Trump’s Tariff Blitz Targets Global Imports, Kazakhstan Faces Harshest Impact in Central Asia

U.S. President Donald Trump has announced sweeping new tariffs on all goods imported into the United States, citing the need to protect American industry and jobs. Speaking at a White House press conference, Trump outlined a base tariff rate of 10% that will apply to 185 countries. However, several nations and blocs face significantly higher rates: China will see a 34% tariff, the European Union 20%, Switzerland 31%, and Israel 17%. The steepest tariffs were imposed on Vietnam (46%), Cambodia (49%), and Laos (48%).

Notably absent from the list are Russia, Belarus, Mexico, Iran, Canada, and Belarus. Ukraine, however, will face the base 10% rate.

Kazakhstan Hit with 27% Tariff

The new U.S. duties also target Central Asian nations. According to a comparative chart published by the White House, Uzbekistan, Turkmenistan, Tajikistan, and Kyrgyzstan will face 10% tariffs on their exports to the U.S. Meanwhile, Kazakhstani goods will be subject to a much higher rate of 27%.

The White House document notes that Kazakhstani imports currently face a 54% tariff in Kazakhstan, figures that surprised local analysts, who have questioned the methodology behind the calculations.

The rationale for the elevated rate on Kazakhstan remains unclear. However, the country’s Ministry of Trade and Integration has initiated consultations with his U.S. counterparts to explore options for exempting certain goods. According to a preliminary analysis, many of Kazakhstan’s key exports fall under exceptions outlined in U.S. regulations.

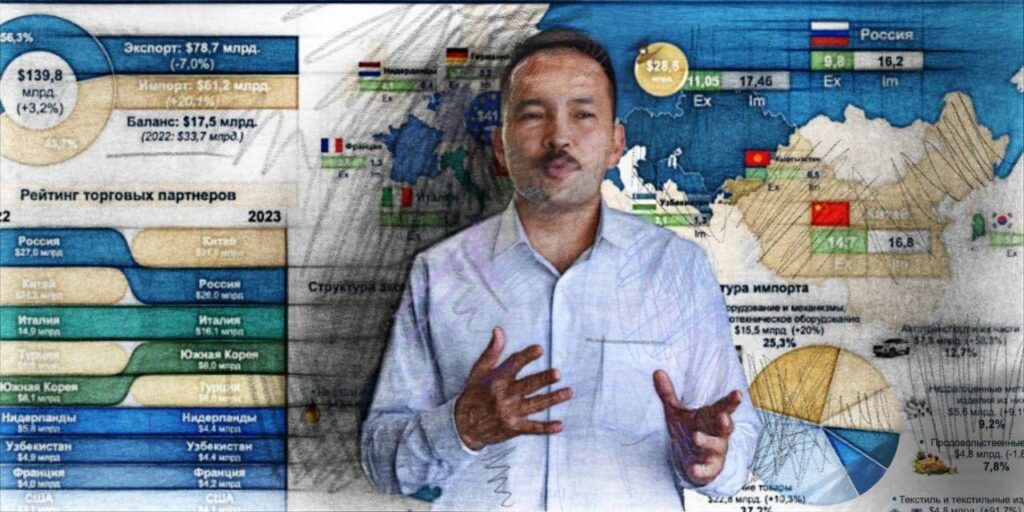

“In 2024, trade turnover between Kazakhstan and the United States amounted to $4.2 billion,” the ministry stated. “Kazakhstan’s primary exports to the U.S. – crude oil, uranium, silver, and ferroalloys – constitute 92% of total exports and are included in the exemption list under the U.S. President’s decree on reciprocal tariffs.”

Turning Tariffs Into Opportunities

Despite the steep new tariffs, some experts believe the impact on Kazakhstan will be limited. Financial analyst Rasul Rysmambetov argues that Kazakhstan’s marginal role in global trade dynamics shields it from major economic fallout.

“The real battle is between the U.S. and the world’s largest economies, China and the EU,” Rysmambetov wrote on his Telegram channel. “Our trade with the U.S. accounts for less than 1% of Kazakhstan’s total foreign trade. Even with a 27% tariff, the effect will be negligible.”

Rysmambetov noted that Kazakhstan exported over $2 billion worth of goods to the U.S. in 2024, while imports totaled $1 billion, maintaining a trade surplus for the tenth consecutive year. “We’re on the tariff list, but it’s mostly symbolic,” he added, emphasizing that Kazakhstan’s exports largely consist of strategic materials.

Rysmambetov also sees potential upsides: countries facing new duties may seek alternative markets, possibly offering Kazakhstan better terms on imports such as equipment, metals, vehicles, and construction materials. “Global trade tensions can open windows of opportunity, for strategic borrowing, better equipment deals, and expanded exports. But quick action is key,” he concluded.

International Backlash

The U.S. move drew swift condemnation from European Commission President Ursula von der Leyen, who called the policy a “severe blow to the global economy.”

“Uncertainty will increase, leading to heightened protectionism. Millions, especially in vulnerable countries, will be hit hardest by the highest tariffs. This move contradicts our international economic goals,” she wrote on X.

Von der Leyen made the remarks during a visit to Samarkand, Uzbekistan, where the first EU-Central Asia summit is taking place, a meeting Brussels has described as “historic.” Observers suggest that trade and tariffs could emerge as key topics at the summit.

Economists have also voiced concern. David Beckworth, a former U.S. Treasury economist, warned of possible “stagflation,” a scenario where inflation rises as growth stalls. Prolonged tariffs, he cautioned, could disrupt supply chains and raise consumer prices.

Olu Sonola, head of U.S. economic research at Fitch Ratings, added that extended trade barriers could push many economies into recession. “You can throw most forecasts out the window if these tariffs remain in place,” he said.

As global leaders and economists weigh the implications, one point is clear: the U.S. tariffs, and the international response they provoke, are reshaping the global trade order in profound and unpredictable ways.