On October 6 of this year, the people of Kazakhstan participated in a referendum to decide whether nuclear power should become a part of their daily lives, or whether the haunting legacy of atomic testing would continue to limit the country’s progress in this area. The official preliminary results, released on October 7, showed that 71.12% of participants agreed to the construction of a nuclear power plant in Kazakhstan with a voter turnout of 63.66%.

President Tokayev’s goal in holding a referendum was to ensure that arguments in favor of nuclear energy were compelling, and that citizens, scientists, and government officials were involved in the decision-making process. Tokayev has since suggested that an “international consortium made up of global companies equipped with cutting-edge technologies” should be involved in the project.

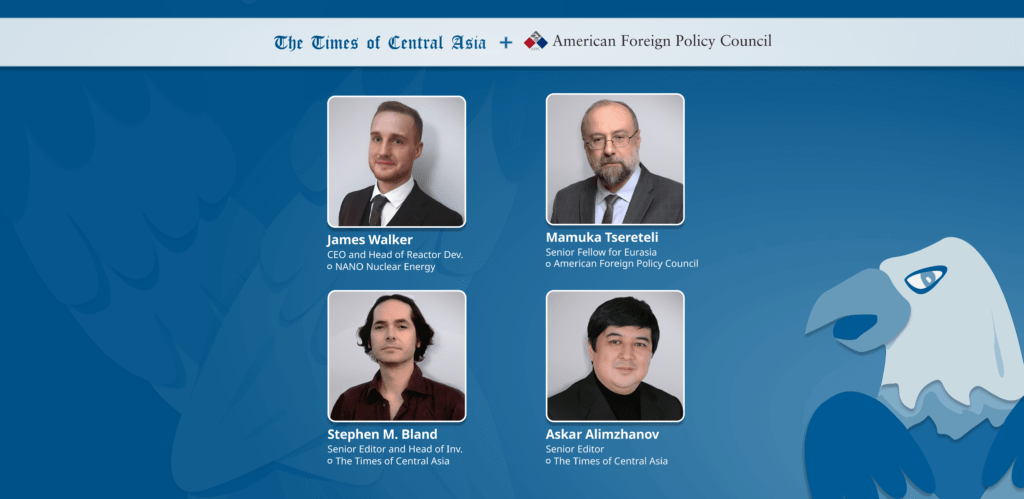

In partnership with the American Foreign Policy Council, on October 30, 2024, The Times of Central Asia convened a virtual event to discuss what the referendum result means for energy security, geopolitics, and new business opportunities for both regional and global actors. Moderating this event was Mamuka Tsereteli, Senior Fellow for Eurasia at the American Foreign Policy Council, whilst the panel comprised Askar Alimzhanov, Senior Editor at The Times of Central Asia, Stephen M. Bland, Senior Editor and Head of Investigations at The Times of Central Asia, and James Walker, CEO and Head of Reactor Development at NANO Nuclear Energy.

Focusing on a local perspective, Askar Alimzhanov told those in attendance that “Kazakhstan is in tough situation today regarding the issue of energy dependence. Because we have the largest nuclear test site in the world and during around 50 years there were just under 500 atomic tests, we all know about the possible consequence. As consumers, however, we’ve seen prices rise around 26% in one year. The population of the country is growing, so when we talk about the annual growth in energy consumption, this is a natural process.

“Since the majority of voters have already made their decision, the main question which remains is who will build it? However, serious concerns persist within society including the fear of corruption, which can result in poor quality structures. As an example, we can talk about the light rail transportation network in Astana, which started in 2009 and still isn’t finished. The officials who stole the money, they still have those funds abroad.”

Speaking about energy dependence and geopolitical considerations, Stephen M. Bland noted that “Kazakhstan’s energy landscape is characterized by a reliance on aging thermal power plants, which are increasingly unable to meet the demands of a growing population and economy, with electricity shortages projected to worsen, particularly in the rapidly developing southern regions. The construction of a nuclear power plant, therefore, is seen as a crucial step toward alleviating these shortages, reducing dependence on overpriced imports from Russia, and achieving carbon neutrality goals.

“The construction of Kazakhstan’s first nuclear power plant presents both challenges and opportunities for the country’s energy independence and regional influence. On one hand, developing a robust nuclear energy sector could ensure a stable, long-term electricity supply and enable Kazakhstan to export excess electricity to neighboring countries. This would solidify Kazakhstan’s position as a key energy player in the region and reduce its dependence on fossil fuels, which currently account for 70% of electricity generation. On the other hand, the complexities of choosing international partners pose a significant challenge which must be carefully managed… Much time and energy has gone into moving Kazakhstan away from Russia’s sphere of influence and turning the face of the nation towards the world as an even-handed potential partner, a ‘Middle Power,’ and even a broker of peace in times of conflict, work which could be undone if Rosatom is chosen for a key role in the project.”

Continuing the theme of energy dependence and potential partners, James Walker stated that “If you look at the challenges the U.S. has faced in launching some of their new reactor designs, there has been a reliance in the U.S. on Russian nuclear fuel. The U.S. is in a situation now where it has to build back a lot of infrastructure to support the building of these reactor systems… I think it would be fair to say that in the nuclear race, in terms of getting commercial plants out there, Russia and China are in the lead. So, when we’re discussing Kazakhstan trying to move away from Russia, the issue can become where they would get the fuel from. Russia has the capacity to supply it more immediately, so the question could become, do we wait for the U.S. to put all this infrastructure in place so we have a more independent supply, or do we still ally with Russia to source this fuel?

“The decision to go ahead with the nuclear power plant is, I think, demonstrably sensible, because it typically means sovereign power, meaning you have more control over your own foreign policy. Kazakhstan could put itself in a very precarious position by sourcing a plant from Russia, which then gives [Russia] influence over the energy that’s being used within the country. Effectively, if you are dependent on certain powers for fuel, for technology, for expertise, for supportive services, they have you over a barrel, in a sense. So there does need to be a geopolitical and political weighted assessment of how to proceed.”

The Burgut Expert Talk Series is a virtual forum where local and international experts discuss defining trends, challenges and opportunities shaping Central Asia.

Watch the discussion in full, here.