Rediscovering Mustafa Shokay: A Fragment of Kazakh History in an American Bookstore

While studying in the United States, I have spent my free hours chasing traces of home — fragments of Kazakh history scattered across libraries, archives, and private collections. Much of our past lies far from the steppe, carried off by the tides of empire and exile. My purpose has been simple: to return those fragments, in words and images, to our people.

One afternoon in Washington, D.C., I wandered into an old bookstore. The two floors seemed to contain the intellectual wealth of the world — every shelf whispering stories of vanished nations and stubborn identities. I made straight for the section on Central Asia, where the spines of a few rare volumes caught my eye. As I turned the pages of one yellowed book, something stopped me cold: a photograph of Mustafa Shokay, the Kazakh statesman and intellectual who devoted his life to the cause of Turkestan’s autonomy.

Mustafa Shokay in his student days

A Visionary in Exile

Born in 1890 in what is now southern Kazakhstan, Mustafa Shokay emerged as one of the most eloquent voices for Central Asian self-determination during the revolutionary upheavals of 1917. When the Russian Empire collapsed, he helped lead the short-lived Kokand (Turkestan) Autonomy, which sought to build a government based on equality and Muslim representation. Within weeks, the Bolsheviks crushed the movement.

Forced into exile, Shokay continued his work from abroad — first in Turkey, then in France — editing journals and writing tirelessly about the rights and dignity of Turkic peoples. His story embodies the tragedy of a generation of intellectuals who dreamed of independence decades before it arrived.

During World War II, Shokay’s moral integrity was tested once again. Arrested by Nazi forces after the invasion of France, he was asked to lead the “Turkestan Legion” — a military formation of Soviet prisoners of war. Shokay refused, condemning the brutal treatment of the prisoners and rejecting any collaboration with the Nazi regime. He died in captivity in 1941, but his name endures as a symbol of conscience and courage in Kazakhstan.

Richard Pipes and the Rediscovery of Forgotten Nations

The photograph I found was printed in The Formation of the Soviet Union: Communism and Nationalism, 1917–1923, a classic study by Richard Pipes, the Harvard historian who helped introduce Western audiences to the complexity of the early Soviet era. Pipes’s research explored how the Bolsheviks built a multiethnic empire from the ruins of tsarist Russia, often manipulating national aspirations for political ends.

Crucially, he paid special attention to the Muslim and Turkic regions — to the Caucasus, the Volga, and Central Asia — and recognized that their quest for self-determination represented the “Achilles’ heel” of the Soviet system. His work anticipated the eventual collapse of the USSR and the independence of states like Kazakhstan, Uzbekistan, and Azerbaijan.

In one recollection, Pipes described visiting Almaty in the 1950s and watching a May Day parade. As Kazakhs marched silently past portraits of Stalin, he turned to a Russian colleague and asked: “And what if the Kazakhs, like the Algerians, one day said to the French, ‘Thank you — now you may go’?” The Russians’ reply — “Let them try” — only underscored the arrogance that history would later undo.

