As a core infrastructure industry, railways play a strategic role in Kazakhstan’s economy. Today, over 50% of freight in the country is transported by rail, while the figure for passengers is 15%. Kazakhstan’s favorable geographical position between the largest producer of goods in the world, Asia, and the largest consumer, Europe, is spurring the development of transit freight transport and related income. However, government regulations and imperfect reforms have failed to reverse a degradation of Kazakhstan’s rail infrastructure and solve its capacity shortage problems.

The robust rail network created during the Soviet period for a single national economy turned out to be ineffective under the new conditions of market dynamics. The country’s railway infrastructure, while reaching almost every region in Kazakhstan, meets neither current nor possible future needs of freight owners and has already nearly reached its limit in terms of throughput and processing capacity.

The national railway carrier of both passengers and freight, Kazakhstan Temir Zholy (KTZ), cannot provide by itself the financial resources and investments at the scale needed to meet current and future challenges. The national budget is also unlikely to allocate such funding. A lack of prompt, large-scale modernization of key areas of rail transport, however, may hurt the country’s economy.

Tentative sources of funding for improvements

According to the Ministry of Transport’s plan for the modernization of rail infrastructure, 1,300 km of railway track is to be added by 2030, while 4,800 km of second track is to be constructed. The expected price tag for these additions is over $11 million.

It is currently unclear where these funds will come from. There have been mentions of borrowing around $400,000 from the national pension fund. According to the Ministry of Transport’s modernization plan, private investments will also be a key source through public-private partnership projects (PPP).

In recent years, state participation in financing the construction and reconstruction of sections of the rail network has been limited and paled in comparison to those involving road projects. As part of the Nurly Zhol (“Bright Path”) infrastructure initiative, $9.2 billion has been allocated for just two programs to develop roads versus only $16.1 million allocated for railways. Added to this is the involvement of KTZ in implementing major transport infrastructure projects – the Khorgos dry port, the Kuryk port ferry complex and more than 1,000 km of railway track built in recent years, among others – using borrowed funds. Thus, the company bears a considerable burden in terms of servicing and repaying loans already raised for these projects, which represent its long-term assets. Given this debt burden, it is clear that the rail industry remains underfunded.

Tariffs present a further dilemma

Across the world, funding for the development of main rail networks is typically allocated from the national budget. In many European countries, for example, government funding covers up to 97% of operating and capital costs of rail infrastructure. Besides direct subsidies from the state, other sources of funds for modernizing and renewing rail infrastructure include bond issuance and sponsorship by financial institutions. The other main natural source of funds remains railway tariffs.

In Kazakhstan, the current growth of the “tariff for mainline rail network services” is insufficient to finance the investment needs of KTZ to construct new sections and reconstruct existing sections of track, as well as for junction stations, digitization, electrification, and automation. This is despite the fact that at the beginning of 2024, KTZ hiked this tariff by 5%.

The Ministry of Transport has a three-year plan to boost the railway tariff, which has been sent for approval to the Committee on Regulation of Natural Monopolies at the Ministry of National Economy. This tariff policy reform – which represents a new methodology for calculating tariffs for mainline rail network services – is seen as one of the strategic initiatives needed for the sustainable development of the sector and of KTZ, making infrastructure use more efficient and motivating the company to provide customized services in line with the demands of different market segments.

Focus on track modernization

According to KTZ, the existing tariff for mainline rail network services makes it possible to undertake capital repairs on 500-600 km of rail given the current annual transport volumes. However, these volumes are not enough. To maintain the rail infrastructure in standard condition, about 800 km of track should see capital repairs annually.

Last year, 1,443 km of railway track was repaired with 557 km of this going through capital repairs. Overall, KTZ annually invests about $123 million in the repair and development of the mainline network.

At the same time, reconstruction of transport infrastructure must be accelerated, and rail transport hubs developed. The latter includes the infrastructure of KZT public stations, i.e., freight stations that serve the population and businesses that do not have private access, and large industrial enterprises. As much as 99% of the freight carried by the Kazakhstani rail network starts at industrial rail hubs. In Kazakhstan today, there are about 4,000 access tracks, most of which belong to large enterprises and have daily traffic of 50 to 200 cars.

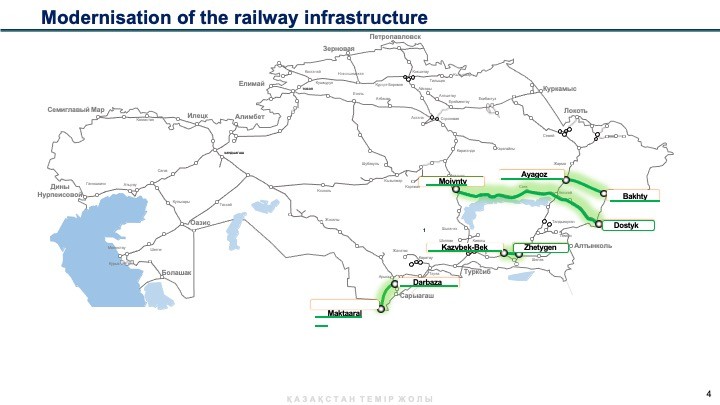

The implementation of several major projects is expected to boost the capacity of rail sections. These include the Bakhty-Ayagoz rail line, opening a third border crossing with China; a bypass line around Almaty, which is expected to decongest the Almaty hub by an average of 30%; and the Darbaza-Maktaaral line, set to decongest the Saryagash Station in the direction of the Central Asian countries and provide a more than fivefold boost to Kazakhstan’s transit potential.

The construction of second track on the Dostyk-Moyynty railway section is also underway. Once completed, the project should increase the capacity of the rail infrastructure of the section fivefold from 12 to 60 pairs of freight trains per day.

Dauren Moldakhmetov is the Editor-in-Chief of industry transportation publications of Kazakhstan, railway magazine “Trans-Express Kazakhstan”, and the business magazine, “Trans Logistics Kazakhstan”.