, Kazakhstan’s railway operator KTZ signed a $4.2 billion agreement with U.S.-based Wabtec for 300 Evolution Series ES44ACi locomotives. The diesel-electric engines are tailored for Kazakhstan’s 1,520 mm gauge network and harsh climate, replacing aging Soviet-era stock.

Wabtec finalized full ownership of the Astana locomotive plant in late 2023; production and services for 1,520-mm stock are now fully under Wabtec’s Kazakhstan subsidiary. Local manufacturing and long-term service contracts are expected to expand domestic engineering capacity. The locomotives’ digital diagnostic systems should improve fuel efficiency and maintenance intervals.

According to the official Wabtec press release, the agreement “strengthens KTZ’s role as a critical and reliable hub for the Middle Corridor,” while KTZ CEO Talgat Aldybergenov said it “confirms our commitment to advanced technologies in the transport sector”. Rail accounts for about 64% of Kazakhstan’s freight turnover (2024), so locomotive performance directly affects Middle Corridor throughput.

Financing details have not been disclosed, but the purchase appears to be domestically funded through KTZ and state support. For Astana, the order fits its multi-vector foreign-policy approach: Kazakhstan continues its partnerships with France’s Alstom, China’s CRRC, and Russia, maintaining balance across suppliers.

While the locomotives are diesel, Kazakhstan is also electrifying key lines with European partners. Diesels provide an immediate boost without new catenary investment, and Wabtec claims lower emissions than previous models. Over time, expanded electrification could complement this upgrade. Overall, the Wabtec partnership represents incremental modernization. This is an interoperability-based approach that strengthens existing routes rather than building new corridors from scratch.

Image: trains.com – One of Kazakhstan’s modern Evolution Series diesel locomotives (model TE33A) produced through a partnership with U.S. firm Wabtec. Kazakhstan’s railways carry about 64% of the country’s freight, making such upgrades crucial for trade connectivity.

The China–Kyrgyzstan–Uzbekistan (CKU) Railway: Building a New Corridor

After nearly three decades of discussion, China, Kyrgyzstan, and Uzbekistan launched construction of the CKU railway in late 2024. The 523 km line will run from Kashgar (Xinjiang) through the Kyrgyz mountain ranges to Andijan, Uzbekistan. It will provide a second direct China–Central Asia connection, bypassing reliance on Kazakhstan’s network.

The CKU is designed with dual gauges: standard (1,435 mm) in China and broad (1,520 mm) in Kyrgyzstan and Uzbekistan, with a dry-port transshipment hub in Makmal, Kyrgyzstan. This compromise allows integration with existing Central Asian networks, but requires reloading at the border. About 80% of the Kyrgyz section crosses mountainous terrain, demanding over 120 km of tunnels and 26 km of bridges. Completion is planned for around 2029, though engineering challenges could extend the timeline.

The CKU’s financing and governance differ from the Kazakhstan rail structure. Unlike Kazakhstan’s self-funded procurement, the CKU is a jointly financed venture. China is expected to cover 51% of costs, including a $2.35 billion low-interest loan and $1.2 billion in direct investment; Kyrgyzstan and Uzbekistan will each contribute 24.5%. Early estimates put the total cost near $4.7 billion, but analysts warn it could reach $10–12 billion due to terrain complexity. China is expected to provide roughly half the project’s financing through a low-interest state loan, while Uzbekistan and Kyrgyzstan each hold equity stakes, giving them limited but formal roles in governance and shared exposure to project risks.

The CKU line also holds implications for strategic value and related cooperation. If extended beyond Uzbekistan, it could shorten China–Europe freight routes by 900 km and cut transit times by seven days. For China, it adds redundancy to western export corridors; for Kyrgyzstan and Uzbekistan, it opens new access to markets and potential transit revenue. Experts estimate the CKU railway could carry up to 15 million tons of freight annually, representing about 47% of the 2024 China-Kazakhstan rail volume.

Uzbekistan’s rail cooperation with China extends beyond the CKU corridor. In August 2024, Uzbekiston Temir Yullari signed a $181 million deal with CRRC Zhuzhou to modernize 12 “Oʻzbekiston” electric locomotives and supply 38 new freight, passenger, and shunting units by 2034. The agreement continues more than two decades of collaboration between UTY and CRRC, and follows the earlier deliveries of high-power two-section locomotives in 2020.

