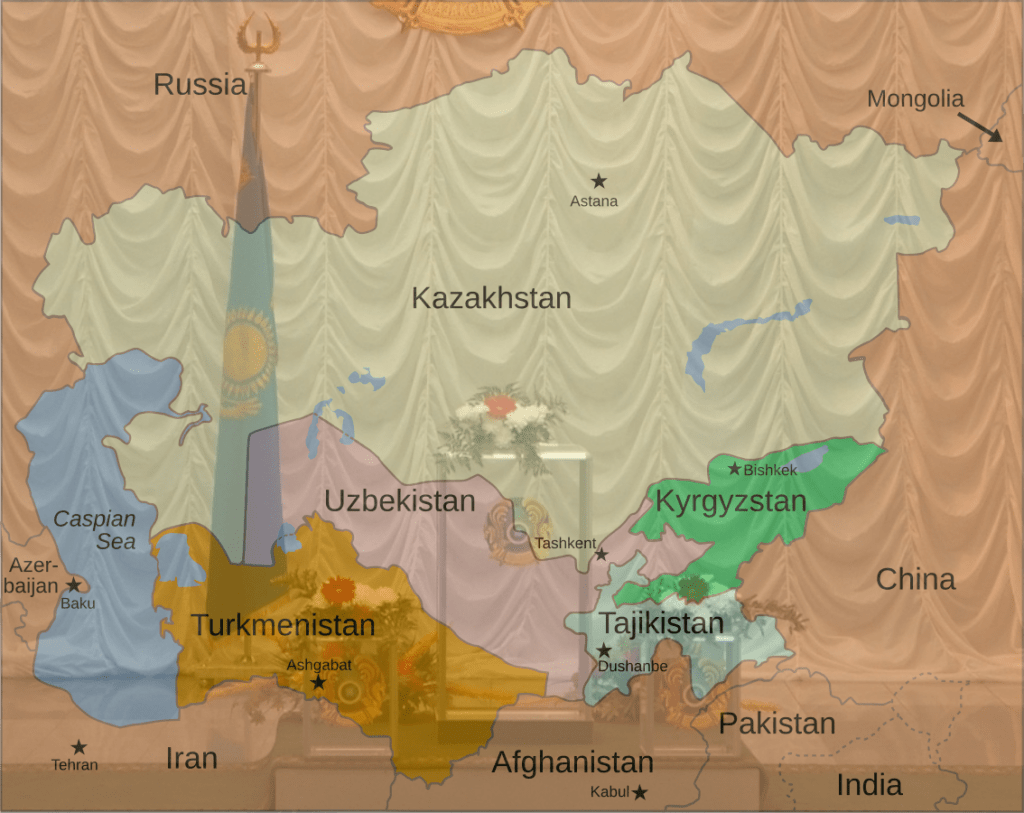

How Can Central Asian Countries Advance Democratization Efforts Amid Geopolitical Uncertainty?

