What Does Raisi’s Death Mean for the Caspian Sea Region?

By Robert M. Cutler

The death of Iranian President Ebrahim Raisi in a helicopter accident on May 19 will have significant effects on Iranian domestic politics and foreign policy. These include not only Iran’s relations with Armenia and Azerbaijan directly, but also indirectly through the Trans-Caspian International Trade Route (TITR, also called the “Middle Corridor”) and the International North–South Transit Corridor (INSTC). Despite conspiracy theories, the only reasonable alternative hypothesis to an accidental crash is that the pilot intentionally ran the helicopter into the mountain head-on at full speed. Both possibilities may be subsumed under the category “Act of God”.

Raisi was working to normalize relations with Azerbaijan and was seen as a potential – even likely – future Supreme Leader of Iran, succeeding the 85-year-old Ali Khamenei, who is in poor health. Now, however, it is not out of the question that his death leads to a reorientation of Tehran’s foreign policy and a wave of radicalization. The outcome will depend upon the obscure machinations of the theocratic and security-service elite, for which the formal organizational and constitutional arrangements set the framework but do not determine the result.

The Iranian president is not the most powerful individual in the country’s political system, but he is still influential. Raisi had sought to improve ties with Azerbaijan, including water projects on the Aras River and discussions about transportation links. These initiatives may now face delays or even reversals. Yerevan’s strategic significance for Tehran’s relationship with Moscow and its broader regional ambitions will not diminish; indeed, their bilateral military-industrial cooperation has only grown since Russia’s re-invigoration of its war of aggression against Ukraine in February 2022. At the same time, Tehran’s relations with Baku are more complicated, for myriad present-day and historical reasons, not least but not only concerning the Azerbaijani minority in Iran.

The South Caucasus and Trans-Caspian Implications

Armenia and Azerbaijan are nevertheless persevering in their bilaterally-based practical cooperation and peace negotiations, now proceeding without third-party mediation. The most recent high-level meeting in this process took place between their respective foreign ministers in Almaty on May 10–11. These significant discussions followed talks between them in Berlin in February of this year, and they took place in the context of ongoing efforts to delimit and demarcate the two countries’ common border.

Delimitation refers to drawing and describing lines on maps, whereas demarcation is the process of installing physical markers on the territory. Demarcation has already begun in the sensitive Tovuz region, and the Russian contingent assisting Armenian border guards under a bilateral agreement has already been withdrawn. In April, as a result of this process, Armenia returned four villages to Azerbaijan.

Unresolved issues involve territorial claims against Azerbaijan in Armenia’s constitution and the reopening of regional transit routes. Armenian Prime Minister Nikol Pashinyan’s initiative for the necessary constitutional reforms, along with his border-demarcation initiatives and continuing peace negotiations, have provoked anti-government protests in Armenia, fueled by the irredentist and xenophobic segments of the diaspora, which are the best established, most lavishly funded, and most vocal. The Pashinyan government is, as a matter of state policy, trying to mobilize other segments of the Armenian diaspora in favor of a “state-centered, pro-state” approach. They have a lot of work in front of them.

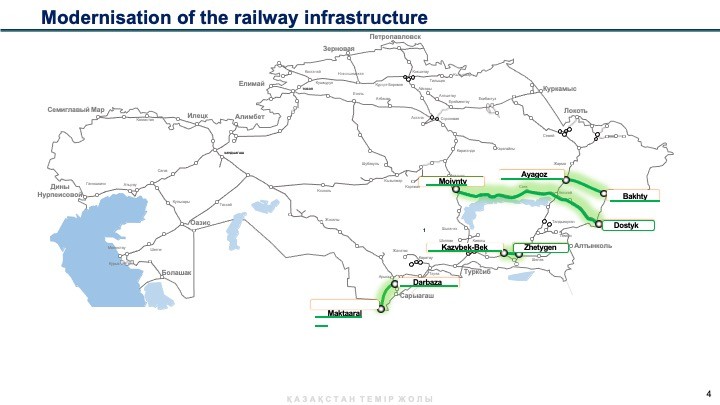

The reopening of the Zangezur Corridor, across southern Armenia from Azerbaijan proper to its exclave Nakhchivan (which has a border with Turkey), would not just improve commerce and communications between these two. It would also improve Russia’s connections with Turkey via Azerbaijani roads and rail, as well as further promote the development of the TITR. Raisi’s death, by contrast, complicates the implementation of the INSTC, which passes through Azerbaijan from Russia to Iran, and then southward to the Iranian port of Chabahar, whence shipping connections are possible to the rest of the world and India in particular.

More Problems for the North–South Corridor

The leadership vacuum created by Raisi’s unexpected death also puts into question the degree of commitment of the government to the International North–South Transport Corridor (INSTC), which relies on Azerbaijan as a key link between Russia and Iran. The attendant uncertainty around the political succession means that there could be delays in decision-making processes, stalling negotiations and potentially even reversing agreements critical to advancing the INSTC.

As mentioned above, Raisi was seen as a stabilizing figure who sought to work with Azerbaijan, which is a crucial partner in the INSTC. A less committed successor president, or one even hostile to Baku, could strain relations and restrain the corridor’s progress. Political infighting and potential public unrest could also delay the implementation of infrastructure projects and international agreements. Even if the semblance of political stability is re-established, still investors and international partners might hesitate to provide necessary funding.

For all these reasons, Raisi’s death and the succession crisis around it threaten to place further obstacles to the implementation of the International North–South Transport Corridor (INSTC), an infrastructure scheme that would link Russia to Iran and potentially to India via the Chabahar port in Iran’s south-east.

Conclusion

Indeed, Raisi’s death comes just within days of India’s signature of a contract with Iran to develop further the Chabahar project, which has languished for over a decade. Within hours of that contract being signed, the U.S. warned that participating companies may face sanctions. To be honest, infrastructure projects in eastern Iran are never good bets: just look at the Iran–Pakistan–India natural gas pipeline. The Azerbaijani-driven “Middle Corridor” (which technically used to designate just the trans-Caspian connection with Kazakhstan) and the extended TITR have much better chances to be realized and, indeed, are already under way with strong support from the international financial institutions.

Robert M. Cutler has written and consulted on Central Asian affairs for over 30 years at all levels. He was a founding member of the Central Eurasian Studies Society’s executive board and founding editor of its Perspectives publication. He has written for Asia Times, Foreign Policy Magazine, The National Interest, Euractiv, Radio Free Europe, National Post (Toronto), FSU Oil & Gas Monitor, and many other outlets. He directs the NATO Association of Canada’s Energy Security Program, where he is also senior fellow, and is a practitioner member at the University of Waterloo’s Institute for Complexity and Innovation. Educated at MIT, the Graduate Institute of International Studies (Geneva), and the University of Michigan, he was for many years a senior researcher at Carleton University’s Institute of European, Russian, and Eurasian Studies, and is past chairman of the Montreal Press Club’s Board of Directors.