The Faces Behind the Pages

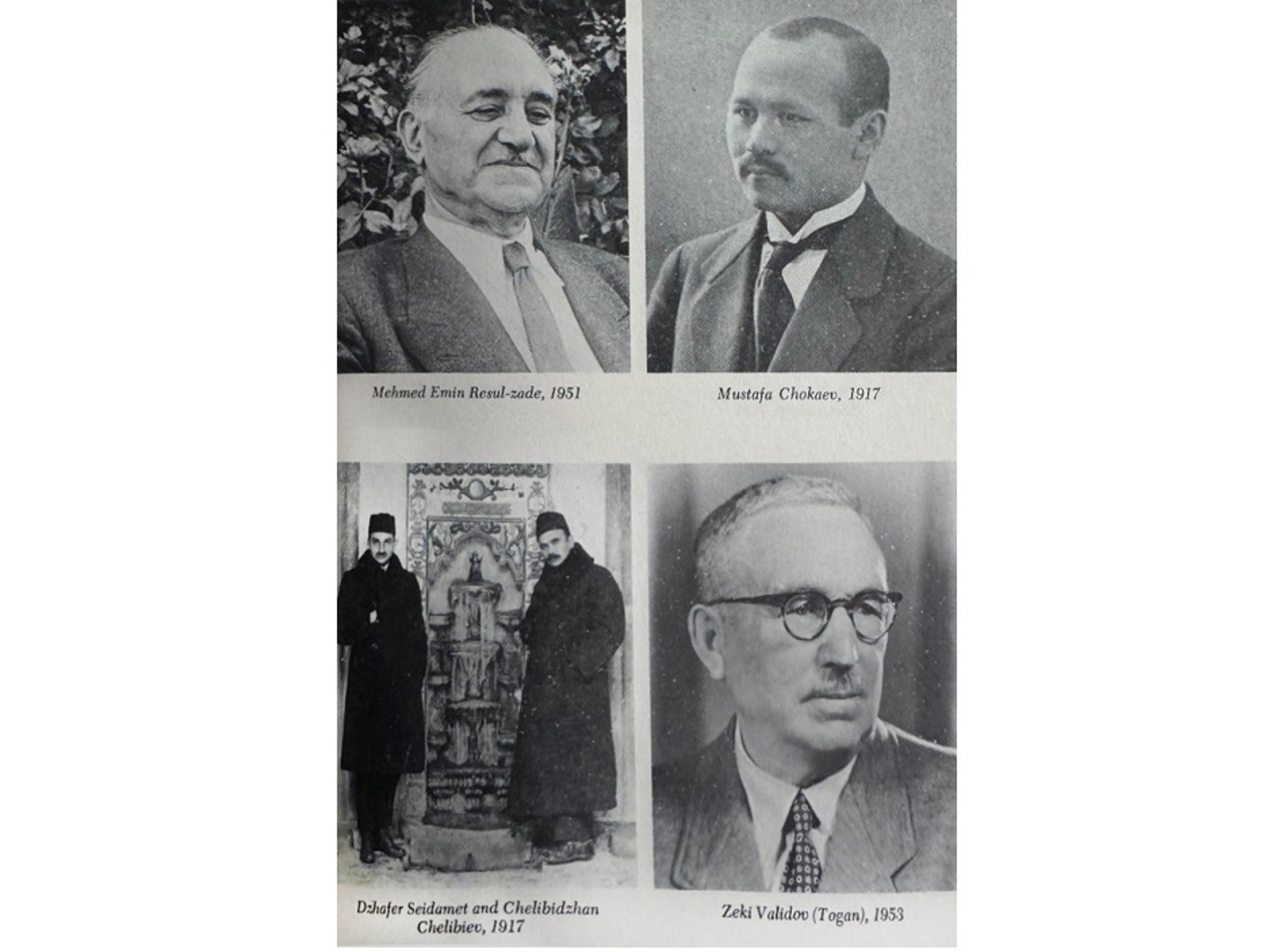

Pipes’s book does more than analyze ideology; it preserves human detail. The photograph that startled me that day in the bookstore shows Mustafa Shokay among fellow exiled leaders of the early Muslim world: Mehmet Emin Resulzade of Azerbaijan, Cafer Seydahmet and Çelebizade Çelebiyev of the Crimean Tatars, and Zeki Velidi Togan, the Bashkir scholar and political figure.

Together, they represent a forgotten network of intellectuals who tried — across frontiers and languages — to defend cultural freedom within the collapsing Russian Empire. That such an image survived in an American academic volume is extraordinary. It links the quiet archives of Harvard and Washington with the unquiet history of Turkestan.

Richard Pipes

Why It Matters Now

For Western readers, Shokay’s life may recall better-known figures such as Jan Masaryk, the Czech diplomat who resisted Soviet domination, or Tomáš Garrigue Masaryk, who bridged cultures between East and West. Like them, Shokay believed that moral integrity mattered more than political expediency. He envisioned a modern, pluralist Central Asia — one defined not by empire but by education, law, and dignity.

In today’s world, where Central Asia is again becoming a crossroads of competing powers, Shokay’s ideas feel newly relevant. He warned against both subservience and isolation, urging his contemporaries to engage globally without surrendering their identity.

A Personal Reflection

Holding that old volume in my hands, I felt something close to awe — not just at the photograph itself, but at the improbable route it had taken to reach me. Here, in an American bookstore, a small piece of Kazakhstan’s intellectual history had waited decades for someone to recognize it.

For much of the twentieth century, figures like Mustafa Shokay were nearly erased from official Soviet memory. Yet fragments of their legacy remain scattered across archives and libraries in Europe and the United States. To recover them is to rebuild our own continuity — to show that the story of Kazakhstan is part of the shared history of the modern world, not a footnote to someone else’s empire.

In that sense, finding Shokay’s photograph was more than a coincidence. It was a reminder that history is still alive, waiting for us to listen — even from the quiet corners of a bookstore on the other side of the world.