Tashkent has also diversified suppliers, acquiring locomotives from Russia’s TMH and Sinara-Transport Machines, and ordering six high-speed trainsets from Hyundai Rotem in June 2024. Together, these initiatives highlight Uzbekistan’s effort to modernize its fleet and expand capacity while balancing foreign partnerships.

Image: rollingstockworld.com – Two-section electric freight locomotives built by China’s CRRC for Uzbekistan Railways (Uzbekiston Temir Yollari). These modern units enhance the country’s mainline hauling capacity and support growing regional freight operations.

Risks and Outlook

Challenges remain. High-altitude construction raises cost risks; the gauge break adds operational friction; and traffic forecasts depend on competitive tariffs and efficient customs. Kyrgyzstan’s debt exposure is another concern, though lending terms are described as concessional. Still, the political momentum is strong, and work on several tunnel portals began in 2025. If successful, the CKU will complement rather than replace existing corridors, expanding Central Asia’s overall connectivity.

Balancing Infrastructure Strategies

Central Asian governments are exercising their agency, not acting as proxies in a great-power contest. Kazakhstan’s cooperation with Wabtec demonstrates gradual modernization within existing corridors, enhancing efficiency while preserving flexibility. Diesel upgrades can later integrate with electrified lines or European digital systems, which is consistent with Astana’s goal of remaining a multi-partner transit hub.

Kyrgyzstan and Uzbekistan, through the CKU railway, illustrate a different model, one of new-build connectivity financed largely through Chinese capital but negotiated on shared-ownership terms. Both countries pushed for mixed gauge and joint management to ensure national stakes rather than full dependency. Uzbekistan is already investing in complementary logistics hubs and digital customs links from the Caspian to the Black Sea. For Kyrgyzstan, the railway also promises domestic unification between its northern and southern regions.

From a policy standpoint, these initiatives reflect two infrastructure models. The U.S.-linked approach provides advanced equipment and know-how within existing systems, requiring less external debt and fewer political strings. The Chinese model mobilizes rapid financing and construction for transformative new lines, but often brings higher leverage and technical lock-in.

While Kazakhstan’s rail network retains its broad gauge (1,520 mm) heritage, the country’s aggressive modernization (in partnership with U.S. and European firms) is bridging the gap with Western rail systems. The introduction of Wabtec’s digitally enabled, fuel-efficient locomotives and the European-supported upgrades in electrification and signaling are advancing alignment on emissions policy, energy-efficiency targets, electronic data interchange, and condition-based maintenance on multiple fronts: from emissions standards and energy efficiency to digital logistics protocols and maintenance regimes.

This subtle alignment with U.S./EU rail technology, in the heart of Eurasia, enhances the Middle Corridor’s appeal as a reliable, high-quality link between China and Europe. Shippers and investors focused on performance and sustainability may view the modernized Kazakhstan route as a competitive alternative, setting the broad-gauge network as a competitive option in international rail commerce. The Middle Corridor’s evolution thus demonstrates how technological integration can overcome legacy differences, integrating Eurasian rail flows into global logistics.

The China–Kyrgyzstan–Uzbekistan (CKU) Railway exemplifies the projection of Chinese technical, digital, and financial standards into Central Asia. Constructed, majority-owned, and primarily financed under Beijing’s direction, the joint venture gives China significant influence over construction, operations, and technology integration. The line incorporates standard gauge (1,435 mm) in China and broad gauge (1,520 mm) in Kyrgyzstan and Uzbekistan with a transshipment interface dual-gauge infrastructure to bridge Chinese and Soviet-era rail standards and is expected to use Chinese-built locomotives, signaling systems, and rail management practices under the China–Kyrgyzstan–Uzbekistan Railway Company. Additionally, it is expected to introduce digital customs platforms aligned with China’s “Smart Customs” initiatives, embedding Chinese-designed logistics and data systems along the route.

These parallel routes highlight how Central Asia is evolving into a multi-standard transport environment. Rather than converging into a single geopolitical framework, the region is developing parallel corridors shaped by distinct Chinese and Western technical and financial models.

Both projects face uncertainties, from cost overruns to shifting trade patterns, but together they broaden the region’s logistics landscape. Astana, Tashkent, and Bishkek are using such partnerships to diversify routes, attract investment, and reinforce regional cooperation. As these railways take shape, Central Asia is positioning itself as a bridge – not a battleground – turning infrastructure pragmatism into a pathway for greater economic resilience and strategic autonomy.