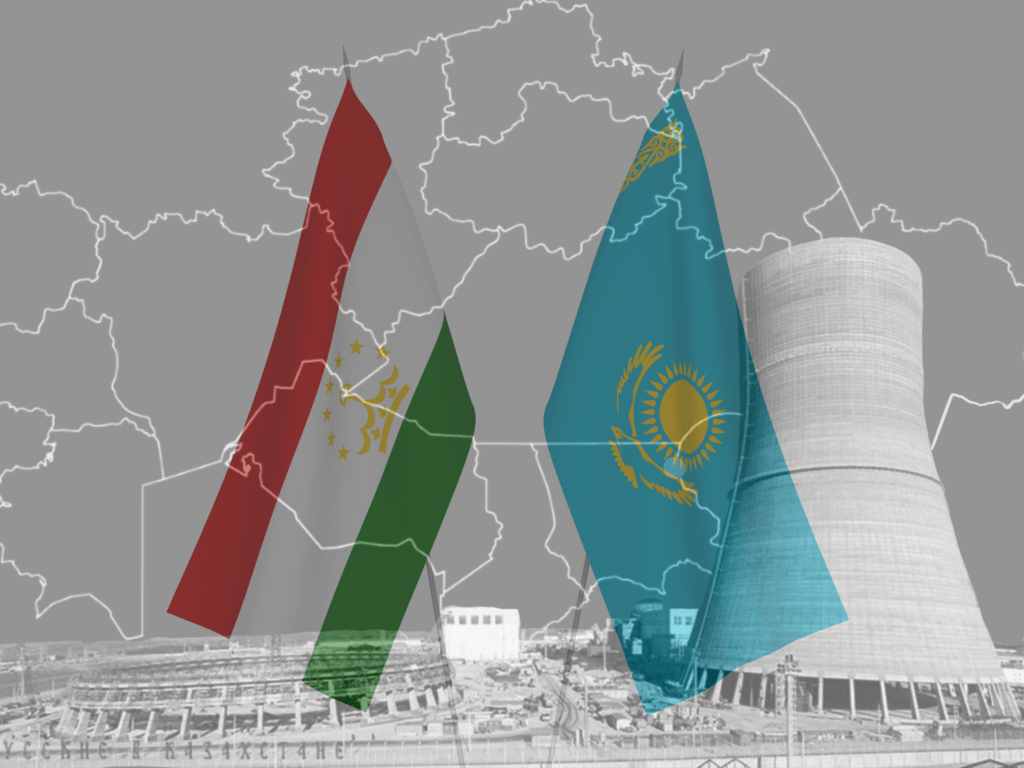

On October 27, Uzbekistan held parliamentary elections, which, along with the referendum in Kazakhstan and upcoming local council elections in Kyrgyzstan, contributed to a global election year. In the elections in Uzbekistan, the ruling Liberal Democratic Party emerged victorious, participating for the first time in elections held under a mixed majoritarian-proportional system. As a result of the vote, the Liberal Democratic Party received 42,7% of the votes, securing 64 out of 150 seats in parliament. Voter turnout was 74.72%, and observers noted the organization and conduct of the elections. Leaders in Central Asia frequently cite the region’s volatile geopolitical landscape as a basis for more cautious internal reforms. This reflects a need to maintain stability in the face of external pressures. Historically and currently, Central Asian countries do not represent homogeneous societies. Additionally, increasing political divisions within society and among political elites are observed in almost all five countries of the region. Against this backdrop, escalating geopolitical conflicts on the global stage may further hinder the realization of major political reforms. Political Reforms and an Unstable World Order It's challenging to definitively assess political reforms in Kazakhstan and Uzbekistan as either negative or positive, as both perspectives exist. European and American leaders often note the countries' aspirations for reforms and express readiness to support them. Therefore, Kazakhstan and Uzbekistan effectively act as locomotives of political reforms in Central Asia at this stage. Under the leadership of President Kassym-Jomart Tokayev, Kazakhstan has undertaken political reforms aimed at modernizing the political system and strengthening democratic institutions. A significant step was limiting presidential powers by introducing a single seven-year presidential term without the right to re-election, which should promote regular changes in political leadership. Kazakh authorities argue that the role of parliament has also been strengthened to increase its influence and accountability to the government, providing a more balanced system of checks and balances. Liberalization of the party system included simplifying the registration of political parties and introducing elections based on single-member districts, which should foster political pluralism. Steps were taken to increase citizen participation in governance, including the introduction of direct elections for village and district mayors and creating mechanisms for open citizen feedback. Additionally, a 30% quota for women, youth, and people with disabilities was introduced in party lists, contributing to strengthening gender equality. Under President Shavkat Mirziyoyev, Uzbekistan is also conducting significant reforms aimed at democratizing the political system. These elections were noteworthy for the introduction of a mixed electoral system, representing a significant departure from past practices. Under this system, 150 seats in the Legislative Chamber of the Oliy Majlis should be filled by two methods: 75 seats were elected through single-member districts (majoritarian system), and the remaining 75 were allocated proportionally based on party results (proportional system). This approach aims to enhance political pluralism by allowing both individual candidates and political parties to gain representation. The majoritarian component allows voters to directly elect representatives from their constituencies, fostering a closer connection between elected officials and their constituents....